- Analytics

- News and Tools

- Market News

- GBP/JPY Price Analysis: At a crossroads testing points of control following BoJ drop

GBP/JPY Price Analysis: At a crossroads testing points of control following BoJ drop

- GBP/JPY bears move in on key points of control following BoJ drama.

- Further downside eyed but corrections not impossible.

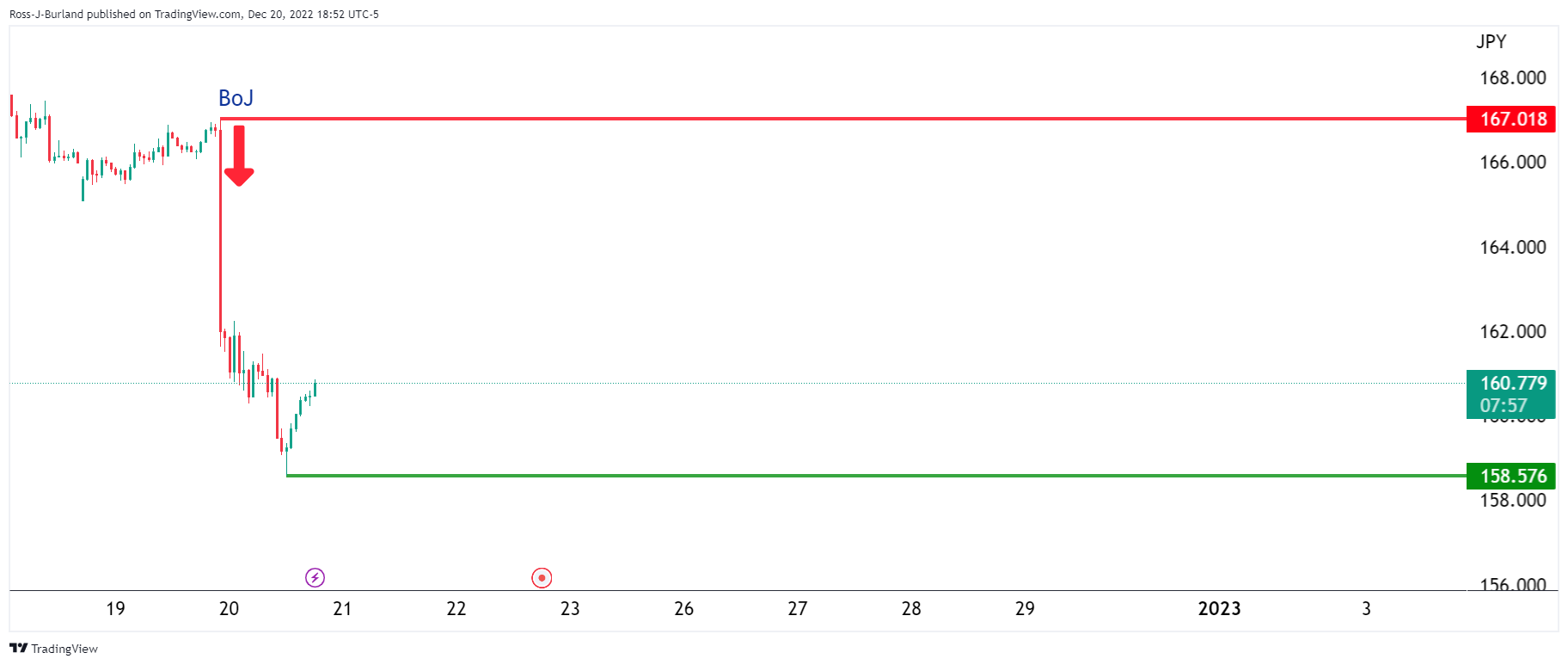

GBP/JPY fell off a cliff in Asia yesterday and continued lower overnight following the Bank of Japan shocked markets on Tuesday with a surprising tweak to its bond yield control. The BoJ has adjusted the terms around long-term interest rates, allowing them to rise more in a move aimed at easing some of the costs of prolonged monetary stimulus.

Consequently, the yen soared across the board sending GBP/JPY down by 5% falling from a high of 167.08 to a low of 158.58:

GBP/USD daily chart

From a daily perspective, the price penetrated below the point of control on the recent move from the prior swing low marked in September and has come right back into it on a correction.

Should the bears commit at this juncture, there could be more downside in store for a continuation of the move over the coming days and weeks:

A 100% expansion of the prior consolidation daily channel's range comes in near the prior structure around 147.70. A move of just a 50% expansion of the range comes in at 153.80ish, back to the September swing lows.

However, should there be a continued correction, then a retest of the prior structure that aligns with a 61.8% ratio could be in order, albeit less likely from a fundamental standpoint at this juncture:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.