- Analytics

- News and Tools

- Market News

- USD/TRY stays bid and climbs to fresh all-time highs near 18.73

USD/TRY stays bid and climbs to fresh all-time highs near 18.73

- USD/TRY flirts with the 18.73 level, new record high.

- Inflation in Türkiye surprised to the downside in December.

- The CBRT could extend the impasse further in the next meetings.

The Türkiye lira gives away part of Tuesday’s gains and motivates USD/TRY to climb further and clinch new all-time peaks near 18.73 on Wednesday.

USD/TRY remains broadly consolidative

Price action in USD/TRY keeps the multi-month erratic performance well in place for the time being.

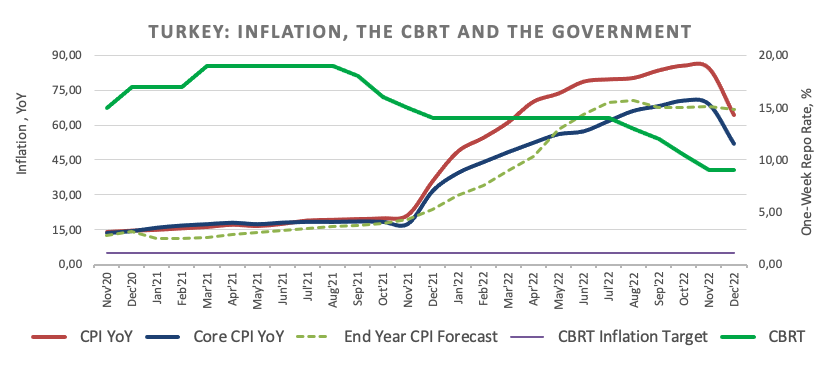

Indeed, the pair remained largely apathetic to the latest release of the inflation figures in the country, where the CPI extended further the drop from 24-year highs recorded back in October 2022, always on the back of strong base effects.

On the latter, the headline CPI rose at an annualized 64.27% in December, while the Core CPI gained 51.93% YoY and Producer Prices climbed 97.72% YoY.

Moving forward, the current disinflation seems to fall in line with President Erdogan’s views that inflation should see a pronounced decline during the first half of the new year amidst the absence of strong headwinds and relatively stable macro environment.

Against this, the Türkiye’s central bank (CBRT) could refrain from acting on the interest rates after a 500 bps cut during the past year.

What to look for around TRY

USD/TRY remains within the multi-month consolidative theme near all-time highs in the 18.70 region.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and dollar dynamics.

In the meantime, the lira is expected to remain under the microscope in response to Ankara’s plans to prioritize growth via transforming the current account deficit into surplus and always following a lower-interest-rate recipe.

Key events in Türkiye this week: Inflation Rate, Producer Prices (Tuesday).

Eminent issues on the back boiler: Threats of FX intervention by the CBRT. Persistent government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 2023.

USD/TRY key levels

So far, the pair is gaining 0.25% at 18.7041 and faces the next hurdle at 18.7287 (all-time high January 4) followed by 19.00 (round level). On the downside, a break below 18.5992 (55-day SMA) would expose 18.5565 (weekly low December 26) and finally 18.4827 (monthly low December 13).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.