- Analytics

- News and Tools

- Market News

- EURUSD climbs to 3-month highs near 1.0270

EURUSD climbs to 3-month highs near 1.0270

- EURUSD adds to Thursday’s gains well north of 1.0200.

- The dollar remains well on the defensive following US CPI.

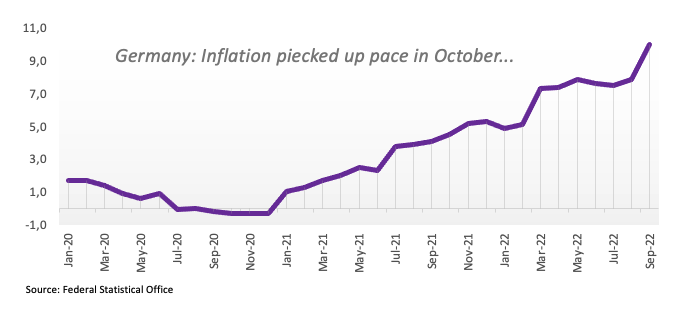

- Germany final Inflation Rate came at 10.4% YoY in October.

The buying pressure keeps growing around the European currency and the rest of the risk complex and lifts EURUSD to new multi-week highs around 1.0270 on Friday.

EURUSD boosted by dollar weakness

EURUSD advances for the second session in a row and flirts with the 1.0270 region, an area last traded back in mid-August, at the end of the week.

The pair saw its upside abruptly reinvigorated after lower-than-estimated US CPI results in October lend support to the idea that inflation pressures could be cooling down and that the Fed could slow the pace of its current hiking cycle.

The daily uptick in the pair so far comes in tandem with a modest upside in German 10-year bund yields, which manage to set aside three consecutive daily pullbacks.

In the domestic calendar, final inflation figures in Germany showed the CPI rise 10.4% YoY and 0.9% vs. the previous month.

Across the Atlantic, the only release will be the preliminary Michigan Consumer Sentiment for the month of November.

What to look for around EUR

EURUSD’s post-US CPI rally remains unabated and trades closer the 1.0300 area at the end of the week.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. The recent decision by the Fed to hike rates and the likelihood of a tighter-for-longer stance now emerges as the main headwind for a sustainable recovery in the pair.

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the fragile sentiment around the euro in the longer run.

Key events in the euro area this week: Germany Final Inflation Rate (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EURUSD levels to watch

So far, the pair is gaining 0.39% at 1.0247 and faces the next up barrier at 1.0273 (monthly high November 11) seconded by 1.0368 (monthly high August 12) and finally 1.0437 (200-day SMA). On the other hand, a breach of 1.0029 (100-day SMA) would target 0.9898 (55-day SMA) en route to 0.9730 (monthly low November 3).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.