- Analytics

- News and Tools

- Market News

- USDCAD: The Loonie to fall towards 1.3500, as the Bank of Canada prepares to lift rates 75 bps

USDCAD: The Loonie to fall towards 1.3500, as the Bank of Canada prepares to lift rates 75 bps

- Improvement in risk appetite due to speculations of a Fed pivot weakened the US Dollar.

- Worse-than-expected US economic data, namely consumer confidence, and housing data are headwinds for the USD, bolstering the CAD.

- The Bank of Canada is expected to hike 75 bps, but if it goes 50 bps, the USDCAD can rally towards 1.3700.

- If the USDCAD is neutral-to-upward biased, but a break below 1.3600 will send the pair towards 1.3500.

The US Dollar recovers some ground as Wednesday’s Asian Pacific session begins, following Tuesday’s trading session, characterized by risk appetite increasing as shown by US equities registering gains due to investors speculating that a Federal Reserve’s pivot is imminent, while the US Dollar weakened. Contrarily, the Canadian dollar was underpinned by expectations of the Bank of Canada’s (BoC) lifting interest rates by 75 bps at its monetary policy decision. Hence the USD/CAD is trading at 1.3626, above its opening price by 0.16%.

The US Dollar gets battered on risk-on mood, weaker consumer confidence, and falling US home prices

Besides US corporate earnings beating previous quarter reports, the US Dollar was hit by weaker-than-expected economic data. The Conference Board (CB) reported October’s Consumer Confidence, which ebbed due to increasing worries about inflation and a possible recession in the United States. The index fell to 102.5 from 107.8 in September and missed street analysts’ forecasts of 106.5. The USDCAD dived in the release, from around 1.3700, toward the 1.3620 area, as consumer confidence data added to weaker US housing market figures, revealed earlier.

The United States calendar revealed that the US housing market continues to cool down, weighed by the Federal Reserve’s monetary policy stance. The S&P CoreLogic Case-Shiller Index reported that prices in 20 large US cities tumbled 1.3% MoM in August, the most since March 2009. At the same time, the Federal Housing Finance Agence (FHFA), in a separate report, flashed that house prices rose by 11.9% YoY in August, though trailed by July’s 13.9% increases.

US Treasury yields dropped, weakening the USD and boosting the CAD

Meanwhile, US bonds rallied, which weighed on US Treasury bond yields. The US 10-year benchmark note rate plunged fourteen bps from around 4.22% toward 4.08%, weakening the greenback, as shown by the US Dollar Index (DXY). The DXY lost almost 1% on Tuesday, capitalized by Canadian dollar buyers, which extended the USDCAD losses toward its daily low of 1.3601.

The Bank of Canada is expected to hike 75 bps the bank rate

Aside from this, the Bank of Canada (BoC) monetary policy meeting looming bolstered the CAD. Given that the last BoC Consumer Survey showed that business sentiment softened and price pressures eased, inflation expectations remained high, as shown by the poll. Also, the Canadian Consumer Price Index (CPI) for September, a measure for inflation, rose by 6.9% YoY, above estimates of 6.8%, though lower than August’s 7.0%, justifying the need for higher interest-rate hikes by the BoC.

In Wednesday, the Canadian economic docket will feature the Bank of Canada’s monetary policy decision. On the US front, additional housing data, with September’s Building Permits, and New Home Sales, would add further downward pressure on the USD, which could be positive for the CAD.

