- Analytics

- News and Tools

- Market News

- Silver Price Forecast: XAG/USD trades at multi-month highs around $23.70s

Silver Price Forecast: XAG/USD trades at multi-month highs around $23.70s

- Silver hit a six-month high at around $24.12 before reversing its curse, though it remains positive.

- Inflation in the United States continues its downtrend, still far from the 2% goal.

- The Federal Reserve is expected to hike rates by 50 bps, with odds around 90%.

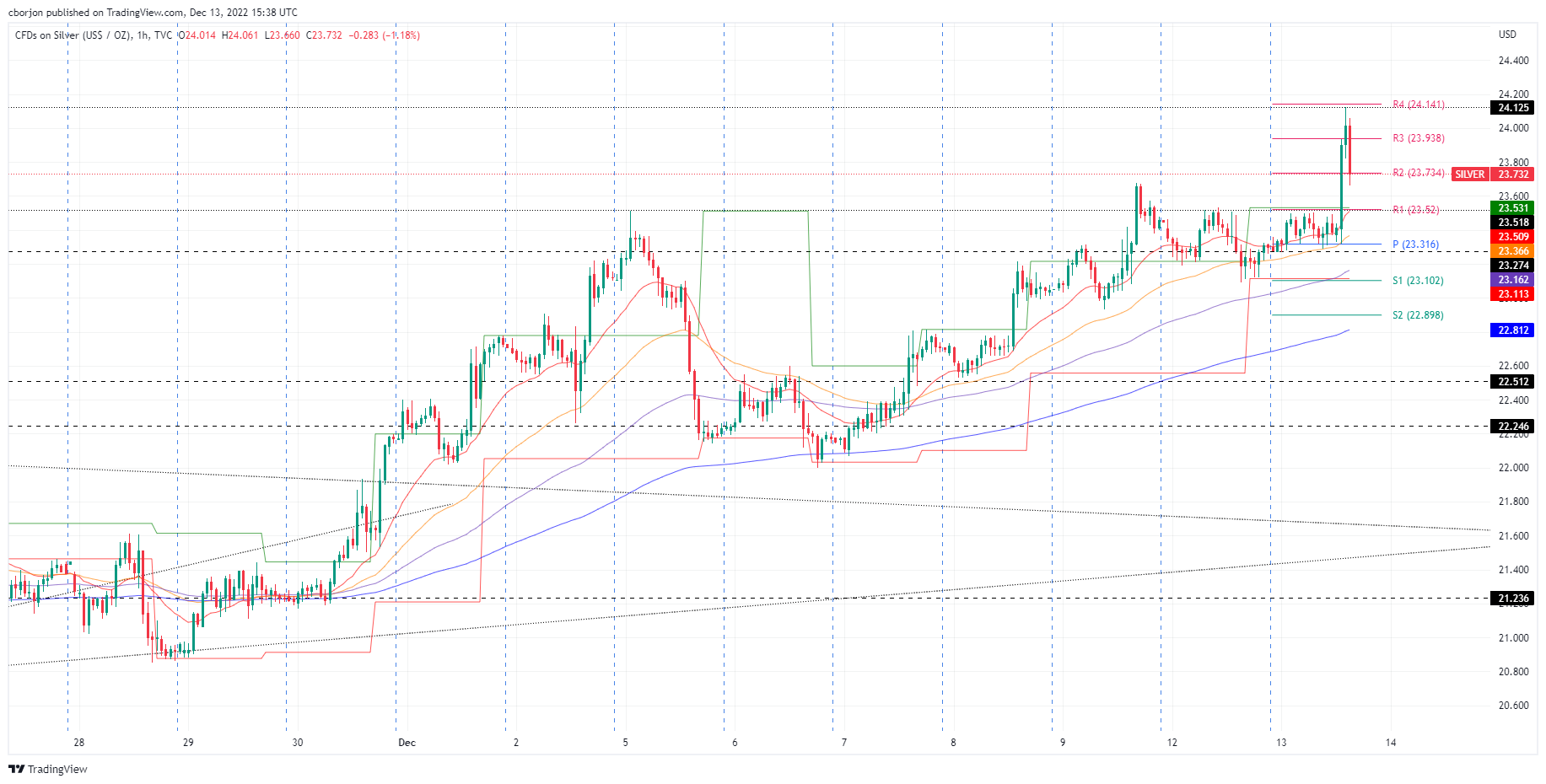

Silver price advanced sharply above the $24.00 figure following the November inflation report in the United States (US) release, which ticked lower, easing pressure on the Federal Reserve (Fed). The US Dollar (USD) is plunging while precious metals advance. At the time of writing, the XAG/USD is trading at $23.74 after hitting an eight-month high of $24.12.

The Department of Labor reported that the Consumer Price Index (CPI) rose marginally by 0.1% from last month and decreased slightly on a year-on-year basis to 7.1%, missing previous analyst expectations of 7.3%. Even though inflation has dropped since its peak in June at 9.1%, the so-called core CPI suddenly shifted upwards during September. Nevertheless, in the last two months, core CPI moved downwards, with November figures standing at 6%, below what analysts had predicted as 6.3%.

Money market futures suggest that the Federal Funds rate (FFR) may reach a peak of 5% before being cut in September 2023, around 20 bps. At the same time, weakness was seen for the US Dollar Index, which sank to six-month lows around 103.586, though it is trimming some of its earlier losses, sitting at 103.900.

Elsewhere, US Treasury bond yields, namely the 10-year benchmark note rate, plunged 15 bps, from around 3.630% to 3.459%, while US 10-year TIPS yield, a proxy for real yields, dropped 11 bps to 1.215%, a tailwind for the precious metal segment.

Silver (XAG/USD) Reaction to US CPI report

XAG/USD remains upward biased and rallied above $24.00, on traders speculating that the Federal Reserve might not be as aggressive as inflation continues to slow down. Silver found solid resistance at the R4 daily pivot at $24.14, since then, retraced $0.40 towards current prices, erasing some of its earlier gains. A fall below the $2 daily pivot at $23.73 could pave the way toward the R1 level at $23.52, followed by the daily pivot at $23.31, which would turn the white metal flat compared to Tuesday’s opening price.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.