- Analytics

- News and Tools

- Market News

- AUD/USD sellers take over and drag the pair toward its lows around 0.6810s post-Fed’s decision

AUD/USD sellers take over and drag the pair toward its lows around 0.6810s post-Fed’s decision

- The US Federal Reserve hiked rates by 50 bps, and the AUD/USD tumbled from around 0.6880s toward its day’s lows.

- Federal Reserve policymakers expect the Federal Funds rates to peak around 5.1%.

- AUD/USD: Break below 0.6800 can exacerbate a fall toward the 20-DM; otherwise, a rally above 0.6900 is on the cards.

The AUD/USD dropped from daily highs nearby 0.6900, toward its daily lows of 0.6820, following the US Federal Reserve (Fed) monetary policy decision on Wednesday, with Jerome Powell and Co., raising rates by 50 bps, as most analysts expected. However, the monetary policy statement remained unchanged from November’s. Therefore, the AUD/USD is trading volatile, around 0.6800/20, at the time of writing.

Summary of the Fed’s decision

The Federal Reserve Open Market Committee (FOMC) made the widely anticipated decision to raise the Federal Funds rate (FFR) toward 4.25-4.50%. The US central bank decision was spurred by a tight labor market and inflation reflecting various supply and demand imbalances due to the pandemic, higher food and energy prices, and broader price pressures. Officials noted that further increases in policy are needed for inflation to return back over to the 2% target and stated that “cumulative tightening of monetary policy,” inflation, and economic and financial developments, to achieve the Fed’s target.

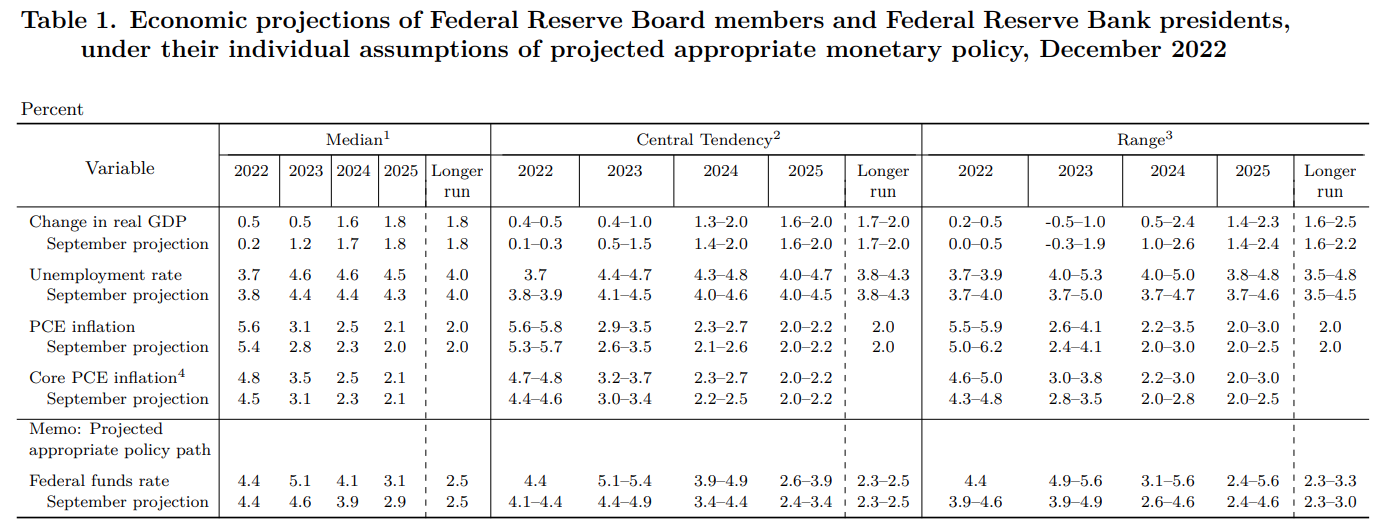

According to the Summary of Economic Projections, Federal officials predict a “terminal” rate average near 5.10%, with GDP anticipations at 0.5% for both 2022 and 2023; inflation is expected to reach 3.5% by 2023 before declining further in future years down toward the 2% US central bank, target.

Source: Federal Reserve

AUD/USD 5-minute Chart

The AUD/USD tumbled from around 0.6875 toward its daily low of 0.6818 on the release of the monetary policy statement, though it had erased some of its losses, but remains volatile as the Federal Reserve Chair Jerome Powell takes the stance.

A fall below 0.6800 could pave the way toward the 20-day Exponential Moving Average (EMA) at 0.6726. On the upside, a rally above 0.6900 could be expected if Powell turns more dovish as expected.

AUD/USD Key Technical Levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.