- Analytics

- News and Tools

- Market News

- AUD/USD Price Analysis: Bulls are moving in with eyes on a 61.8% Fibonacci retracement towards 0.6800

AUD/USD Price Analysis: Bulls are moving in with eyes on a 61.8% Fibonacci retracement towards 0.6800

- AUD/USD bulls are waiting patiently for a change of character in the market structure.

- Bulls eye a test of 0.6800 for the days ahead while bears await confirmation of a downside opportunity.

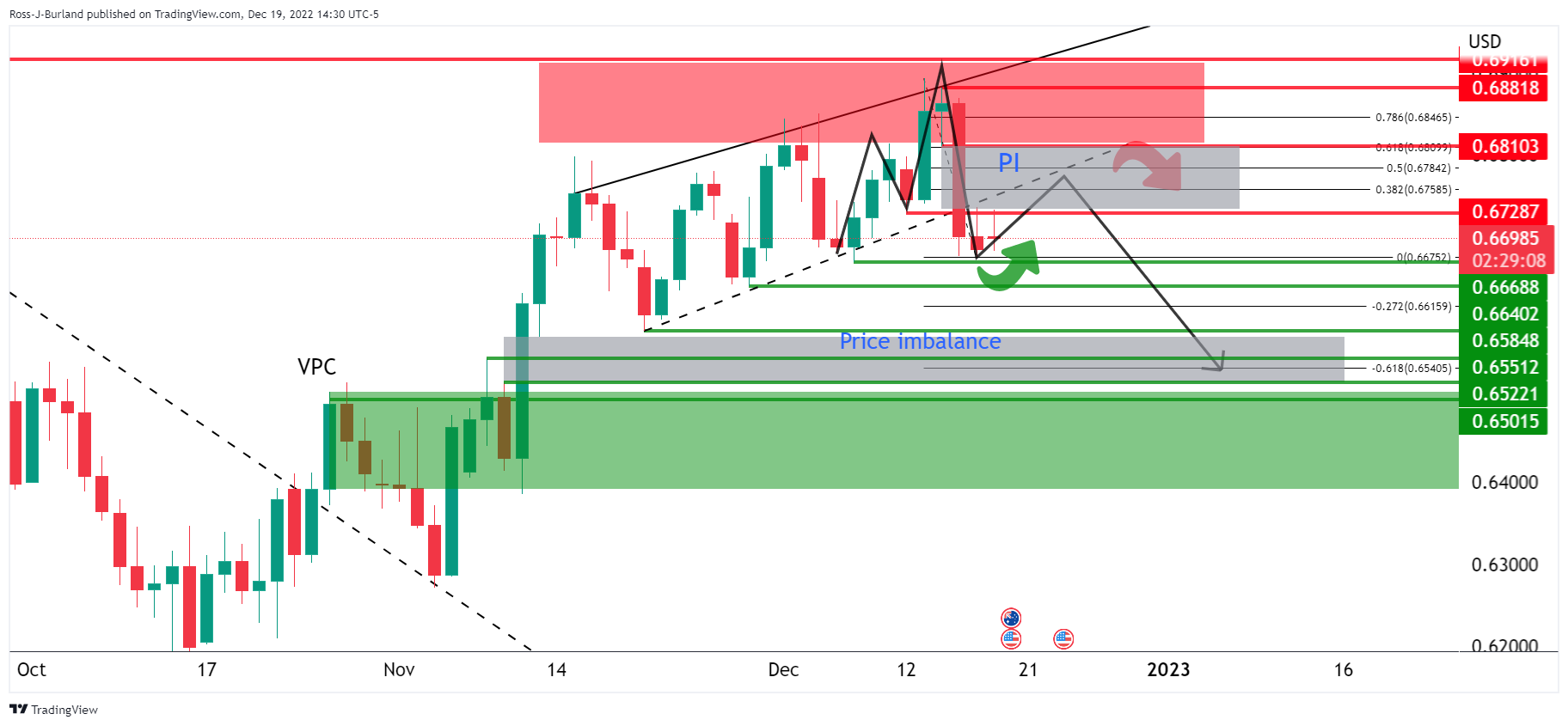

As per a prior analysis, AUD/USD drops heavily in risk-off markets following hawkish BoE, ECB and Federal Reserve, whereby bears were targeting a downward continuation move toward 0.6500, the thesis remains in play as the following will illustrate. However, for the immediate future, a correction towards 0.6800 could be on the cards first.

