- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD

Gold Price Forecast: XAU/USD

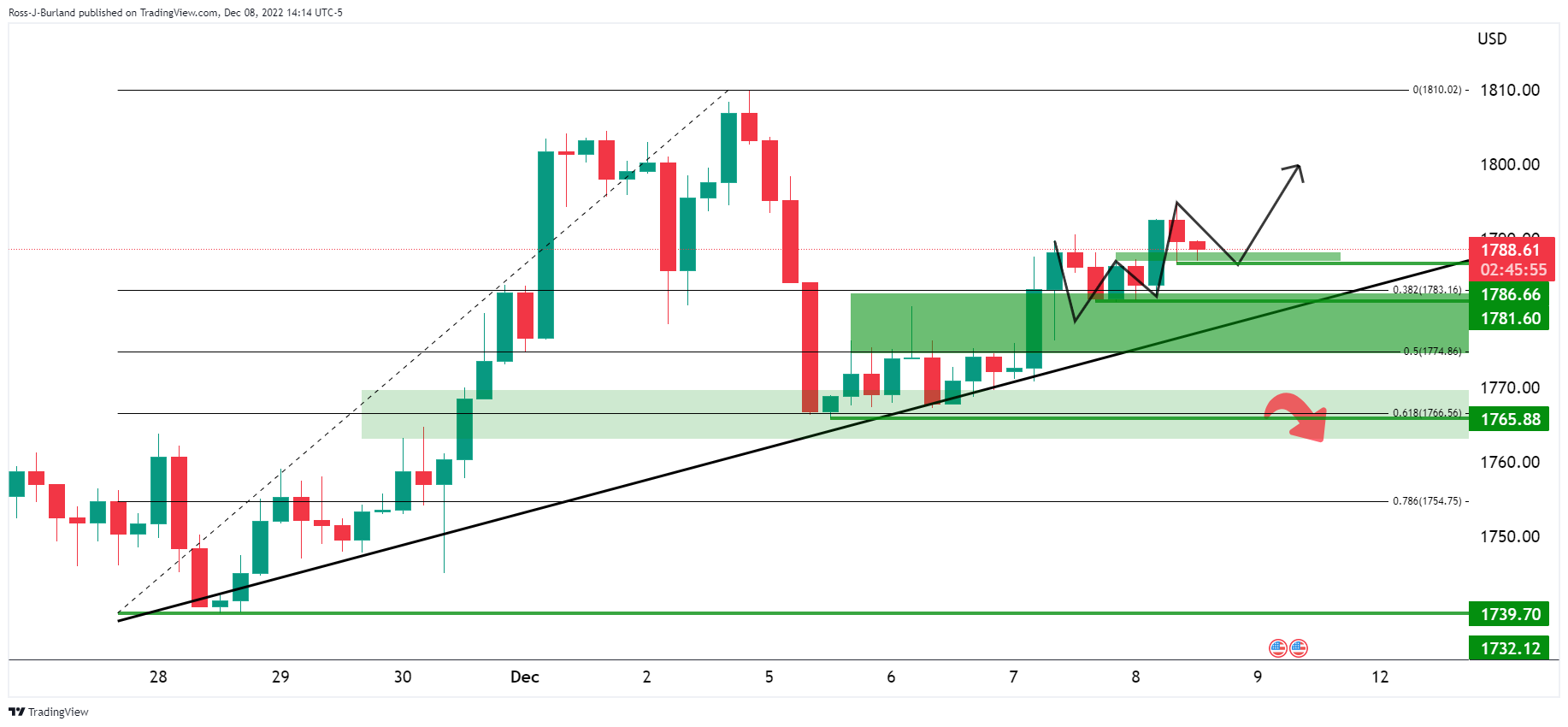

- Gold bulls eye a run towards $1,800 from W-formation neckline support.

- All eyes will be on the Federal Reserve next week and key data before then.

Gold price is up on the day by some 0.22% after rising from a low of $1,781 to a high of $1,794.88 so far on Thursday. Markets have been relatively quiet on the day with little data released and the Federal Reserve in a blackout. Nevertheless, The US dollar eased, while investors positioned themselves ahead of key US inflation data and the Federal Reserve's policy meeting due next week.

The US Dollar index, as measured by the DXY index, fell 0.4% from a high of 105.433 to a low of 104.724, making gold less expensive for other currency holders. The dip came at the same time a rise in weekly jobless claims suggested that the labour market is slowing down. Weekly jobless claims rose to 230K, as expected. Continuing claims rose to 1.671M, topping the forecast of 1.6M and the data comes ahead of next week's Federal Reserve meeting.

There will be more key data events coming up before the Federal Reserve December 14 meeting. The Producer Price Index and the University of Michigan's consumer sentiment survey on Friday as well as November's Consumer Price Index are due. Investors will be on the watch for any signs that the Federal Reserve is getting ready to pause its hikes.

Fed expectations

Meanwhile, money markets show there is a 91% chance that the policy-setting Federal Open Market Committee (FOMC) will raise rates by half a point next week, and just a 9% chance there will be another 75 basis point increase with the rates peaking in May 2023 at 4.92%. The US Federal Reserve has already raised its policy rate by 375 basis points this year in the fastest hikes since the 1980s.

Meanwhile, supportive of the Gold price, safe haven assets were in strong demand amid growing recessionary fears this week as seen in the thirty-year Treasuries that dropped more than 10bp to a three-month low while yields on the 10-year were also lower. The yield curve between the 2-year and 10-year Treasury notes US 10-year has also widened in recent days.

Gold technical analysis

The daily charts above show the Gold price correcting in the harmonic formation although it has started to decelerate below the key $1,800s. On the 4-hour chart below, the Gold price is attempting to move higher and so long as the W-formation's neckline holds, there will be prospects of an upside continuation:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.