- Analytics

- News and Tools

- Market News

- Breaking: USD/JPY pierces key 150.00 level, Japan intervention imminent?

Breaking: USD/JPY pierces key 150.00 level, Japan intervention imminent?

- USD/JPY rises for the twelfth consecutive day to renew a multi-decade high.

- US 10-year Treasury yields refresh 14-year high, 2-year bond coupons rally to the highest since 2007.

- Japan policymakers keep jawboning the prices without actual intervention.

- Risk catalysts, market meddling will be crucial for near-term directions, bulls can keep the reins.

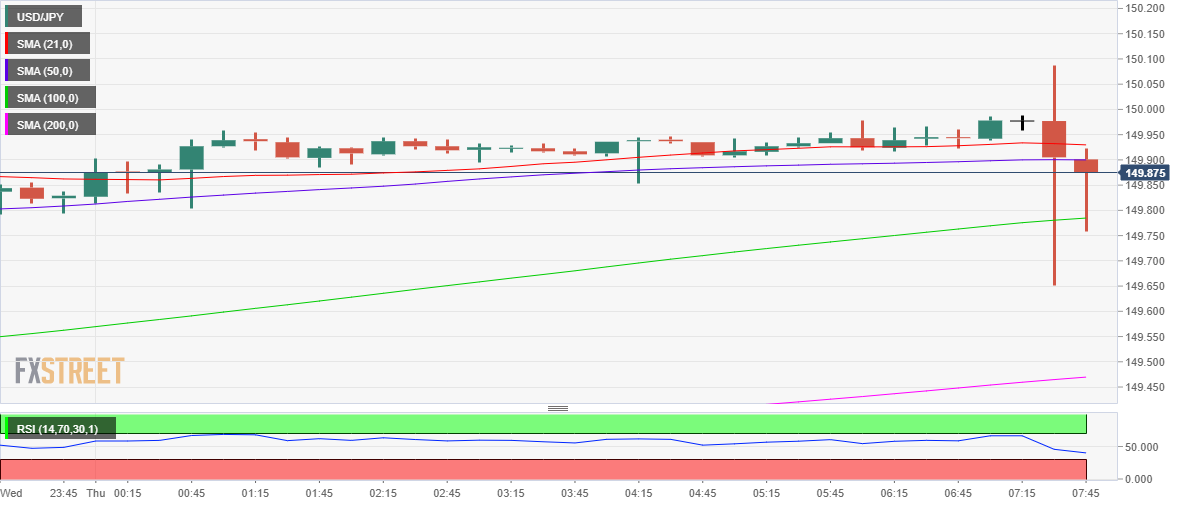

USD/JPY overcomes the early Asian session inaction as bulls approach the highest levels since 1990 while renewing the 32-year high at 150.09 on Thursday.

Earlier in the day, the Bank of Japan (BOJ) announced emergency bond-buying worth $667 million as the yields on the Japanese Government Bonds (JGB) briefly surpassed the central bank’s 0.25% limit.

The buying resurgence seen around the US Treasury yields could be associated with the latest leg higher in the USD/JPY pair, as bulls briefly recaptured the critical 150.00 mark.The benchmark 10-year US rates are at their highest level in 14 years above 4.15%, up 1.20% on the day while the pair is easing to near 149.90, at the time of writing.

The Fed-BOJ policy divergence continues widening, as the US central bank is expected to remain on course for aggressive tightening to tame red-hot inflation. Meanwhile, the BOJ policymakers stick to their stance that an easy monetary policy is required to support economic growth.

The spike, however, got quickly sold off above 150.00, as sellers resurfaced amid looming risks of another Japanese intervention. There is speculation that Japanese authorities may have conducted a "stealth" intervention in recent days, though Japanese officials have remained mum, per Kyodo News.

USD/JPY: 15-minutes chart

USD/JPY: Technical levels to watch

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.