- Analytics

- News and Tools

- Market News

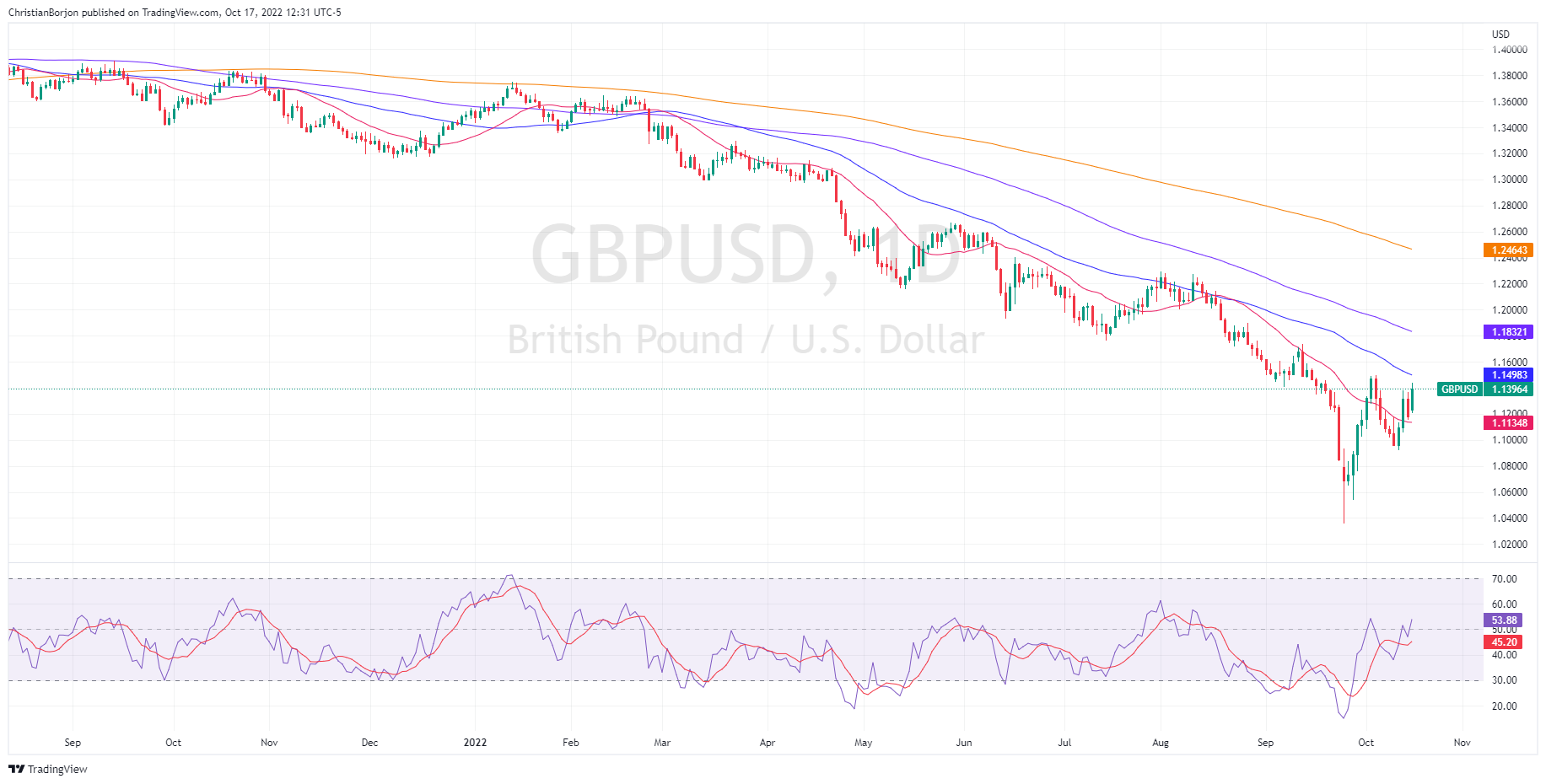

- GBP/USD rallies to a two-week high above 1.1400 as traders approve Hunt's plan

GBP/USD rallies to a two-week high above 1.1400 as traders approve Hunt's plan

- GBP/USD climbed sharply by more than 200 pips, gaining 2%.

- UK 30-year bond yields dropped 50 bps to 4.38% as the bond sell-off trims.

- UK’s Finance Minister Hunt calmed the markets, buying some time for UK’s PM Liz Truss, as pressures to oust her increase.

The GBP/USD pierces the 1.1400 mark, as the UK’s new Finance Minister, Jeremy Hunt, said in the House f Commons that the government changed its course while reiterating that Britain is a country that “pays its debts.” So far, UK Government’s U-Turn keeps investors’ mood upbeat, with global equities trading in the green. At the time of writing, the GBP/USD is trading at 1.1384, above its opening price but shy of the two-week high.

GBP/USD jumped as UK’s newest Finance Minister scrapped PM Liz Truss’s initial budget proposal

An absent US calendar left investors adrift to UK’s economic turmoil news. The UK Chancellor of the Exchequer, Jeremy Hunt, slashed the tax cuts from the newest government budget to calm the markets. So far, the 30-year Gilts has fallen 45 bps, from 4.85% to 4.35%, as tweaks made by the newest Finance Minister bought PM Liz Truss government time.

The British pound rallied sharply against the dollar on Monday, almost 2% up, gaining more than 200-pips, bouncing from daily lows around 1.1208 to its daily high at 1.1439.

Jeremy Hunt’s program increased the corporate tax rate while reversing tax changes on dividend income, alcohol duty, and a VAT-free shopping scheme aimed to raise GBP 5 billion. Additionally, Hunt commented that he would form an “economic advisory council” to provide independent advice to the government.

Aside from this, the US latest inflation figures reported last Thursday’, further cemented the case for another big-size rate hike by the Federal Reserve. Several officials expressed that inflation remains stubbornly high, the market labor is tight and emphasized the need for ratest to be restrictive.

On Saturday, the St Louis Fed President James Bullard said that US higher interest rates bolstered the greenback, which is weighing on other worldwide currencies, an addressed theme by some countries at the G20 meeting. Nevertheless, Bullard added that once the Fed gets rates to a level that could pressure inflation down, the greenback might fall.

What to watch

Tuesday’s light UK economic calendar will leave traders leaning toward UK’s political turbulence and US dynamics. On the US front, Industrial Production m Capacity Utilization, and NAHB Housing Market Index would update the status of the US economy.

GBP/USD Price Forecast

The GBP/USD recovered some ground, distancing from the 20-day EMA, as the Relative Strength Index (RSI) broke above the 50-midline, a bullish signal. On its way north, the 50-day EMA lies at 1.1498, which, once cleared, will expose the 1.1500 figure, followed by a test of the 100-day EMA at 1.1832.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.