- Analytics

- News and Tools

- Market News

- USD/JPY Price Analysis: Corrective bounce needs validation from 132.80

USD/JPY Price Analysis: Corrective bounce needs validation from 132.80

- USD/JPY picks up bids after falling the most since October 1998.

- Oversold RSI backs recovery moves bearish MACD signals 50% Fibonacci retracement challenges bulls.

- Previous support lines, key SMAs are additional upside hurdles to cross for the bulls before taking control.

- August month’s low, golden Fibonacci ratio eyed during fresh downside.

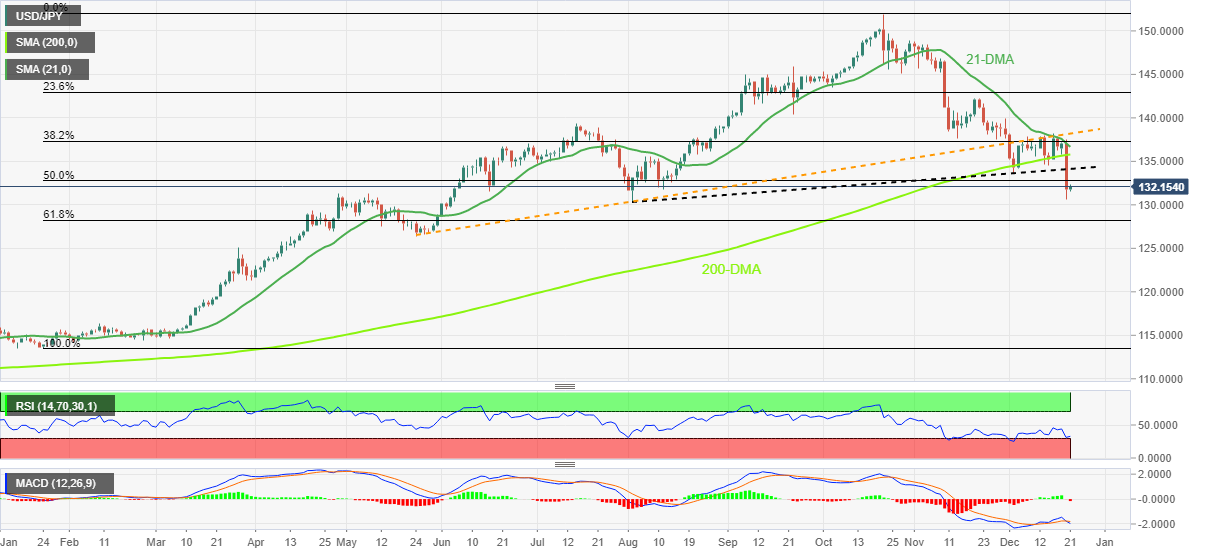

USD/JPY licks its wounds above 132.00, up 0.30% intraday near 132.20 heading into Wednesday’s European session. That said, the Yen pair dropped the most in 24 years and refreshed a four-month low after the Bank of Japan (BOJ) shocked the markets.

The quote’s latest rebound seemed to have justified the oversold RSI (14) conditions as bulls approach the 50% Fibonacci retracement level of the pair’s January-October upside near 132.80.

It’s worth noting, however, that the previous support line from August and the 200-DMA, respectively near 134.00 and 135.80, could challenge the USD/JPY buyers afterward.

Even if the quote manages to stay firmer past 135.80, the 21-DMA and a seven-month-old support-turned-resistance line, around 136.70 and 138.60, will be in focus for the bulls.

On the flip side, April’s low near 130.40 and the 130.00 psychological magnet could challenge the short-term USD/JPY downside.

Following that, the 61.8% Fibonacci retracement level of 128.20, also known as the “Golden Ratio”, should test the bears. Also acting as a downside filter is May’s low near 126.35.

Overall, USD/JPY is likely to remain off the buyer’s radar unless trading below 138.60 while the sellers need to wait for a break below the 130.00 level to retake control. Even so, an upside break of the immediate resistance could extend the latest recovery.

USD/JPY: Daily chart

Trend: Limited recovery expected

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.