- Analytics

- News and Tools

- Market News

- EUR/USD fell toward 1.0640s after the Federal Reserve hiked rates by 50 bps

EUR/USD fell toward 1.0640s after the Federal Reserve hiked rates by 50 bps

- Federal Reserve maintained a neutral-hawkish tone in the monetary policy statement, almost unchanged from November’s.

- Fed officials expect the Federal Funds rate to get as high as 5.1%, vs. 4.6% in September.

- Inflation in the United States is expected to hit the 2% threshold by 2024.

The EUR/USD dropped toward 1.0630s after the Federal Reserve (Fed) raised rates by 50 bps, as widely expected by analysts while maintaining a dovish tone, as investors prepared for the Fed Chair Jerome Powell press conference around 18:30 GMT. At the time of writing, the EUR/USD trades volatile, around the 1.0640/1.0660 range.

Summary of the Federal Reserve monetary policy statement

The Federal Reserve Open Market Committee (FOMC) decided to hike the Federal Funds rate (FFR) as expected toward the 4.25-4.50% range, acknowledging that the labor market remains tight and that inflation remains elevated, “reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures.”

FOMC officials added that “ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.” Additionally, policymakers expressed that it would take the “cumulative tightening of monetary policy,” inflation, and economic and financial developments.

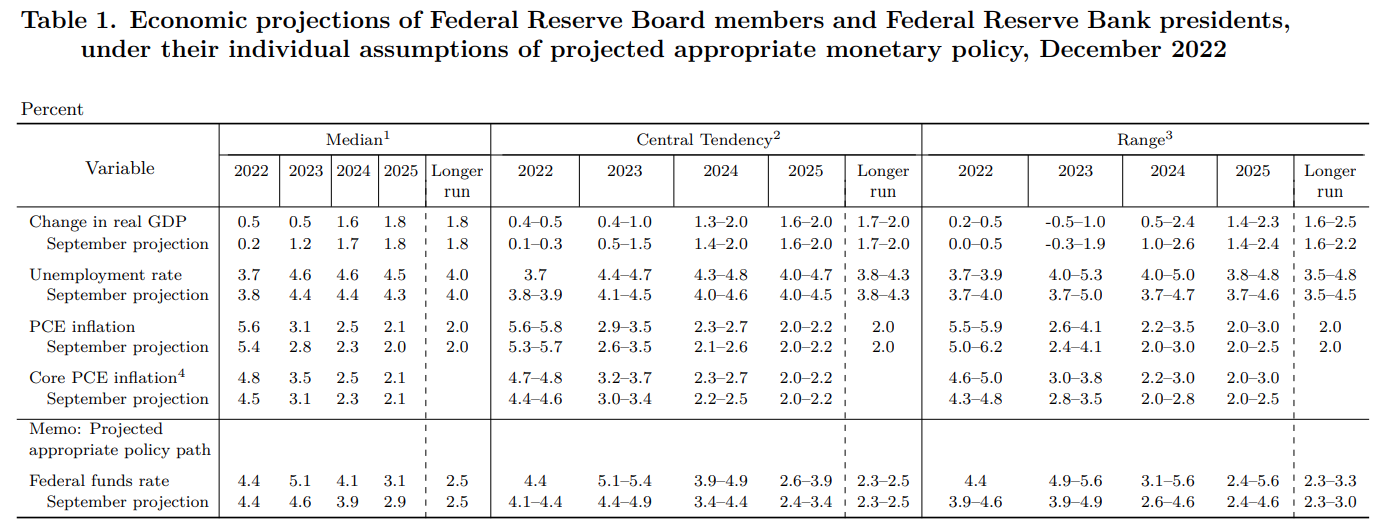

Regarding the Summary of Economic Projections (SEP), most officials expect the “terminal” rate at around 5.10% according to the median and foresee the Gross Domestic Product (GDP) for 2022 at 0.5% and in 2023 at 0.5%. Inflation is expected to fall to 3.5% in 2023 and will hit the 2.1% mark by 2025.

Source: Federal Reserve

EUR/USD 5-minute Chart

EUR/USD Key Technical Levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.