- Analytics

- News and Tools

- Market News

- EUR/USD steadies in bullish territory ahead of the Fed

EUR/USD steadies in bullish territory ahead of the Fed

- EUR/USD sits back into neutral territory as markets get set for the Fed.

- Traders are on look out for a pivot in the chair's tone.

EUR/USD is sitting tight in mas investors await the outcome of the Federal Reserve this week while investors fret over a potential slowdown in the pace of interest-rate hikes from December.

Analysts at TD Securities look for the FOMC to deliver another 75bp rate hike and say the decision will bring policy to a level at which the Committee might feel more comfortable in shifting to a steadier hiking pace. ''The exact timing, however, will highly depend on the CPI data before the Dec meeting. Powell might offer some hints in the post-meeting presser.'

Looking forward, for December, the fed funds futures market has priced in a 57% probability of a 50-bps increase amid suggestions from Fed officials of potentially slowing down the tightening pace. That was down, however, from roughly a 70% chance last Friday. ''Any dovish tone in Powell's testimony could bull steepen the curve. The tactical market is decently priced for a flexible Fed but can still extend. Absent any clues from Powell risks a pain trade. That could be limited given the USD's tighter correlation with easing priced into the curve vs terminal, however.''

The US dollar index has rallied more than 15% this year as the Fed has hiked rates hard, crushing other currencies and heaping pressure on the global economy. Investors have therefore taken cheer from speeches and interviews by some Fed officials that have suggested the central bank could do smaller hikes after Wednesday's meeting.

Meanwhile, the Institute for Supply Management (ISM) purchasing managers' index (PMI) shed 0.7 point to land at 50.2, remaining in expansion territory by the skin of its teeth. The dip in new orders was shallower and employment was unchanged. Markets were also reminded that global inflation remains stubbornly high on Monday when data showed euro zone prices surged by the most on record in the year through October.

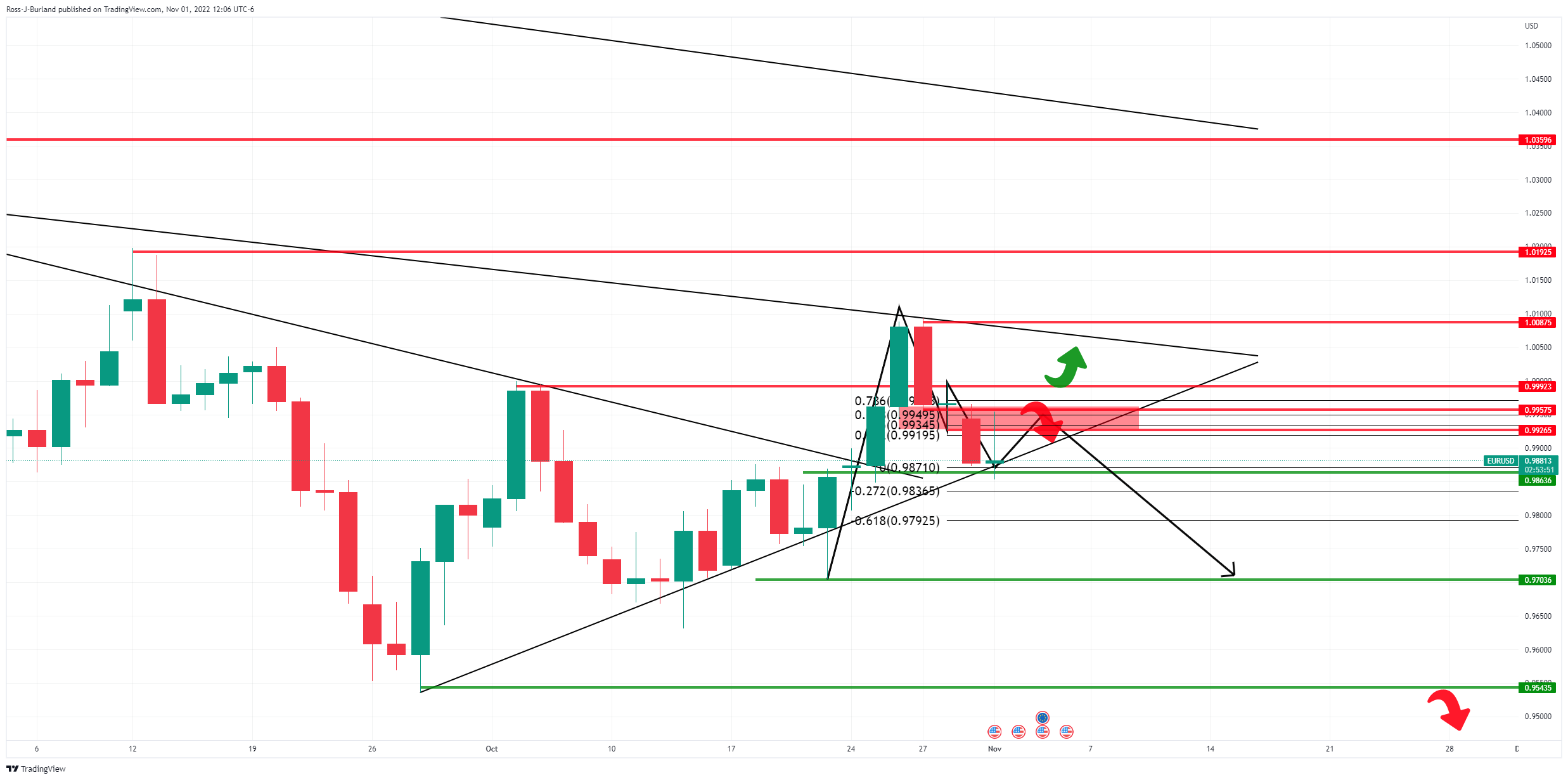

EUR/USD technical analysis

The price has carved out an M-formation within the symmetrical triangle which leaves bias to the downside so long as the neckline of the M-formation holds over the coming sessions:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.