- Analytics

- News and Tools

- Market News

- EUR/USD extends risk-off slid into key support territories

EUR/USD extends risk-off slid into key support territories

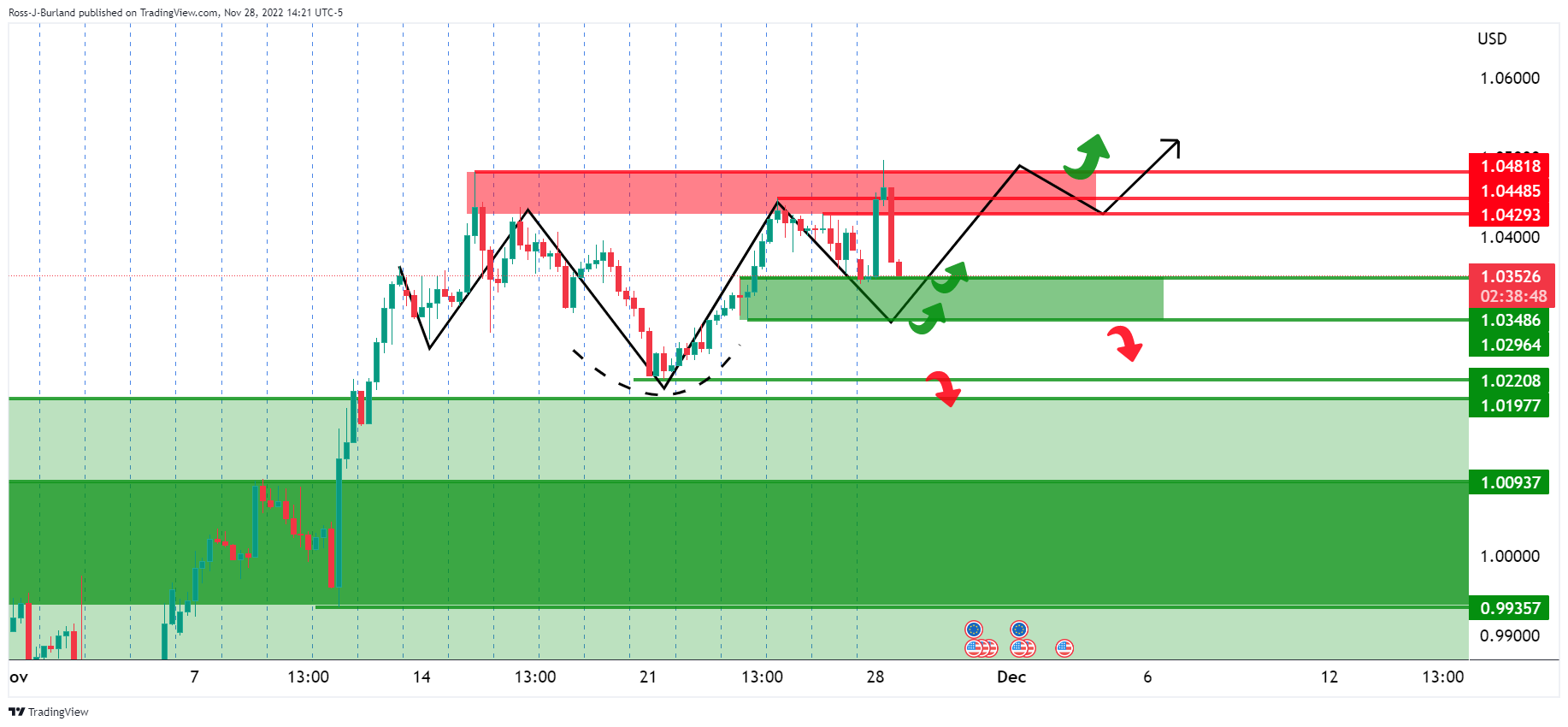

- EUR/USD dropped into key support on risk-off themes.

- An inverse head & shoulders could be in the making.

At the time of writing, EUR/USD is down some 0.29% falling to a low of 1.0354 from a higher of 1.0496. Risk currencies, such as the Euro are under pressure as protests against COVID restrictions in China weighed on market sentiment.

The violent protests in major Chinese cities over the weekend against the country's strict zero-COVID curbs have knocked growth expectations in the world's second-largest economy. This is creating a flight to safety in support of the yen, US Dollar and CHF.

Meanwhile, the economic challenges facing the euro area are not the same as in the US which is a weight on the euro. ''Supply-side shocks set the scene for an extended period of high inflation coupled with lacklustre growth. A recession seems difficult to avoid and we expect Gross Domestic Product to decline by 0.9% in 2023, followed by stagnation in 2024,'' analysts at Danske Bank argued.

Key points:

''Elevated inflation pressures coupled with the risk of de-anchoring inflation expectations will keep the ECB firmly in tightening mode. Rate cuts could be on the cards in 2024, but uncertainty remains high.''

''Europe's biggest fragility stems from the (geo)political front, as well as a renewed flaring up of the energy crisis or new Covid-19 outbreaks next winter. Upside risks to the growth outlook arise from pandemic-related private savings buffers, fiscal measures and accelerated investment spending.''

'Stagflation' does not have to be the new normal, but structural reforms to address low productivity and adverse demographic trends as well as securing a leading position in the green transition race remain key.

Fed speakers in play

Federal Reserve speakers will be important this week. On Monday, New York Federal Reserve Bank President John Williams said that he believes the Fed will need to raise rates to a level sufficiently restrictive to push down on inflation, and keep them there for all of next year:

"I do think we're going to need to keep the restrictive policy in place for some time; I would expect that to continue through at least next year," Williams said at a virtual event held by the Economic Club of New York, adding that he does not expect a recession.

James "Jim" Bullard, president and CEO of the Federal Reserve Bank of St. Louis, has said that rates need to go higher to bring inflation down. ''We've got a ways to go to get restrictive on policy.'' He also said the Fed ''will have to keep rates at a sufficiently high level all through 2023 and into 2024.''

Bullard also said that a ''tight labour market gives us a license to pursue disinflationary strategy now.''

In this regard, for the week, investors will keep a close watch on Nonfarm Payrolls for November, as well as the second estimate for third-quarter gross domestic product and consumer confidence this month.

EUR/USD technical analysis

Despite the risks of a downside continuation, an inverse head & shoulders could be in the making at this juncture. Bullish commitments around 1.0300/50 would be forming the right-hand shoulder of the bullish pattern.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.