- Analytics

- News and Tools

- Market News

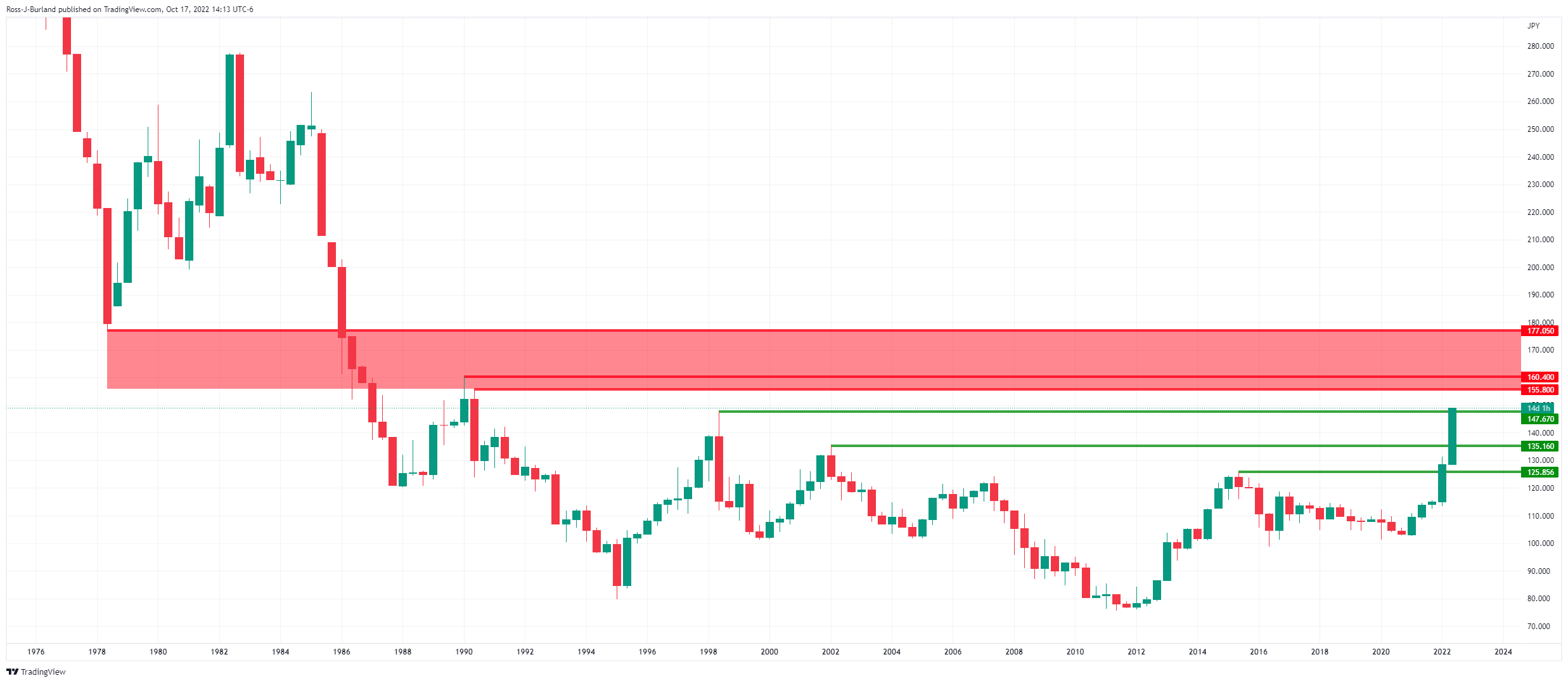

- Breaking: USD/JPY pops 149.00, highest since June 1990s

Breaking: USD/JPY pops 149.00, highest since June 1990s

- The Japanese yen hits a new 32-year low.

- Will the BoJ intervene again this week?

USD/JPY has pierced the 149.00 level as per the following 5-month chart:

The bull eye the prospects of running up to the psychological level of 150 where speculating lies for further intervention from the Japanese authorities. At the start of the week, Japan’s top currency diplomat Masato Kanda said authorities would firmly respond to any excessive currency fluctuations.

Each country would respond appropriately to an agreement on foreign exchange market moves by the Group of Seven (G7) and G20 meetings last week, he said.''

Japan's Finance Miniter Shun'ichi Suzuki has also stepped in and said that they will take decisive action against excess forex moves based on speculation. Suzuki says they are constantly watching fx movements with a sense of urgency.

The yen has declined nearly 30% against the dollar this year already as the divergence between the US Federal Reserve's hawkish stance and the Bank of Japan's ultra-lose policy. Last month, Japanese authorities conducted their largest-ever currency intervention to support the rapidly falling yen, having spent 2.84 trillion yen for its efforts which yielded a fleeting effect.

Meanwhile, the US dollar was softer against a basket of major currencies and sterling jumped on Monday after Britain's new finance minister ditched most of the government's "mini-budget", while better-than-expected earnings from Bank of America helped to boost risk appetite.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.