- Analytics

- News and Tools

- Market News

- Crude Oil, WTI, testing key $81.00 level, eyes on test of $80.00

Crude Oil, WTI, testing key $81.00 level, eyes on test of $80.00

- West Texas Intermediate (WTI) bulls are pressured despite China easing Coronavirus restrictions.

- Organization of the Petroleum Exporting Countries (OPEC) meeting in high anticipation.

- US Dollar heavy on dovish Federal Reserve chair Jerome Powell.

West Texas Intermediate (WTI) was buoyed by easing COVID-19 restrictions in China. However, at the time of writing, WTI is lower by some 0.2% in early Asia and hovers around $81.20 although remains in bullish territory having rallied through a major downside channel this week. WTI was reaching a high of $83.32bbls, taking out liquidity above the mid-November structure between $81.90bbls and $82.50bbls.

Organization of the Petroleum Exporting Countries meeting in high anticipation

The potential reopening of China presents a challenge for the Organization of the Petroleum Exporting Countries (OPEC) and Sunday's virtual meeting of members is in high anticipation as there is no clear indication of whether the cartel will keep current quotas in place or cut production to support prices. Cuts to OPEC supply have already helped to stabilise the market.

China relaxes coronavirus measures

Meanwhile, raising expectations of higher demand for oil. it was reported that Sun Chunlan, China's vice-premier, announced that the nation may be ready to amend its Zero-Covid policy. Shanghai, Guangzhou and a few other cities are lifting some quarantines despite rising case numbers. Guangzhou has been reported that it has lifted all restrictions in several districts.

Analysts at TD Securities explained that oil demand had suffered under the strict measures to contain the virus, with implied oil demand currently at 13 million barrels per day (mb/d) 1mb/d lower than average. ''China’s National Petroleum Corp estimates the demand is likely to fall 2% in 2022. The fall in consumption of Oil products has been even greater, down 7.3%. However, it expects demand to rise 2.1% next year as restrictions ease,'' the analysts at TDS said.

US Dollar falls further on dovish Federal Reserve

Away from direct oil industry fundamentals, WTI was made cheaper to the WTI market on the back of a drop in the US Dollar leading to speculative bids in Oil. On Wednesday, Federal Reserve chair Jerome Powell said in a speech that the Fed may moderate future rate hikes, with smaller rate hikes coming as soon as the Federal Open Market Committee (FOMC) meeting of its policy committee later this month.

“The time for moderating the pace of rate increases may come as soon as the December meeting,” Powell said in remarks at the Brookings Institution. Consequently, it was risk-on, with the US Dollar dropping, US Treasury yields eased and stocks rose. The S&P 500 ended its three-day losing streak and closed up 2.7% while the Dow officially entered a bull market.

Lastly, declining US Oil stocks were seen with the Energy Information Administration on Wednesday reporting that crude Oil inventories fell by 12.9 million barrels last week. This was supportive of WTI and was the biggest drop since June 2019. However, gasoline and distillate inventories were rising.