AUD/USD prior analysis

it was shown that AUD/USD had broken channel support and there were eyes on a break to the Volume Point of Control (VPC) of the late August to mid-October bear cycle:

The neckline of AUD/USD M-formation is still expected to serve as a resistance area of a restest in the coming days and that could lead to a downside continuation below the now counter-trendline to target the 0.65s.

AUD/USD update

Zoomed in...

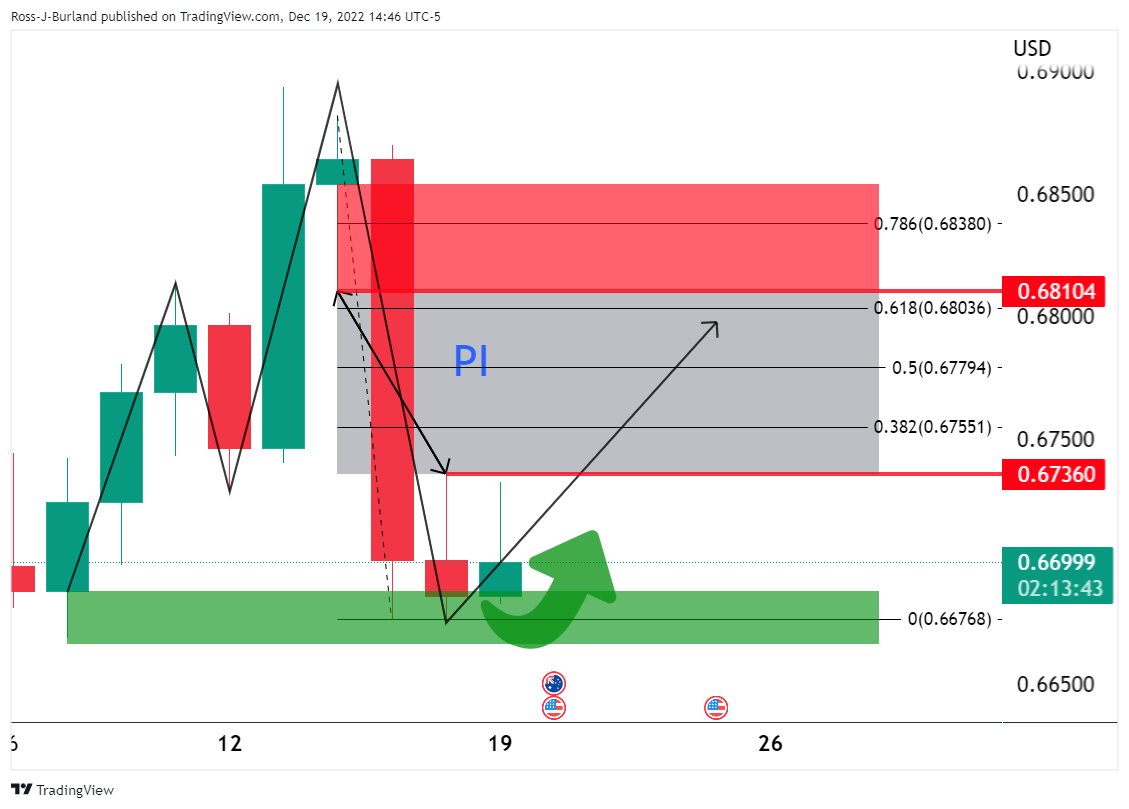

The M-formation is still in the making. A bottom has not been confirmed yet as we are yet to see a daily first green day close that would signal the deceleration of the bearish impulse and prospects of a bullish correction of the same.

However, the upper quarter of the 0.66s is giving some support AUD and it could be time to start monitoring for a first green day close and planning the playbook on the lower time frames for a short squeeze set-up.

There is a price imbalance (PI) between 0.6736 and 0.6810 with the 61.8% ratio eyed as a confluence:

AUD/USD H1 chart

On the lower time frames, bulls will want to see a break of the trendline and prior lower high to confirm a bullish bias:

On the hourly time frame, we have seen a break in the trendline. The market is coiling sideways. We have equal lows at 0.6695 that are being pressured currently with liquidity in market orders expected below and under 0.6675 lows. A ''sweep' of the liquidity could result in a surge of demand from the bulls and ultimately provide enough fuel to take out the 0.6720 and then the 0.6736 resistance and create a change of character (CoCh) in the structure to bullish.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.