USDCAD price forecast

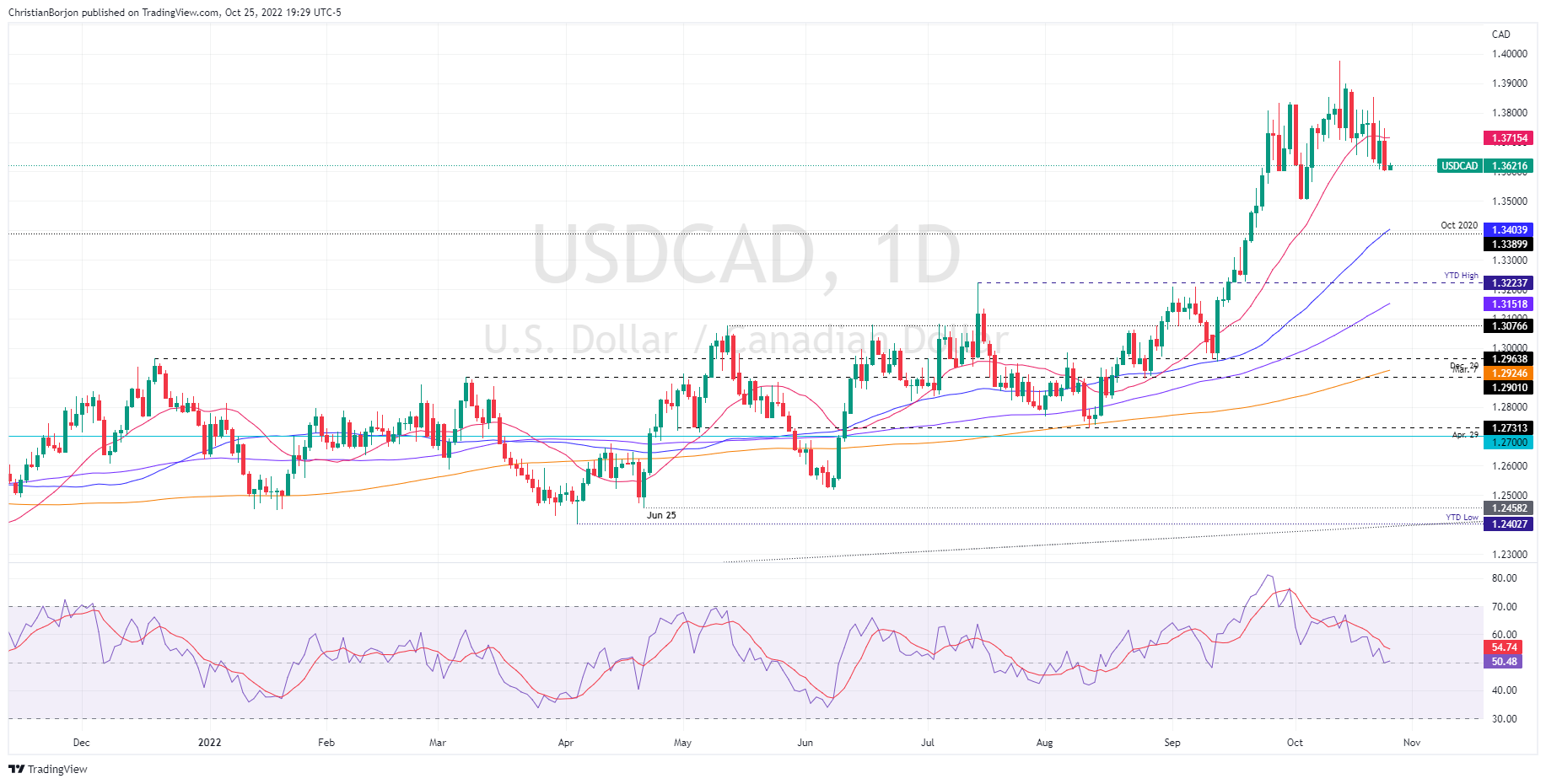

The USDCAD is neutral-to-upward biased, as shown by the daily chart. On Tuesday, the Loonie strengthened vs. the US Dollar as the exchange rate slumped below the 20-day Exponential Moving Average (EMA), hitting a fresh three-week low at 1.3600. Although the USD recovered some ground, it remains vulnerable to selling pressure, as the Relative Strength Index (RSI) at 50.43 extended its fall, aiming towards the bearish territory. That could mean sellers are gathering enough momentum to push the USDCAD towards the 1.3500 figure.

Key support levels lie at 1.3600, followed by the October 6 daily low at 1.3564, ahead of the 1.3500 figure. On the flip side, the USDCAD’s first resistance would be the 1.3700 mark, followed by the 20-day EMA at 1.3715 and October’s 25 high at 1.3747.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.