- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD reversing its technical path (or is it?) despite Bank of Japan surprise move

Gold Price Forecast: XAU/USD reversing its technical path (or is it?) despite Bank of Japan surprise move

- Gold price is making tracks to the upside despite the Bank of Japan's surprise relaxation on the yield of its 10-year bonds (JGBs).

- US Dollar sinks as the Yen rallies to the moon.

- US Treasury yields and a hawkish Federal Reserve could be the spanner in the works for the Gold price bulls.

The Gold price is higher on Tuesday due to volatility in the market that has sent the USD Dollar lower on the back of a surge in the Japanese Yen following a surprise move by the Bank of Japan (BoJ) in Asian markets.

Gold price rallies on Bank of Japan's surprise move

A decision by Japan's central bank to raise a cap on the yield of its 10-year Japanese government bonds (JGBs) sent markets into a state of shock and lured investors away from US debt. The BoJ is allowing 10-year bonds to trade at interest rates up to 0.5%, up from 0.25% and such a rise in the cap encourages domestic buying of its bonds. However, the Gold price has rallied despite the subsequent lower global borrowing costs and sell-off in bonds across the world, likely as a direct effect of a cheaper US Dollar.

US Dollar is slammed as Yen soars

Nevertheless, the US Dollar has sunk as per the DXY index as the Bank of Japan (BoJ) switches gears which sent the Yen around 5% higher vs the USD. USD/JPY fell from a pre-BoJ high of 137.40 to a low of 130.56. Consequently, the US Dollar as measured against a basket of currencies, including the yen which makes up 13.6% of the basket fell to a low of 103.77. DXY was trading at a high of 104.90 before the announcement by the BoJ.

US Treasury yields and yield curve in view

Nevertheless, higher global yields are potentially capping the rally in the Gold price since Gold offers no interest. The benchmark 10-year Treasury note yields rose to 3.710 and two-year note yields rose to 4.312% although they have started to come off their highs and Gold price is finding demand in late North American trade. Nevertheless, the US Treasury yield curve between two-year and 10-year Treasury notes remains at deeply negative levels, indicating concerns about an impending recession which is commonly positive for the US Dollar.

Federal Reserve sentiment remains key

Going forward, what is going to be critical for the Gold price is the sentiment surrounding the Federal Reserve (Fed). After rising as high as 5.5% after last week’s Federal Open Market Committee (FOMC) meeting, the terminal rate as seen by the swaps market fell back to just below 5.0% despite the hawkish rate hike.

''We cannot understand why the markets continue to fight the Fed,'' analysts at Brown Brothers Harriman said. ''With the exception of some communications missteps here and there, Fed chair Jerome Powell and company have been resolute about the need to take rates higher for longer. Although the media embargo has been lifted, there are no Fed speakers scheduled this week.''

Gold price technical analysis

Prior Gold price analysis:

It was stated that the downside bias in Gold price was in play so long as the bulls are kept at bay below the counter trendlines and $1,800. The price has instead rallied on Tuesday and the bales could be turning. However, holiday markets are setting in and it is uncommon for intended momentum trade setups to play out in what are usually choppy conditions for the Gold price.

