- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bulls look to $1,780 from daily support area

Gold Price Forecast: XAU/USD bulls look to $1,780 from daily support area

- Gold bears have charged in and the price is now at a fresh layer of support.

- Gold price is now on the backside of the micro trend, testing the daily W-formations' neckline support.

- A bullish correction could be on the cards with $1,780 eyed.

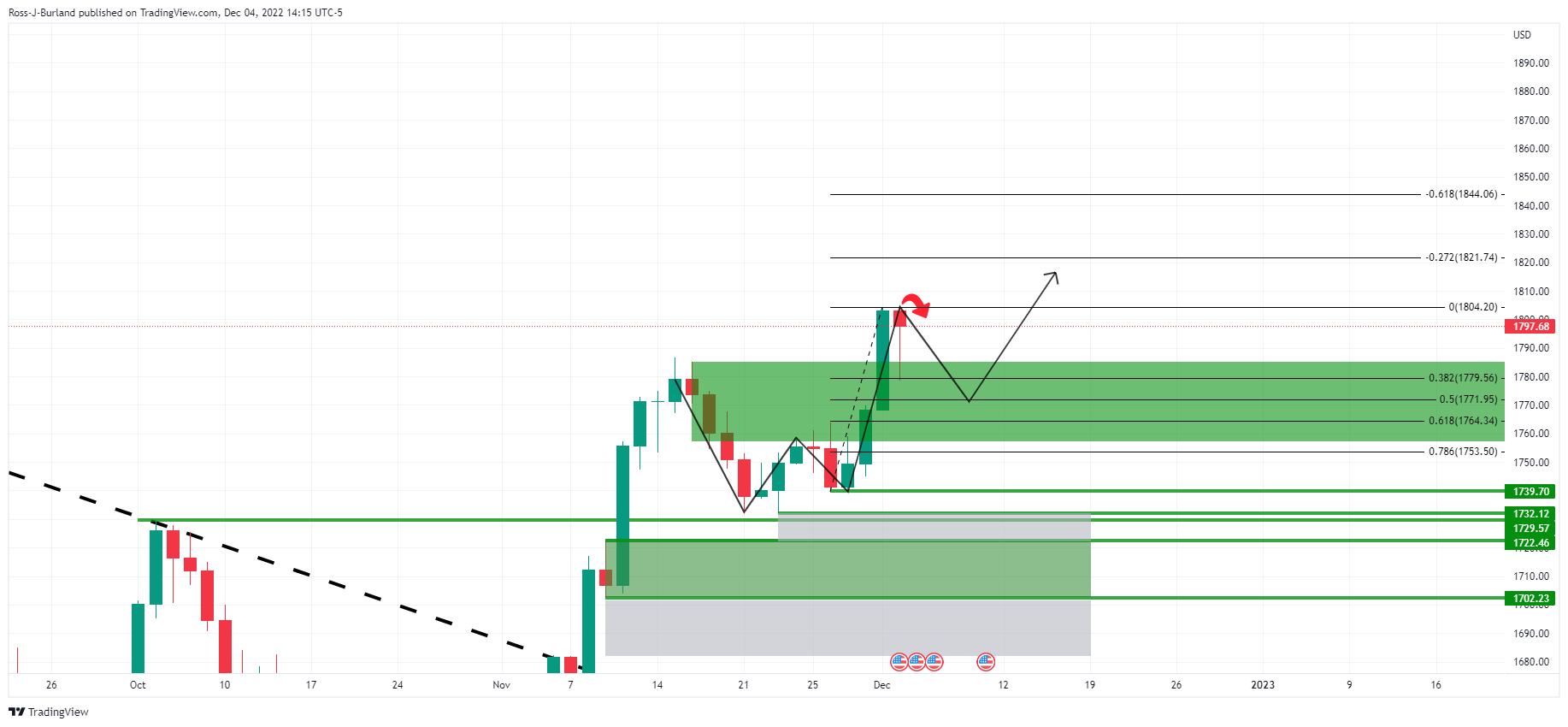

Gold price was smashed lower at the start of the week and is ending the North American session lower by some 1.65%. XAU/USD printed a low of $1,765.91 and fell from a high of $1,810.01 in a move that was forecasted in this week's pre-market analysis: Gold, Chart of the Week: XAU/USD bears eye a typical corrective opportunity below critical resistance

While there was a technical bias to the downside for the start of the week, the fundamentals drove the move as investors fretted that better-than-expected service-sector activity could point to the Federal Reserve hiking interest rates for longer.

US data switch flipped

The Institute for Supply Management (ISM) said its Non-Manufacturing PMI rose to 56.5 last month from 54.4 in October, indicating that the services sector, which accounts for more than two-thirds of US economic activity, remained resilient in the face of rising interest rates.

The data beat forecast the Non-manufacturing PMI would fall to 53.1. This data combined with Friday's surprisingly strong Nonfarm Payrolls and wage growth data in November as well as news that consumer spending had accelerated in October gives has raised optimism that a recession could be avoided in 2023.

The switch has flipped since the recently weaker Consumer Price Index, prior ISM data and dovish Federal Reserve chairman Jerome Powell's comments that combined had started to weigh on the market's pricing of the terminal rate that had declined to below 5%. The rate was seen topping out at 4.75%-5% before the series of bullish data.

However, the Fed is now seen raising its policy rate, currently in the 3.75%-4% range, to 4.92% by March of next year and more likely than not into the 5%-5.25% range by May, based on futures contract prices and the CME Fed watch tool. However, futures contracts tied to the Fed policy rate still imply an 89% chance that the US central bank will increase interest rates by 50 basis points next week to 4.25%-4.50%, with the rates peaking at 4.984% in May 2023.

Nevertheless, US bond yields are still rising, bearish for gold since it offers no interest. The yield on the US 10-year note was last seen up 3.4% to 3.605%. The Federal Open Market Committee (FOMC) meets on Dec. 13-14.

Gold technical analysis

Prior analysis:

As per this week's pre-open analysis, it was stated that the price was on the back side of the trend, which is overall bullish as per the harmonic pattern while above the W-formation's lows near $1,730.

Zooming in ...

There were prospects of a correction towards the neckline of the W-formation as illustrated above and below, down on the hourly chart:

With the price potentially basing, for the meantime, in the $1,790s, a move into test into the $1,800s was expected to ''draw in the sellers again for the opening sessions with a move into the dynamic support that meets the daily 38.2% Fibonacci and a 50% mean reversion below that.''

Gold update:

The price action has followed the projection to the tee as illustrated above.

While the price is now on the backside of the micro trend, testing the daily W-formations's neckline support, a bullish correction could be on the cards with $1,780 eyed.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.