- Analytics

- News and Tools

- Market News

- US Dollar put to the guillotine, but plenty to live on for

US Dollar put to the guillotine, but plenty to live on for

- The US Dollar is under pressure on the back of the US CPI report.

- Markets are in two minds as to whether this is the end of the bull cycle.

The US Dollar has been sent into a critical support level as the following charts will illustrate. The markets are in a phase of hysteria on the back of one inflation print that undershot expectations on Thursday. US Consumer Price Inflation rose 0.3% MoM in October as goods prices fell and service price inflation, ex-shelter, eased. Food price inflation also moderated, rising 0.6% MoM versus 0.8% in September.

With pent-up demand for risk, investors have run with the idea that the Federal Reserve will react to the report and pivot and as a result, they are stampeding away from the US Dollar. Indeed, the softer-than-expected US CPI has bolstered the case for risky assets as the data gave some investors confidence that consumer prices may have finally started trending lower. Consequently, the data sent US Treasury yields below key trendlines, with the benchmark 10-year hitting 3.8387%, its lowest in about a month - narrowing gaps between yields on US and foreign government debt that have burnished the greenback's appeal.

However, ''the Federal Reserve will not put too much weight on one month’s numbers,'' analysts at ANZ Bank said. ''It wants to see a sustained moderation in monthly inflation before being confident that inflation is on track to return to target.''

On Thursday, Fed's Cleveland President Loretta Mester spoke in recent trade and commented on the CPI data. She said, ''this morning’s October CPI report also suggests some easing in overall and core inflation,'' but added, “there continue to be some upside risks to the inflation forecast.” This type of rhetoric will guide the market to think that even when Fed policy rates peak, they are likely to remain higher for longer.

This could be significantly bullish for the greenback over the horizon of today's CPI data. Additionally, Fed's Daly spoke and said that there is no evidence of wage prices spiralling and that inflation is one of the most lagging variables, adding, the Fed needs ''policy to be sufficiently restrictive until see inflation is well on its way to 2%.''

The analysts at ANZ Bank said they expect that the Fed will raise rates by 50bp in December and 25bp in February and March anticipating some moderation in core inflation in the fourth quarter, Q4. ''We maintain that profile and see the fed funds rate peaking at 5.0% in Q1.''

Indeed, plenty of investors are cautious about betting on a lasting dollar reversal. Analysts at Rabainak said it is their view that even when Fed policy rates peak, they are likely to remain higher for longer, with no interest rate cut until 2024.

''This is a message already mooted by Fed speakers including Daly who spoke last month about the persistence of inflation. Even when price pressures fall from their peak, they could remain buoyed by wage rises which may be a function of factors such as an ageing demographic and the fall in the US labour force participation rate.''

In addition to the outlook for rate increases, the analysts said that in their view, the USD is set to remain supported by safe-haven flows. ''Like many other assets including equities and property, cryptocurrencies performed well in an era of cheap money. This year, higher US interest rates have been undermining the outlook for risky assets and promoted the attraction of the safe haven USD.''

US Dollar, DXY, weekly chart

Indeed, looking back over the charts, the dollar index has fallen by 3% or more three times over the last two years, only to resume its upward trend:

In summary, we will get one more jobs report and another set of inflation and Retail Sales data before the December 13-14 meeting. If there are signs that inflation is picking up again or an escalation of geopolitical and COVID risks to global growth, the greenback could be seen as the cleanest shirt in the laundry basket once again. ''Simultaneously USD strength is a constraint on global trade and world growth which feeds back into demand for USDs,'' the analysts at Rabobank said. The USD may be approaching the later stages of its rally, but we consider it far too soon to expect the USD to reverse course.''

US Dollar daily chart

The DXY is now well below the counter trendline and has formed a sopping M-formation.

this is a reversion pattern, however, that could see the price move back into the Fibonacci scale from this first support juncture in the coming days.

