- Analytics

- News and Tools

- Market News

- USD Index treads water near 113.00 ahead of data, Fedspeak

USD Index treads water near 113.00 ahead of data, Fedspeak

- The index alternates gains with losses near the 113.00 mark.

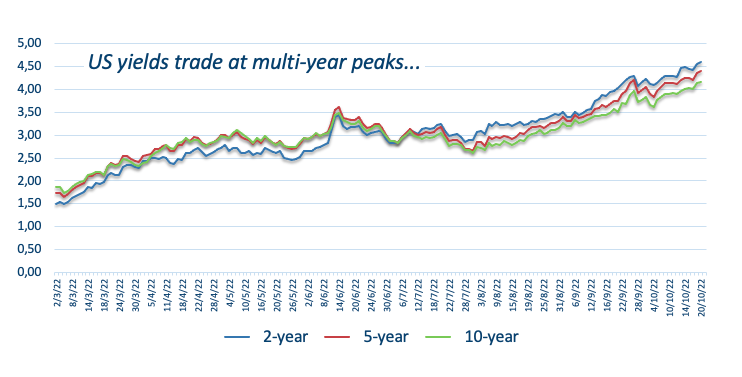

- US yields keep the march north unabated on Thursday.

- Weekly Claims, Philly Fed Index, Fedspeak next of note in the docket.

The greenback, in terms of the USD Index (DXY), trades without a clear direction around Wednesday’s close near the 113.00 zone.

USD Index now looks to data, Fedspeak

The weekly recovery in the index appears to have met some initial and decent resistance just above 113.00 the figure on Thursday despite the move higher in US yields remains unabated for the time being.

On the latter, the short end of the curve now flirts with the 4.60% region for the first time since August 2007, while the key 10-year benchmark note hover around 4.16%, an area last seen back in June 2008.

Firm expectations around the continuation of the Fed’s tightening stance have been behind the upside in US yields since early August, although the persistent elevated inflation have nothing but exacerbated that trend as of late.

In the US data space, usual Initial Jobless Claims are due in the first turn seconded by the Philly Fed Manufacturing Index, the CB Leading Index and Existing Home Sales.

In addition, Philly Fed P.Harker (2023 voter, hawk) and FOMC’s permanent voters P.Jefferson (centrist), L.Cook (centrist) and M.Bowman (centrist) are also due to speak later in the NA session.

What to look for around USD

The dollar’s recovery seems to have met some initial hurdle in the area just past the 113.00 mark so far on Thursday.

In the meantime, the firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market continues to prop up the underlying positive tone in the index.

Looking at the more macro scenario, the greenback also appears bolstered by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: Initial Jobless Claims, Philly Fed Index, Existing Home Sales, CB Leading Index (Thursday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is losing 0.08% at 112.91 and the breakdown of 110.05 (weekly low October 4) would open the door to 109.35 (weekly low September 20) and finally 107.68 (monthly low September 13). On the other hand, the next hurdle comes at 113.88 (monthly high October 13) followed by 114.76 (2022 high September 28) and then 115.32 (May 2002 high).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.