- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bulls need to commit at key trendline support

Gold Price Forecast: XAU/USD bulls need to commit at key trendline support

- Gold price meets major trendline support in blow-off move on Thursday.

- The Federal Reserve theme is alive and kicking, weighing on the Gold price.

- US Treasury yields and US Dollar benefitted from sold Weekly Jobless Claims.

The Gold price has dumped to a critical area on the daily charts, as shown below, losing some 1.5% on Thursday. The yellow metal is back below the psychological $1,800 area as the Gold price continues to face resistance in attempts to break out to the upside. Most prevalent in the fundamentals surrounding the Gold price has been the sentiment in markets for a hawkish Federal Reserve (Fed) in 2023.

US Treasury yields rally, weighing on Gold price

US Treasury yields are higher following the data on Thursday showed Weekly Jobless Claims in the US rose less than expected. The US 10-year Treasury yield is up 0.14% at the time of writing, but it rose to a high of 3.692% earlier in the day, bearish for the Gold price as the shiny metal offers no interest.

The US Dollar and Gold price took their cues when the Department of Labor said seasonally adjusted numbers of initial unemployment claims rose by 2,000 to 216,000 in the week ended Dec. 17. The consensus on Econoday was for a 225,000 print. The previous week's level was revised up by 3,000 to 214,000. The four-week moving average tallied 221,750, sliding by 6,250 from the previous week's revised average of 228,000. Unadjusted claims declined by 4,064 on a weekly basis to 247,867.

US Dollar in demand

The US Dollar was in demand following the numbers as these are the type of data that could keep the Federal Reserve (Fed) hawkish for longer. The Fed last week projected at least an additional 75 basis points of increases in borrowing costs by the end of 2023. DXY, an index that measures the US Dollar against a basket of currencies rallied into the 104.50s from a low of 103.75. The US Dollar, however, remains well below the highs for the month near 107.20 and the Gold price has been able to capitalize on the slide over recent weeks.

Meanwhile, analysts at Brown Brothers Harriman noted that the current consensus for Nonfarm Payrolls (NFP) stands at 208k vs. 263k in November, with the Unemployment Rate seen steady at 3.7% and average hourly earnings falling a tick to 5.0% YoY. ''While job growth is clearly slowing, it’s not by enough to materially impact unemployment and so we continue to believe that the Fed will have to do more than the market is expecting.''

Gold price technical analysis

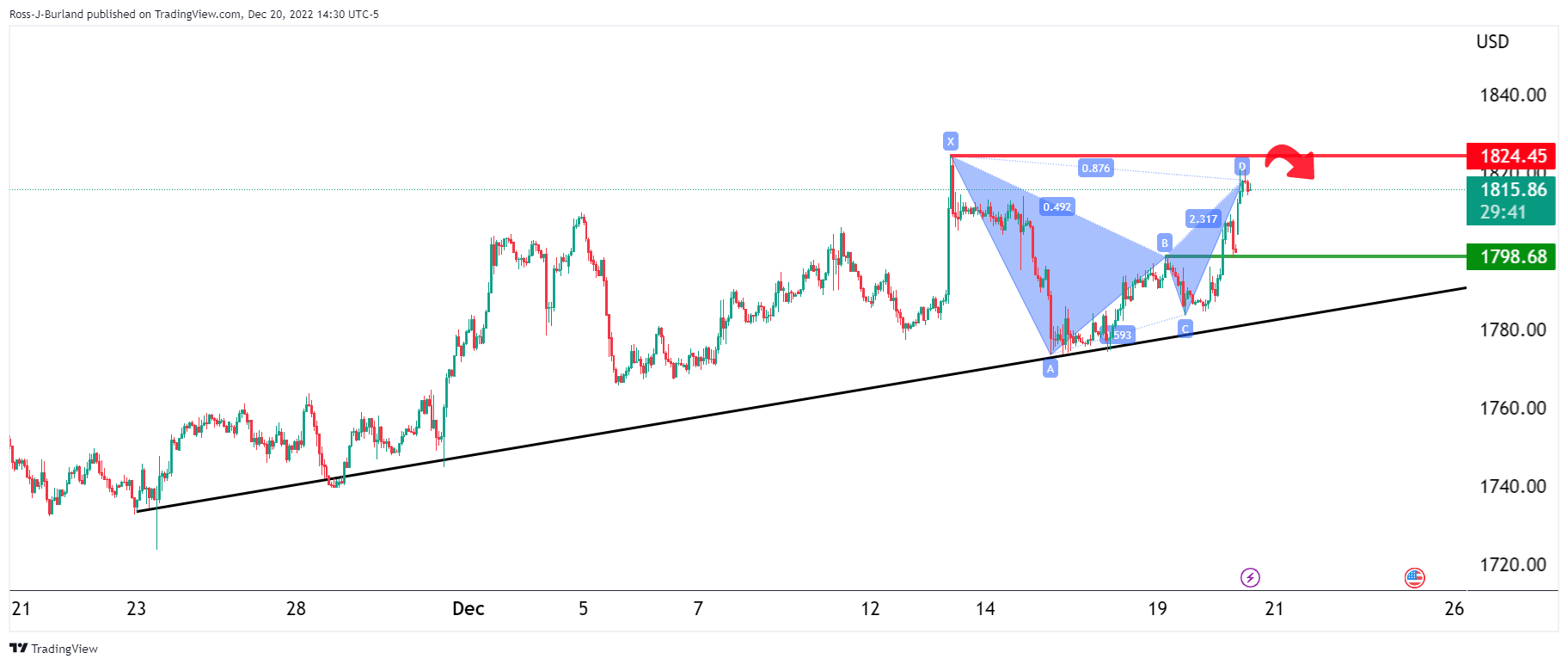

In a series of prior analyses, it was stated that the Gold price 1-hour picture was bearish while below the resistance near $1,825 and on the backside of the micro trendline and there are eyes on eyes on $1,795.

