- Analytics

- News and Tools

- Market News

- US dollar bulls fight back hard on Fed Powell's hawkish comments

US dollar bulls fight back hard on Fed Powell's hawkish comments

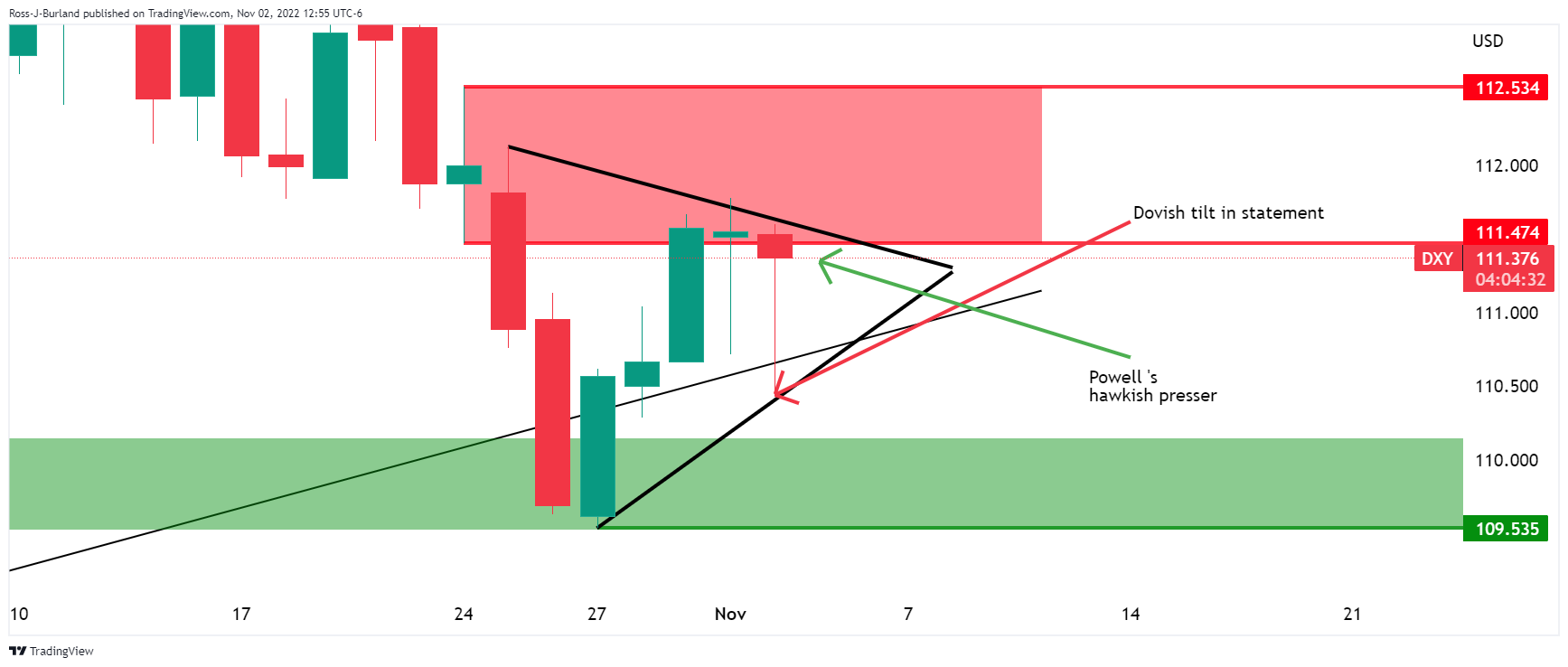

- FOMC dovish statement sent the US dollar lower but Fed's Powell's hawkish presser came to the rescue for the greenback.

- DXY is whipsawed and retraced close to 100% of the initial drop.

The US dollar has been whipsawed between a dovish FOMC statement followed by a hawkish delivery from Fed's Chair Jerome Powell who advocates for continued rate hikes with the potential to slow as soon as December, but without such a commitment to do so so soon.

At the time of writing, DXY, an index that measures the greenback vs. a basket of currencies, is trading at around 110.89 and has been traded between a post-FOMC statement high of 111.598 and 1110.426 the low.

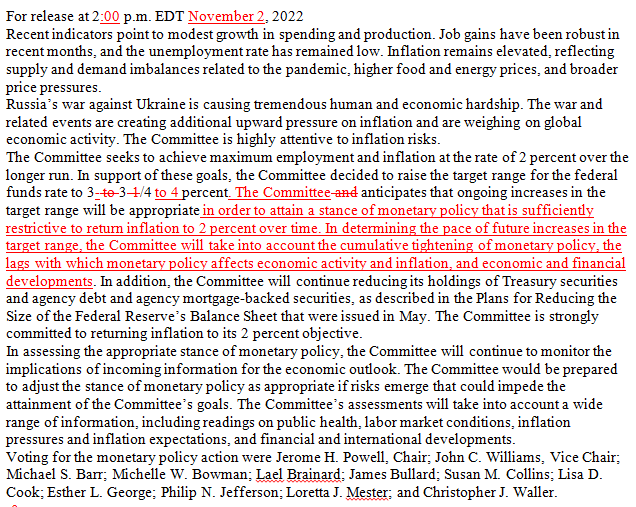

Changes to FOMC statement

Firstly, DXY was offered heavily on the following in the statement: "In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial deviations."

Before the FOMC statement, the terminal top was priced at 5.03% in May, it's down to 4.95% now after the new sentence in the FOMC statement that signals more increases but hints at possibly smaller increments.

The US dollar fell critical trendline support as shown on the hourly and daily charts below:

However, as the event progressed and Jerome Powell spoke, the dollar bounced back.

-

Powell speech: Will likely need restrictive stance of policy for some time

-

Powell speech: Longer-term inflation expectations are still well anchored

-

Powell speech: Will take time for full effects of monetary restraint to be realized

-

Powell speech: Time for slower hikes may come as soon as December or February

US dollar technical analysis

The daily outlook shows the price sandwiched between support and resistance.

The presser started out with a hawkish delivery from Powell which wiped out alomost 100% of the FOMC dovish statement drop.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.