- Analytics

- News and Tools

- Market News

- GBP/USD Price Analysis: Bears challenge ascending channel support on upbeat US ADP report

GBP/USD Price Analysis: Bears challenge ascending channel support on upbeat US ADP report

- GBP/USD comes under heavy selling pressure on Thursday amid resurgent USD demand.

- The upbeat US ADP report provides an additional lift to the USD and contributes to the slide.

- The technical setup favours bearish traders and supports prospects for a further downfall.

The GBP/USD pair continues losing ground through the early North American session and weakens further below the 1.2000 psychological mark in reaction to the upbeat US ADP report.

According to the data published by Automatic Data Processing (ADP), the US private sector employers added 235K jobs in December against expectations for a reading of 150K. This comes on the back of a hawkish assessment of the FOMC meeting minutes and provides a strong boost to the US Dollar, which, in turn, exerts downward pressure on the GBP/USD pair.

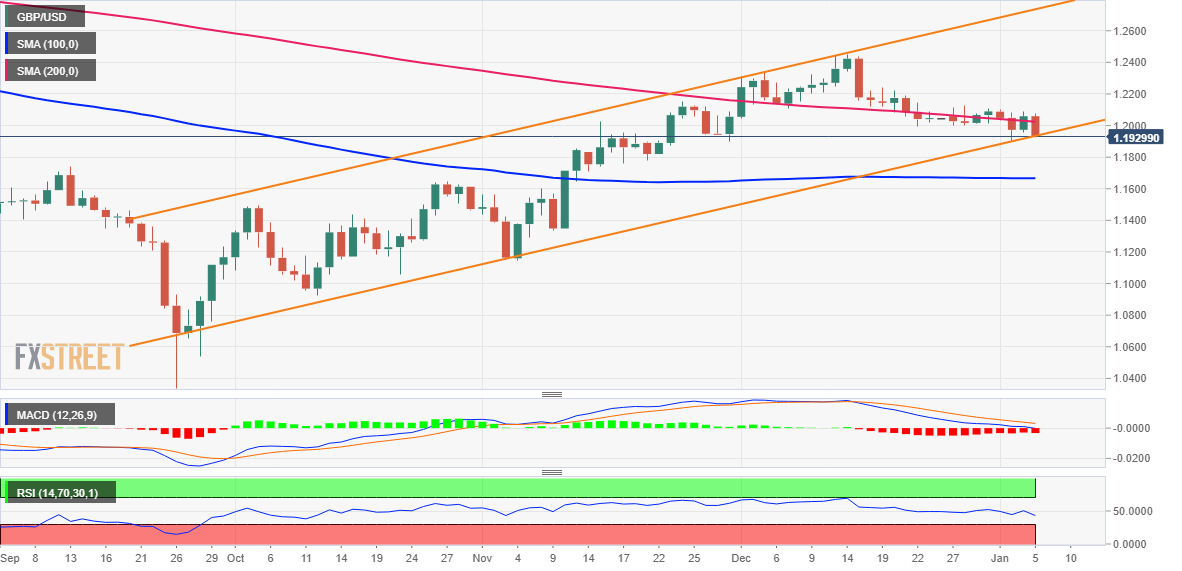

From a technical perspective, the recent fall and acceptance below the 200-day SMA suggested that the strong recovery from an all-time low might have run out of steam already. This GBP/USD pair is seen flirting with support marked by the lower end of an ascending channel extending from late September, which if broken should pave the way for deeper losses.

Given that oscillators on the daily chart have just started gaining negative traction, the GBP/USD pair might then turn vulnerable to accelerate the slide towards the 1.1900 mark. The downward trajectory could get extended further towards the 1.1825-1.1820 intermediate support en route to the 1.1800 round figure and the 1.1750-1.1740 horizontal support zone.

On the flip side, attempted recovery might now confront immediate resistance near the 1.2000 mark ahead of the 1.2025 region (200 DMA). The next relevant hurdle is pegged near the 1.2075-1.2080 region ahead of the 1.2100 mark. A sustained strength beyond will negate any near-term negative outlook and allow the GBP/USD pair to aim back to reclaim the 1.2200 round figure.

GBP/USD daily chart

Key levels to watch

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.