Gold price, prior analysis

- Gold Price Forecast: XAU/USD bears lurking at key resistance, eyes on $1,795

- Gold Price Forecast: XAU/USD reversing its technical path (or is it?) despite Bank of Japan surprise move:

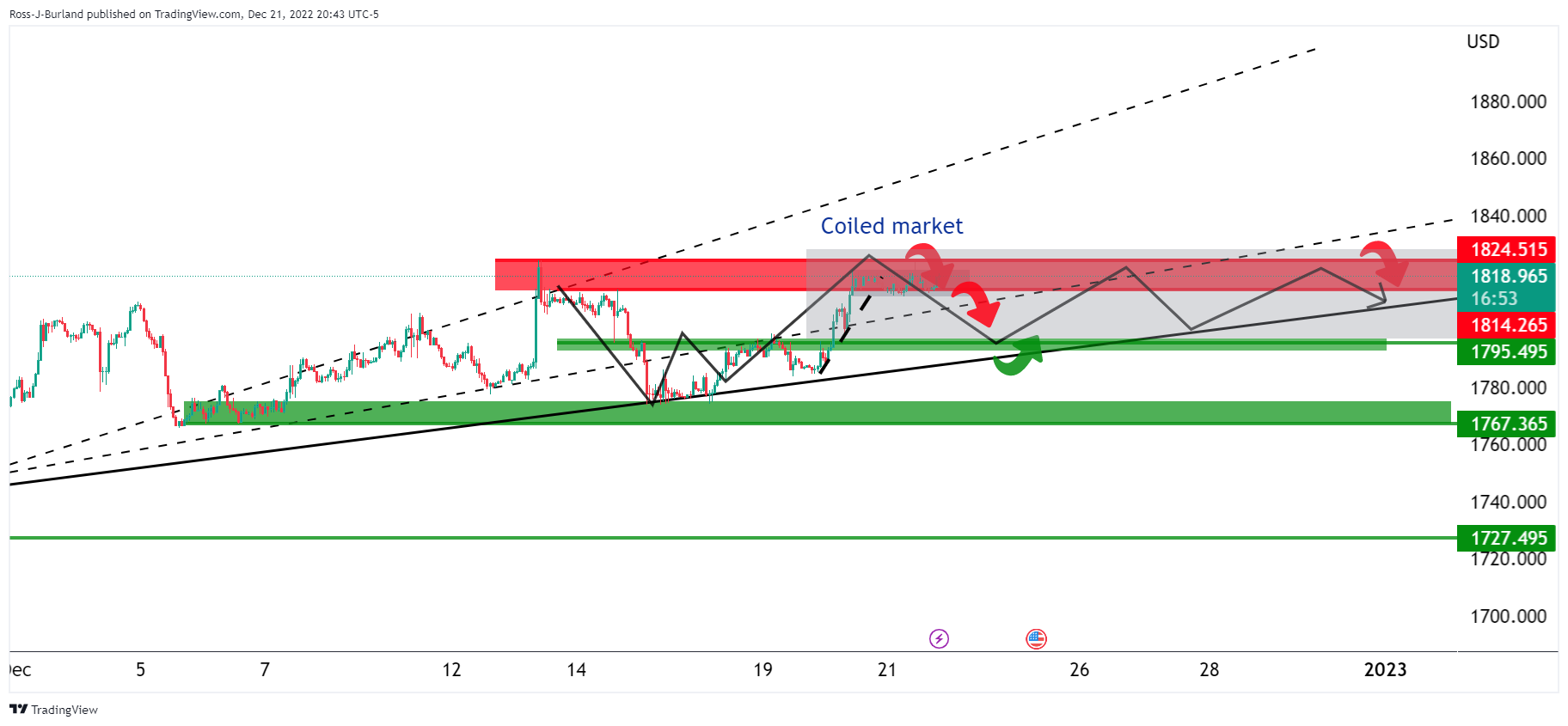

The Gold price 1-hour picture is bearish while below the resistance near $1,825 but not until the Gold price moves to the backside of the micro trend line:

On the 15-minute chart for the Gold price, we drew the extensions to the downside based on the presumed sideways consolidation box that had been forming over the prior sessions/days.

Gold price, update

As illustrated, the Gold price dropped to the targetted area and exceeded it into the $1,784s for a 300% measured move and to where the prior micro trend started off at.

At this juncture, a correction in the Gold price would be expected, respecting the bullish trend:

Failing this, then an even deeper move in Gold price would be on the cards for the days ahead, making the case for a significant downside correction with $1,775 eyed.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.