- Analytics

- News and Tools

- Market News

- NZD/USD stalls at 0.6400 following strong advance on soft US Dollar

NZD/USD stalls at 0.6400 following strong advance on soft US Dollar

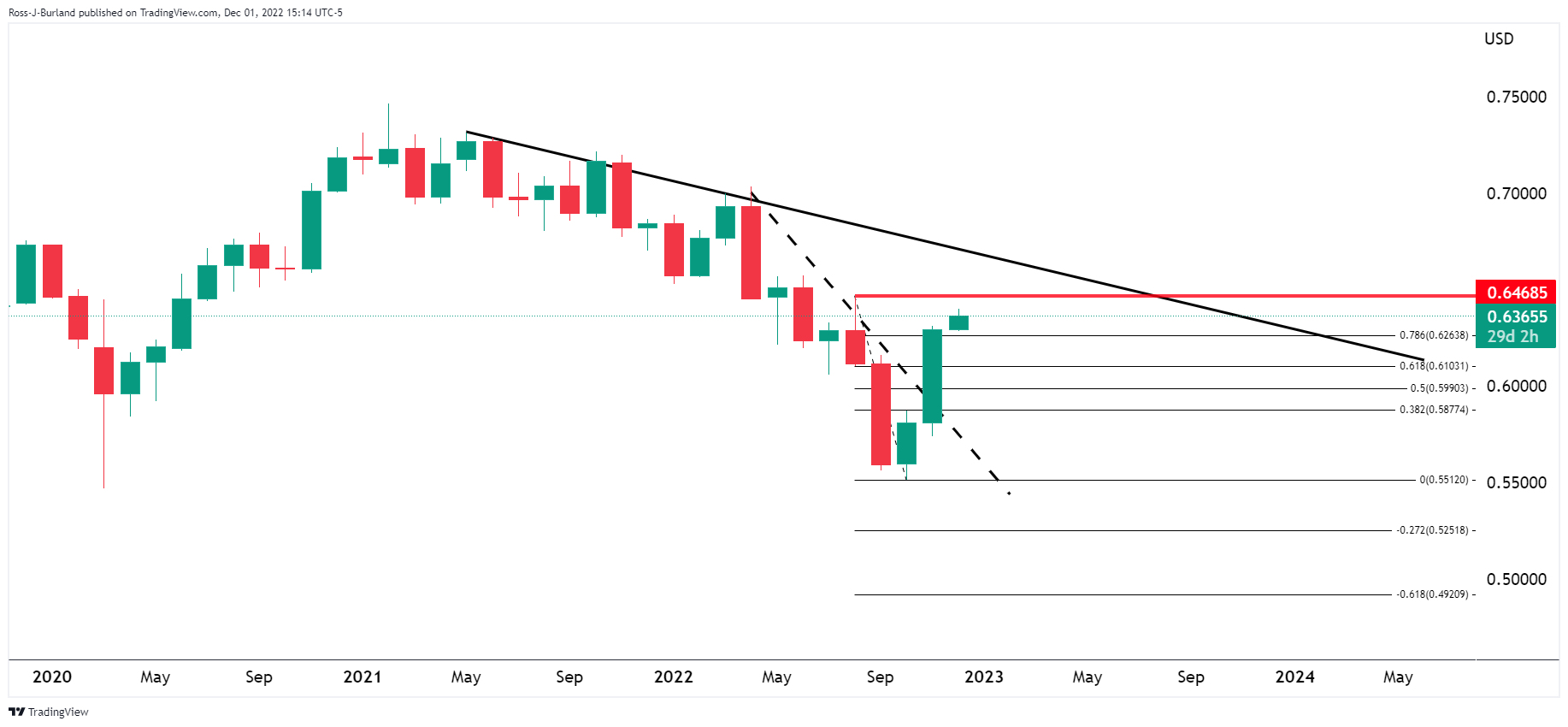

- NZD/USD advances towards a test of 0.6400 and has eyes on the 0.6450s.

- 0.6450 comes as a confluence between Aug high and the 61.8% retracement of the whole 2022 move.

NZD/USD is stalling below 0.6400 as the US Dollar attempts to correct what has been a significant move to the downside in the currency markets this week. At the time of writing, NZD/USD is down by over 1% and has fallen from a high of 105.896 to a low of 104.664 so far.

The move in the greenback has been driven by dovish remarks from the Federal Reserve's chair, Jerome Powell, or at least the comments that the market prefers to listen to. Fed's Powell gave a speech on Wednesday indicating that the Fed would ease the historically-high pace of interest rate rises at its next policy meeting in December.

“The time for moderating the pace of rate increases may come as soon as the December meeting,” Powell said in remarks at the Brookings Institution. Consequently, the US Dollar dropped, US yields eased and stocks rose. The S&P 500 ended its three-day losing streak and closed up 2.7% while the Dow officially entered a bull market.

However, Powell’s admission that “the path ahead for inflation remains highly uncertain” and when he said “by any standard, inflation remains much too high,” and “it will take substantially more evidence to give comfort that inflation is actually declining,'' likely means the Fed will keep hiking well into 2023. Additionally, earlier on in the week, St. Louis Federal Reserve President James Bullard warned that the stock market is underpricing the risk of a continually aggressive Fed. On Thursday, the New York Fed’s John Williams who recently said that he predicts a time, “probably 2024”, when the Fed will lower the federal funds rate, said on Fox News that the Fed has a ways to go on rate hikes.

Nevertheless, the market is running with the dovish comments from a speech that had something for both hawks and doves and that has seen the Kiwi rally strongly over the past 24 hrs through the resistance at 0.6325 (the 76.4% Fibo of the Aug-Oct sell-off) as the following technical analysis will show:

NZD/USD technical analysis

The above series of charts, weekly, daily and H4, illustrate the prospects of a move into the 0.6450s. Analysts at ANZ Bank argued that the ''price action looks extremely solid, and technically, the next major target level is 0.6450 (marking both the Aug high and the 61.8% retracement of the whole 2022 move).''

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.