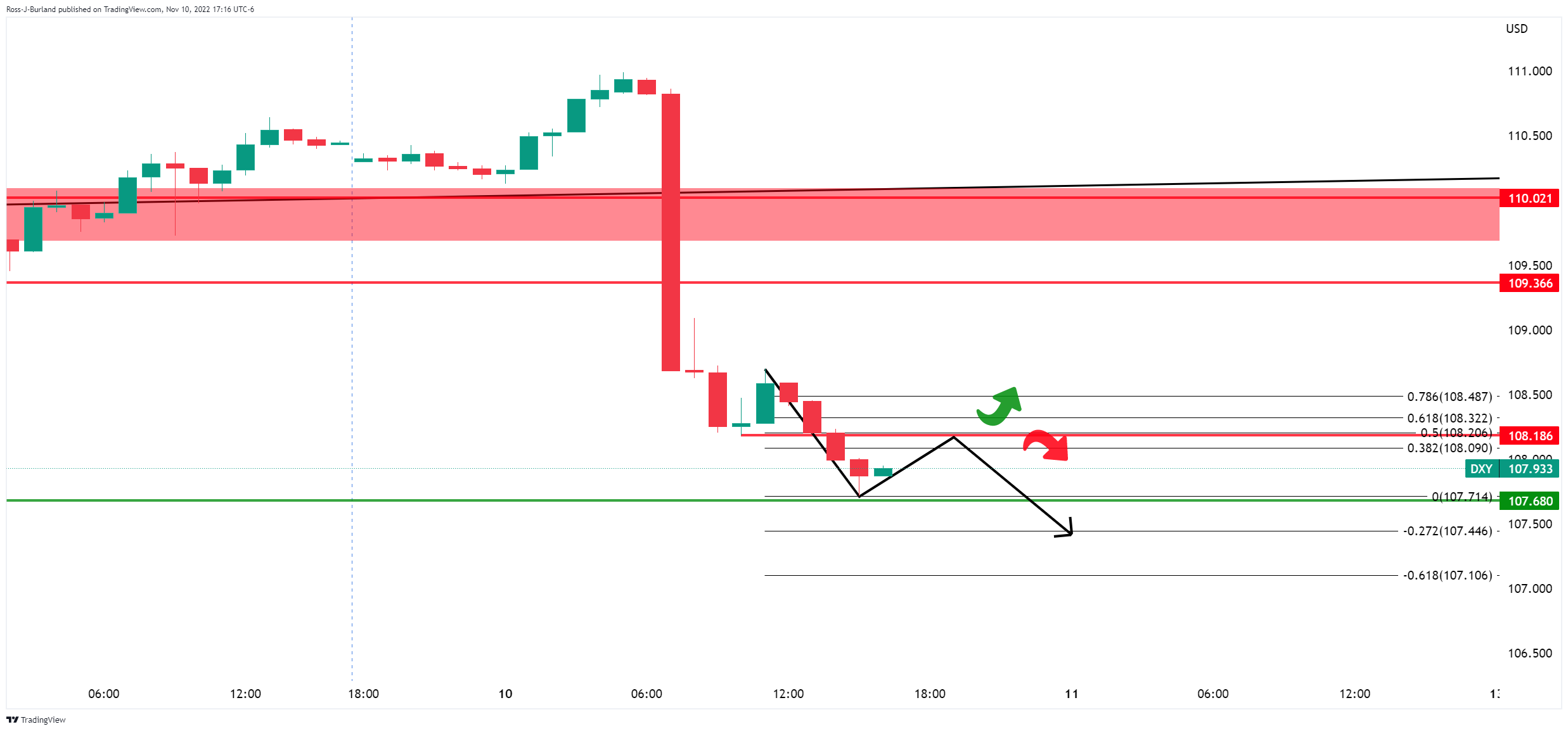

US Dollar, DXY, H1 & H4 chart

However, the hourly picture is less bullish and a test of the 50% mean reversion mark could lead to another jolt to the downside before the week is out. On the other hand, profit-taking ahead of the weekend could ensure and leave the US dollar hanging over the edge of the abyss at around current support 107.50/ 108.20 and put to 109.00:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.