- Analytics

- News and Tools

- Market News

- WTI reaches up to key resistance as trend followers stay on the bid

WTI reaches up to key resistance as trend followers stay on the bid

- WTI has moved into key resistance as trend followers stay on the bid.

- Supply concerns have been dominating the energy complex.

At the time of writing, West Texas Intermediate crude oil (WTI), is up by over 0.9% at $89.10 having claimed from a low of $87.35 reaching a high of $89.78 so far. Supply concerns have been dominating the market on the back of the United States reporting better-than-expected economic growth data for the third quarter. At the same time, tight supplies of diesel and other distillates are fuelling the bid.

The United States reported its gross domestic product rose by 2.6% on an annualized in the third quarter, beating the 2.3% consensus forecast but above the second quarter's 0.6% drop. The data comes ahead of PCE on Friday and the Federal Reserve meeting next week. In any case, the data today is expected to keep the Fed on track in its attempt to slow inflation by hiking rates steeply.

Meanwhile, weak distillate supplies are offering support to prices. The Energy Information Administration mid-week reported distillate stocks rose by 0.2 million barrels last week, rising off a 17-year low and offering support to oil. The EIA also noted US oil exports rose to a record last week. The agency reported that US gasoline inventories fell by about 1.5 million barrels last week and distillate stocks remained at record lows, while US exports of crude oil were strong, the bank said. This offset a smaller-than-expected 2.6-million-barrel increase in crude inventories.

Analysts at TD Securities argued that energy prices are being supported by algorithmic trend follower purchases. ''CTAs are building a net long position in Brent crude as uptrend signals strengthen, but extreme volatility is likely to cap participation from this cohort amid weak trend signals and risk parity portfolio deleveraging.

Diesel prices are also being supported by CTA trend followers, but similarly to other energy markets, algo firepower remains capped by extreme volatility in the complex which argues for little follow-through from CTAs.''

WTI technical analysis

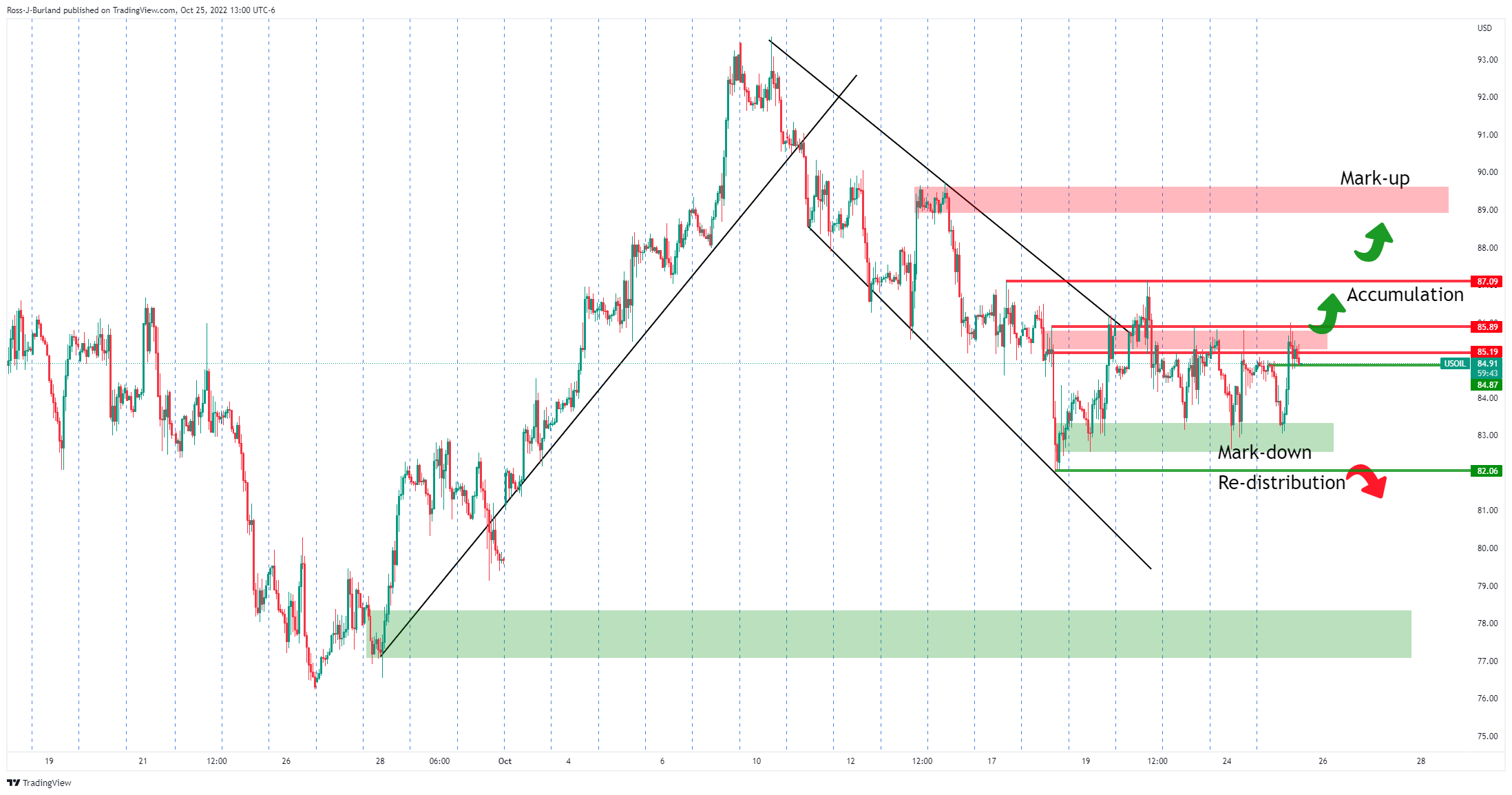

In a prior analysis, it was stated that ''the price could be on the verge of an upside rally on a break of structure, with bulls accumulating the recent price drop,'' with the price being on the backside of the channel:

As the following will illustrate, the price has moved into the projected resistance as follows:

At this juncture, the bulls will need to get above $90.00 for prospects of a break of the $93.60 mid-October highs.

$88.50 comes as the first key support ahead of $87.00.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.