- Analytics

- News and Tools

- Market News

- RBA Minutes: Considered pausing hikes at Dec meeting, still sees more ahead

RBA Minutes: Considered pausing hikes at Dec meeting, still sees more ahead

The Reserve Bank of Australia (RBA) published the minutes of its monetary policy meeting two weeks after the prior interest rate decision.

RBA minutes key notes

Reuters reported that the RBA ''considered leaving interest rates unchanged at its December policy meeting, citing the lagged effects of the aggressive tightening delivered so far and the benefits of moving cautiously in an uncertain environment.''

''Reserve Bank of Australia's (RBA) Board weighed three options at its last decision this year - hiking by 50 basis points, 25 bps or pausing, but the arguments for a 25 basis-point hike prevailed.''

''It was the first time the Board considered pausing since it started raising interest rates in May. Rates have already risen by 300 basis points to a ten-year high of 3.1% and much of that had yet to feed through into mortgage payments.''

''In particular, the Board noted there was considerable uncertainty about the outlook for inflation and the labour market amid deteriorating prospects for the global economy.''

"Recognising this uncertainty, members noted that a range of options for the cash rate could be considered again at upcoming meetings in 2023.''

"The Board did not rule out returning to larger increases if the situation warranted. Conversely, the Board is prepared to keep the cash rate unchanged for a period while it assesses the state of the economy and the inflation outlook."

''Ultimately, the minutes showed it decided against pausing because shifting course with no clear impetus from incoming data would create uncertainty about its reaction function, noting that no other central bank had yet paused.''

AUD/USD update

There has been no reaction to the minutes. AUD/USD continues to consolidate around 0.6700.

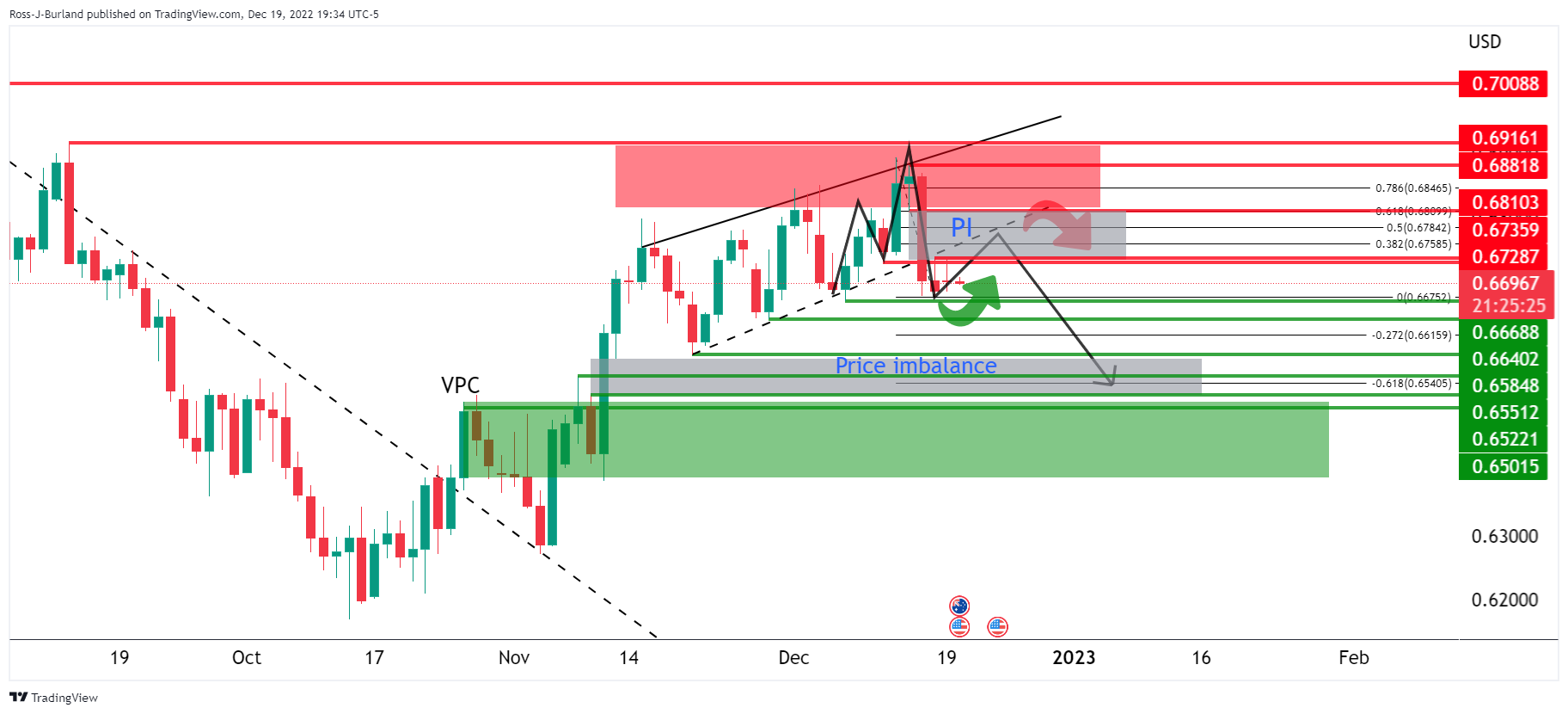

The price is consolidating but as the above 4-hour chart analysis illustrates, there are prospects of a bullish correction into a price imbalance to retest the prior bullish channels now counter trendline and 0.68s. If this were to hold as resistance, then the bias will be to the downside towards 0.6500.

About the Reserve Bank of Australia (RBA) minutes

The Reserve Bank of Australia (RBA) publishes the minutes of its monetary policy meeting two weeks after the interest rate decision is announced. It provides a detailed record of the discussions held between the RBA’s board members on monetary policy and economic conditions that influenced their decision on adjusting interest rates and/or bond buys, significantly impacting the AUD. The minutes also reveal considerations on international economic developments and the exchange rate value.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.