- Analytics

- News and Tools

- Market News

- NZD/USD bulls come up for air, eye 0.5650

NZD/USD bulls come up for air, eye 0.5650

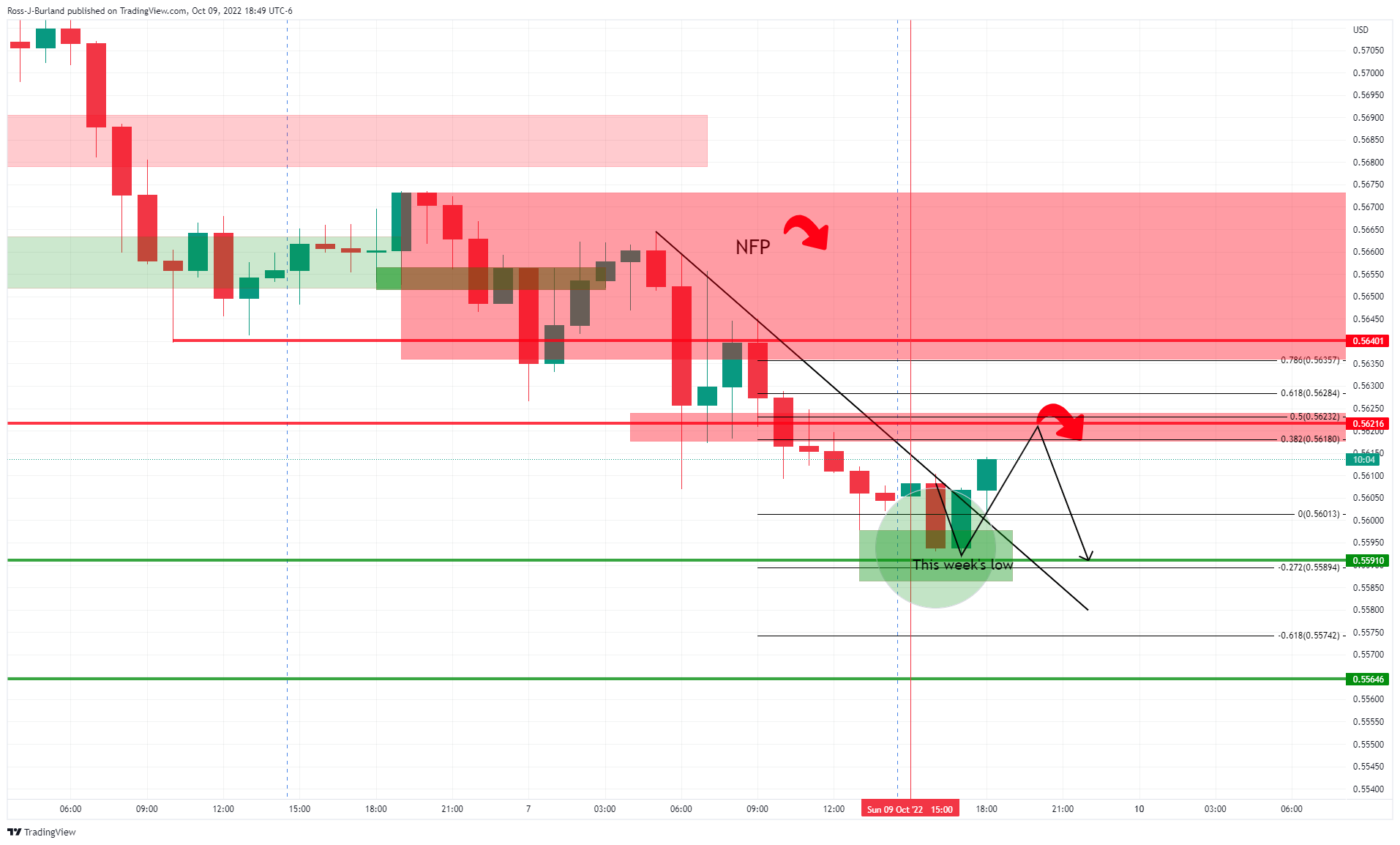

- NZD bulls eye a run to test 0.5640/50 territories for the day ahead.

- First, the bulls need to clear 0.5625 or face resistance from the bears ahead of this week's key US data and FOMC minutes.

NZD/USD is correcting from a 30-month low at the start of the week, trading higher by some 0.2% at the time of writing in holiday thin market conditions. NZD/USD has travelled from a low of 0.5592 to a high of 0.5616 so far.

The mixed US data in the Nonfarm Payrolls was overall bullish for the greenback and US yields and a thorn in the side for the Federal Reserve as it battles with inflation headwinds aheaf of this week's US Consumer Price Index data and US Retail Sales. The bird was lower on the release of the data and moved in on a test below 0.5600. However, it has popped higher at the start of the week to tackle resistance up ahead as the charts below illustrate.

Meanwhile, trader will also be keen to see the minutes from the prior Fed meeting. ''The September dot plot revealed a higher-than-expected Fed Funds terminal rate of 4.625%, with a fairly even dot distribution around this level,'' analysts at TD Securities said. ''The question is how much of this was reflected in the deliberations at the Sep meeting. The tone of these deliberations likely was more hawkish given core CPI inflation trends, upsetting the current dovish pivot markets narrative.''

''Friday night saw the Kiwi drift back down towards 0.56 as market expectations for Fed hikes rose, giving the USD a boost,'' analysts at ANZ Bank explained in a note at the start of Monday.

''We say mixed because while the data beat expectations and the Unemployment Rate fell, the pace of jobs creation fell and monthly earnings growth came in as expected. The USD DXY is now around 2½% higher than it was late last Tuesday, and all eyes are now on US CPI data later this week.''

''Local factors are simply not featuring, and anecdotally, NZ’s current account deficit is attracting more unwanted attention. In a world where US interest rates are leading the way higher, the NZD needs positive rather than negative attention, and that seems to be lacking at present.''

NZD/USD techncial analysis

The price is attempting to slide out of the resistance of the dynamic bearish trendline that was formed on the back of the NFP data on Friday. A break there opens the risk of a correction into 0.5640/50 territories for the day ahead. First, the bulls need to clear 0.5625 to put a firm grip on the baton:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.