WTI technical levels

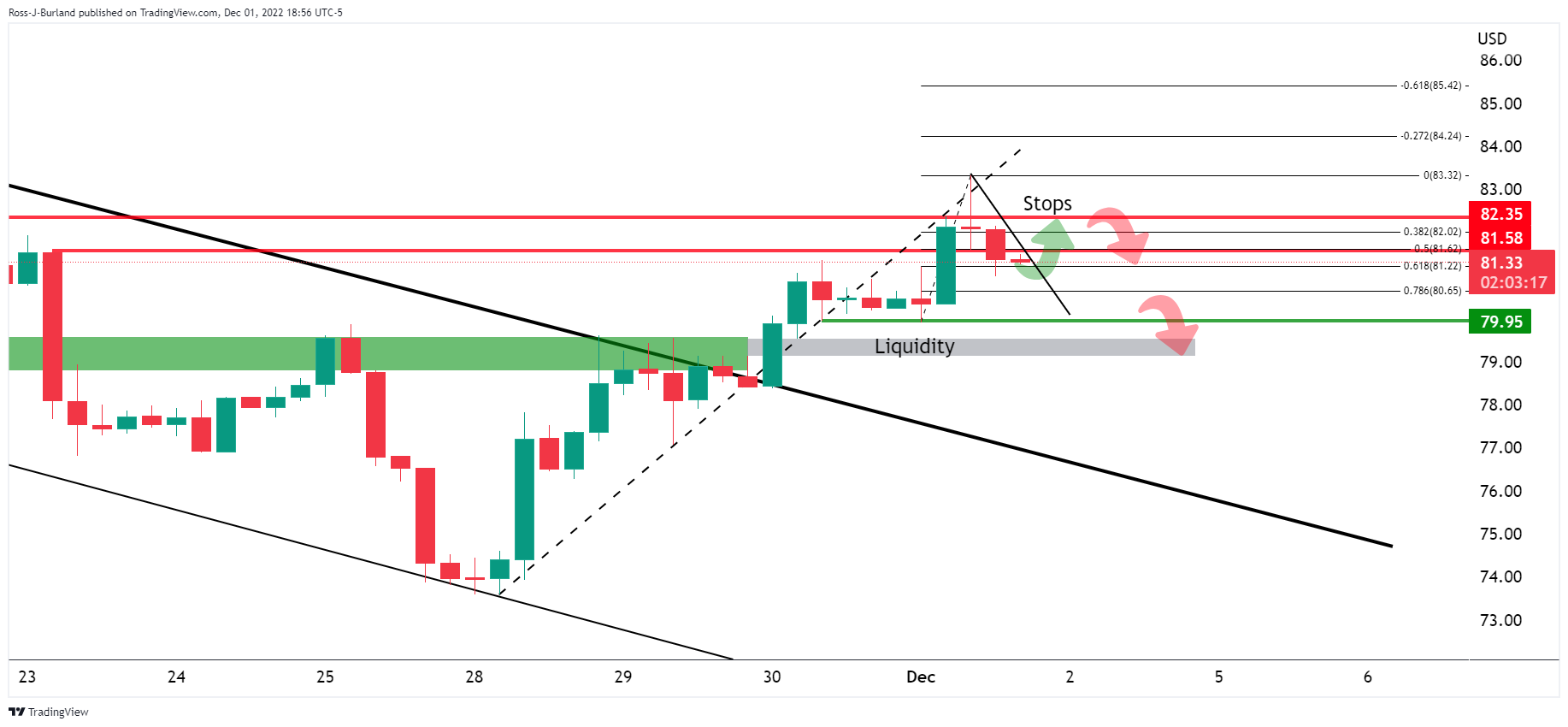

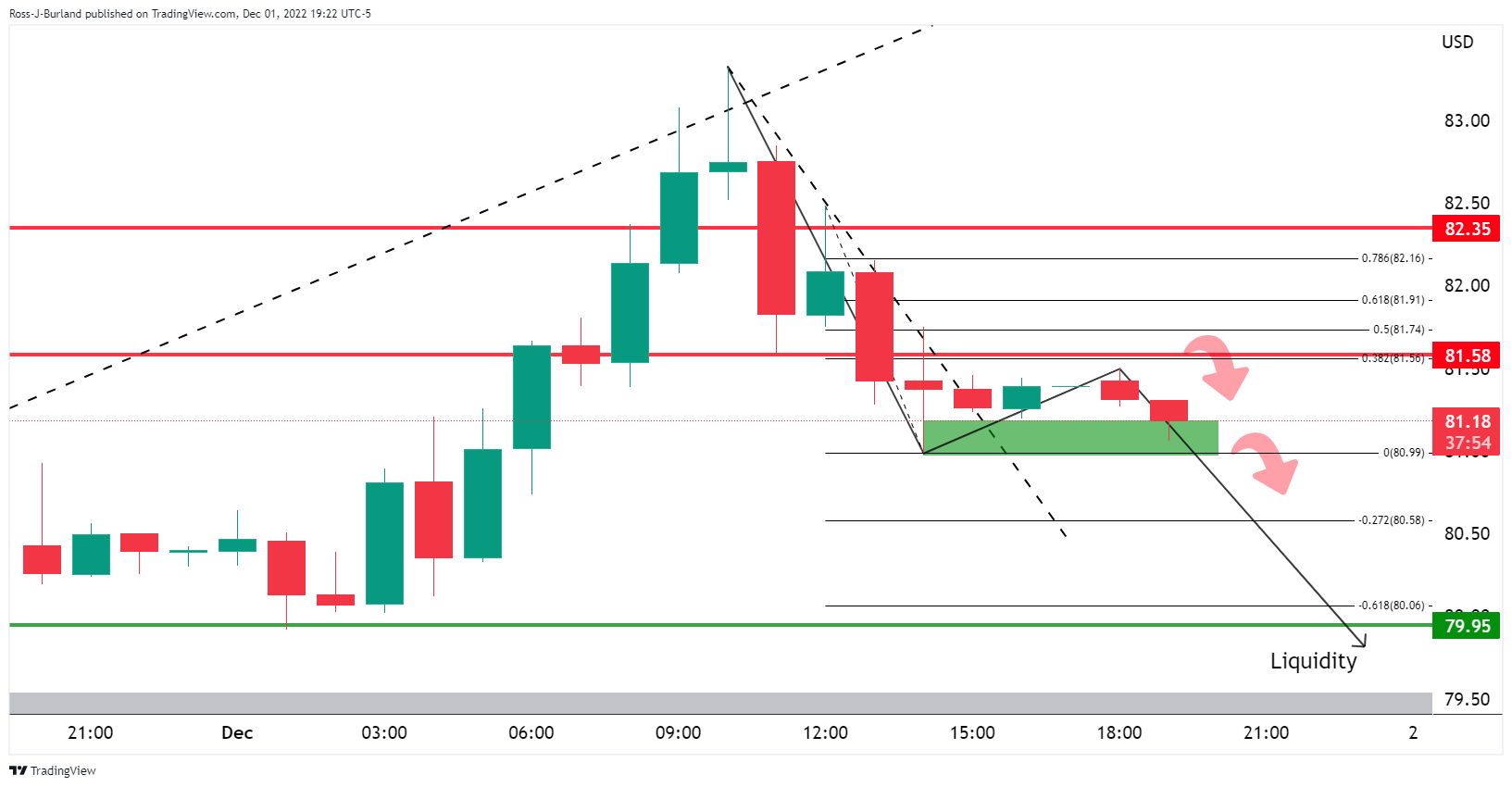

In the above daily charts, WTI is seen moving into prior highs and this has swept liquidity. The Oil price is now being faded. It is common for the highs to be retested in such a schematic and on the 4-hour chart we can Oil sliding out of the trendline resistance as follows:

A move towards where WTI short position stops are likely located could be the next port of call if there is not to be an immediate continuation of the downside in Oil to target liquidity below $78.00.

However, while below $81.50, the bias is in WTI is on the downside:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.