Gold price update

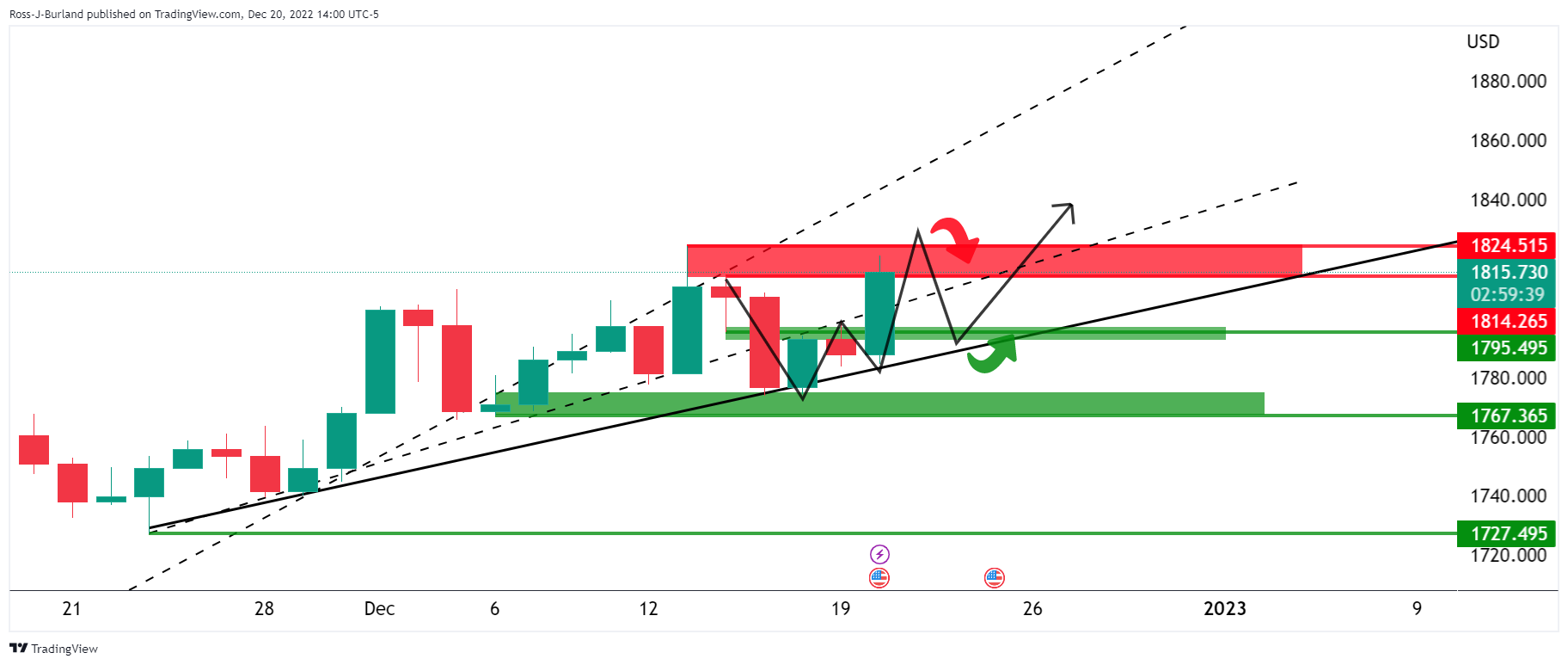

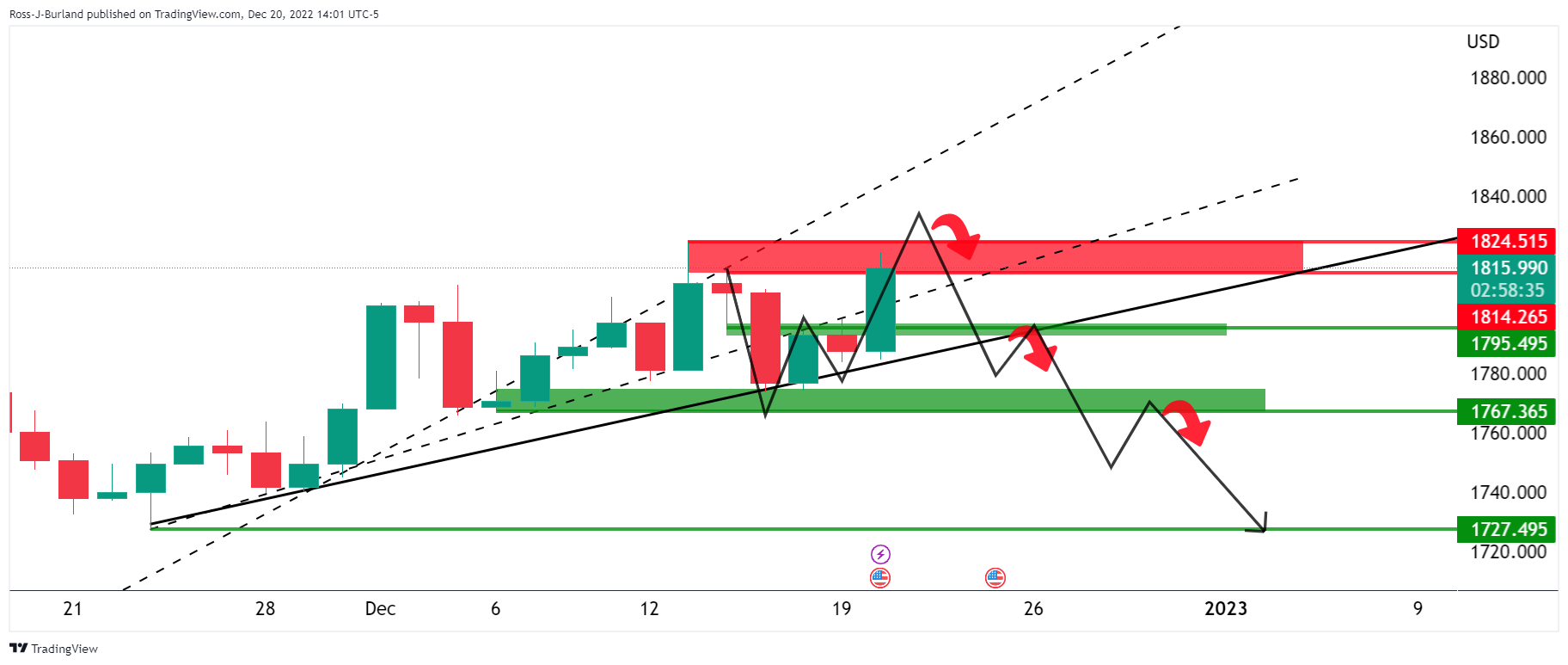

The Gold price has switched bullish as per the move into the $1,800s and bulls are now facing a resistance area.

