- Analytics

- News and Tools

- Market News

- RBA says to raise rates further, on pace with global peers

RBA says to raise rates further, on pace with global peers

Michele Bullock, who is the Assistant Governor (Financial System) at the Reserve Bank of Australia, has spoken today and said the central bank expects to raise interest rates further over the coming months, adding the bank can achieve a similar rise in rates to its global peers through smaller hikes.

Bullock was appointed to her current position in October 2016. In this role, she is responsible for the Bank's work on financial stability, including the production of the twice-yearly Financial Stability Review, as well as the Bank's oversight of the payments system.

Key notes

The board expects to increase interest rates further over the coming months; pace and timing will be determined by data.

Factors the board will monitor closely include the global economy, household spending and wage- and price-setting behaviour.

Board is determined to do what is necessary to return inflation to target.

Our policy rate trajectory has been as steep, or steeper, than other central banks.

A very tight labour market starting to put upward pressure on wages.

Rate rises and price rises are starting to put pressure on household budgets.

Board felt a 25 basis point rate rise was warranted in October while it took stock of developments in consumption, wages and the international economy.

Was an active discussion internally and at the board meeting about the appropriate size of the October rate increase.

As the board meets more frequently than most peers, it can achieve similar tightening with smaller individual rate rises.

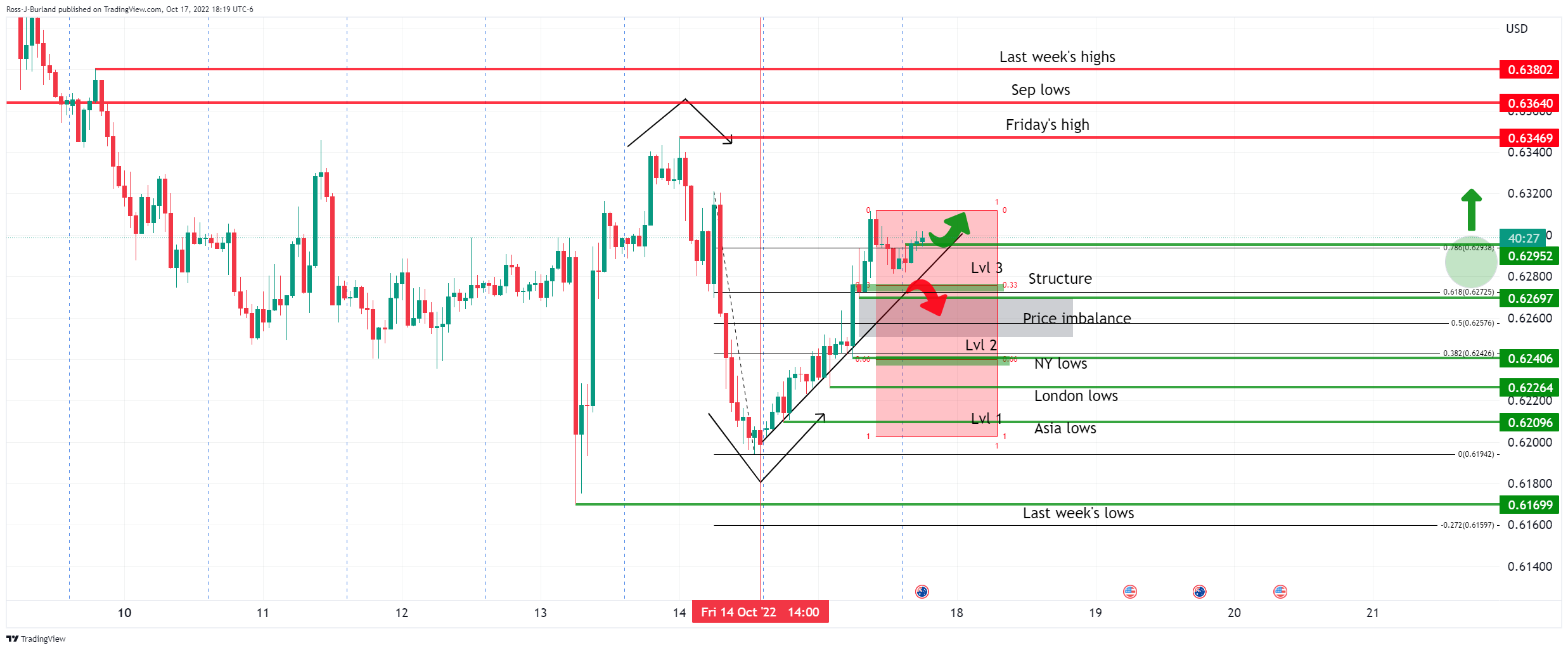

AUD/USD update

AUD/USD Price Analysis: Bulls eye a run to test September lows

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.