- Analytics

- News and Tools

- Market News

- AUD/USD Price Analysis: Bears lurking at a critical resistance juncture

AUD/USD Price Analysis: Bears lurking at a critical resistance juncture

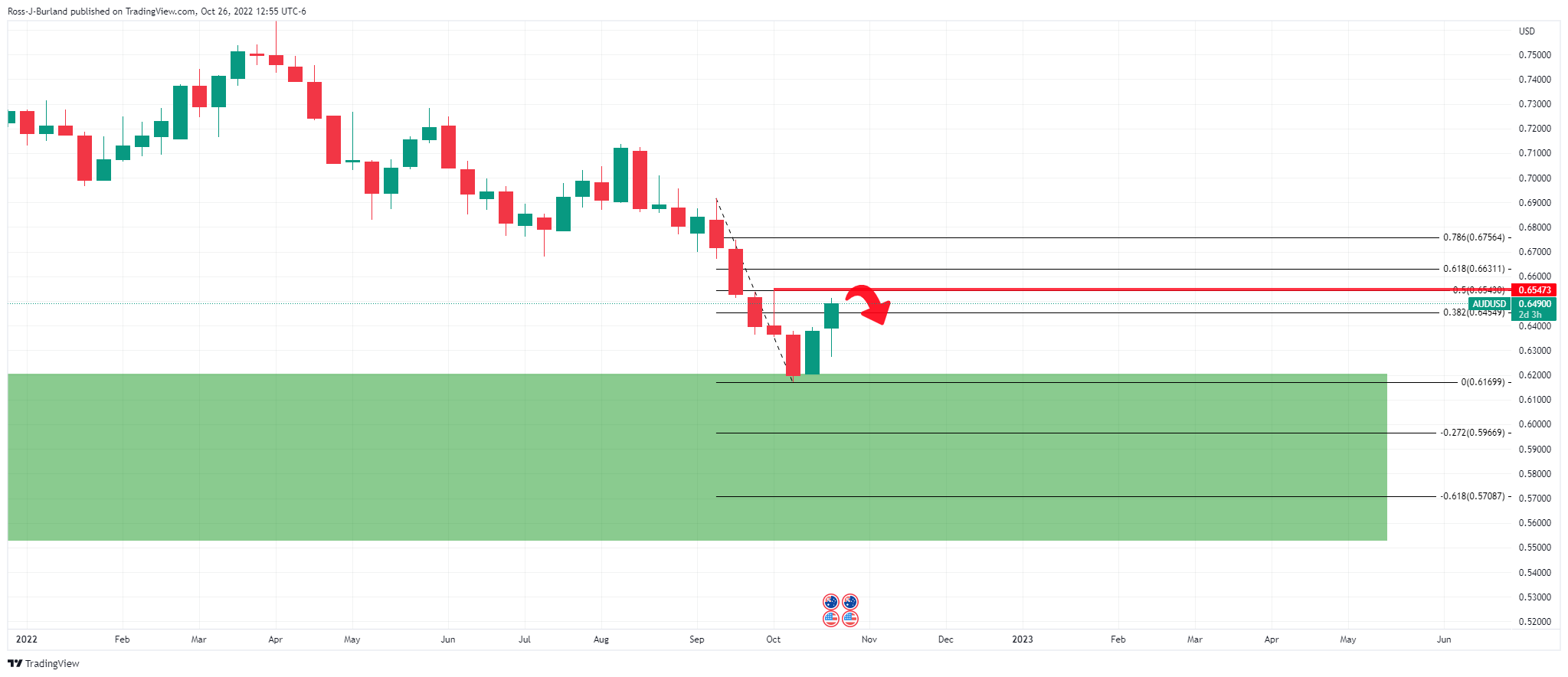

- AUD/USD bulls are moving in on a critical area of resistance.

- Key supports are located at 0.6450, 0.6390 and 0.6270 while the markets bearish below 0.6550.

AUD/USD rallied on the back of strong Aussie inflation data on Wednesday and capitulation of the US dollar bulls with the market headed for a test of the key support structure in the DXY and US 10-year yields:

(US 10-year daily chart above, DXY daily chart below)

However, there are prospects of a stronger dollar for longer so long as the trendline supports hold and all the while the woes out of Europe and economic dire straits in China remain a thorn in the side of risk sentiment.

Meanwhile, the Aussie remains upbeat following the Consumer Price Index data as follows:

AUD/USD during CPI

AUD/USD after:

AUD/USD weekly chart

So long as the US dollar commits to the upside, the outlook remains bleak for risk sentiment, stocks and high beta currencies such as the Aussie. The weekly chart remains bearish at this juncture despite the corrective attempts.

Zooming in, we can see the prospects of a failure at resistance:

AUD/USD daily & H4 charts

For the immediate future, the price outlook is bullish but a capitulation of the bulls can be expected. The daily chart is seeing the price head into a key resistance level and failures there could see the price move in on the longs that have built up for the week. If the market breaks key structures, falling out of the symmetrical triangle could be significant, especially around the Federal Reserve, leading to a downside continuation as per the weekly chart. Key supports are located at 0.6450, 0.6390 and 0.6270 while the markets bearish below 0.6550.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.