However, Gold price markets do one of three things: 1) Break out, pull back and continue 2) break out pull back and reverse, or 3), break out, pull back and go into a trading range.

Gold price scenario 1:

Gold price scenario 2:

Gold price scenario 3:

Gold price lower time frames

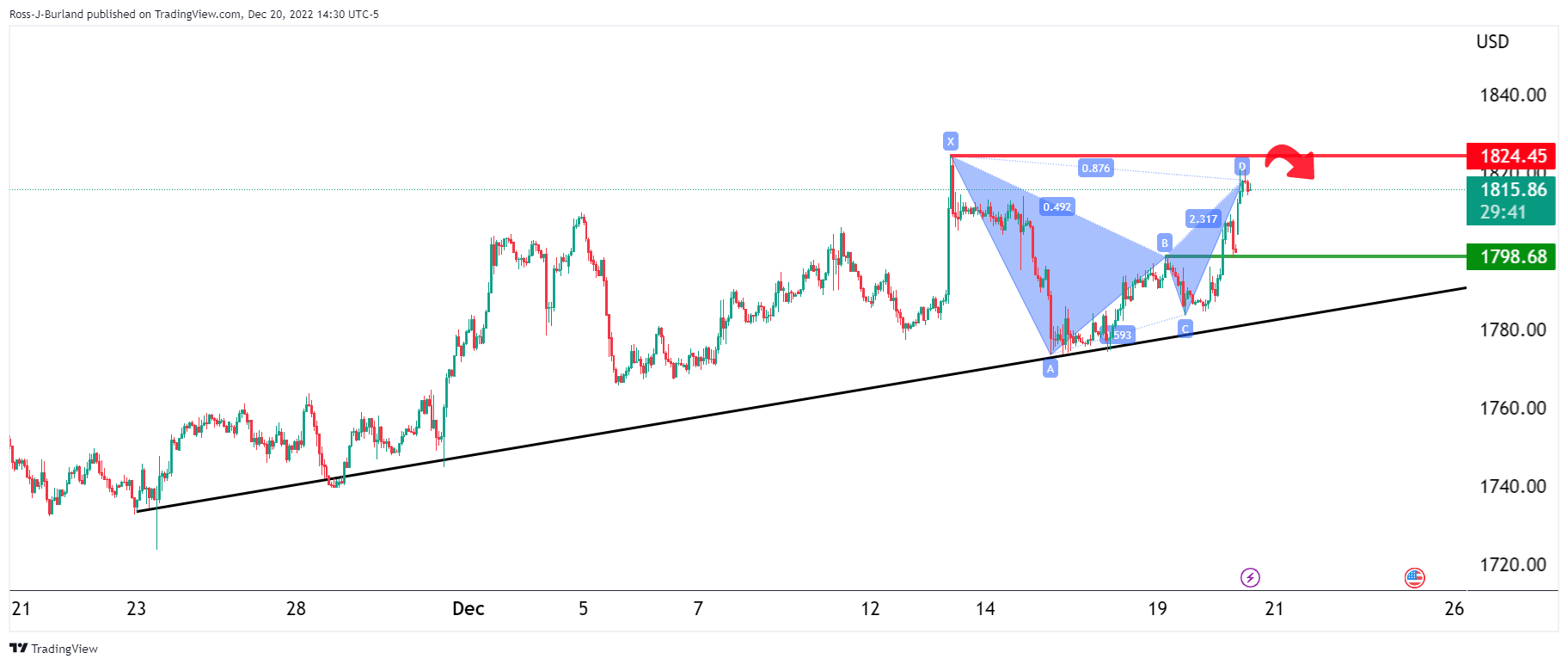

The Gold price 1-hour picture is bearish while below the resistance near $1,825 but not until the Gold price moves to the backside of the micro trend line:

On the 15-minute chart for the Gold price, we can draw the extensions to the downside based on the presumed sideways consolidation box that could form over the coming sessions/days due to the pull of the harmonic bearish pattern on the Gold price daily chart.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.