- Analytics

- News and Tools

- Market News

- US dollar bulls back in the game into all or nothing US CPI key event

US dollar bulls back in the game into all or nothing US CPI key event

- US dollar falling back into the hands of the bulls with rampant US yields.

- Eyes will be kept on the yen's weakness and US CPI this week.

The US dollar made an impressive comeback on Friday and strengthened against major currencies on the back of US data that showed employers have taken on more workers than expected in September, suggesting the Federal Reserve will likely stick to its aggressive tightening policy for now. The likelihood of ongoing interest rate increases helped drive up the Treasury yields yet again. The dollar index DXY, which tracks the greenback versus a basket of six other major currencies, was up 0.43% by the close of play on Friday and made a high of 112.5882. The yield on benchmark 10-year Treasury notes climbed to a high of 3.908%.

Nonfarm payrolls climbed 263,000, above the consensus estimate for an addition of 250,000 jobs. The service sector added 244,000 jobs, driven by gains in education and health services and leisure and hospitality. The Unemployment Tate fell to 3.5% in September from 3.7% in August, compared with calls for the rate to remain unchanged. The labour force participation rate slipped 0.1 percentage point to 62.3%. This goes against their battle to restore demand-supply-side balance in the labour market in the face of inflation, meaning that strong rate hikes are a given for the foreseeable future and this is a headwind for gold prices vs. a flattening curve. This will make for another critical week for the days ahead with plenty of US calendar events, including the minutes f the prior Fed meeting, US inflation data and Retail Sales.

Markets are currently pricing in a 92% chance of a 75-basis-point increase for next month's Federal Open Market Committee meeting. The remaining 8% probability is for an increase of 50 basis points. US inflation data will be watched closely as well and could prove influential in setting investors' expectations for the Fed. In an effort to tame sky-high inflation, the central bank has hiked its policy rate from near-zero at the beginning of this year to the current range of 3.00% to 3.25%, and last month signalled more large increases were on the way this year. This is underpinning the greenback that seemed to have hit a floor last week as the following techncial analysis below ill show. The DXY is up about 18% for the year so far.

''Core prices likely stayed strong in September, with the series registering another large 0.5% MoM gain,'' analysts at TD Securities said ahead of the CPI data. ''Shelter inflation likely remained strong, though we look for used vehicle prices to retreat sharply. Importantly, gas prices likely brought additional relief for the headline series again, declining by about 5% MoM. Our moM forecasts imply 8.2%/6.6% y/y for total/core prices.''

In other events, the FOMC minutes will be released. The September dot plot revealed a higher-than-expected Fed Funds terminal rate of 4.625%, with a fairly even dot distribution around this level. Analysts at TDS said that the ''question is how much of this was reflected in the deliberations at the Sep meeting. The tone of these deliberations likely was more hawkish given core CPI inflation trends, upsetting the current dovish pivot markets narrative.''

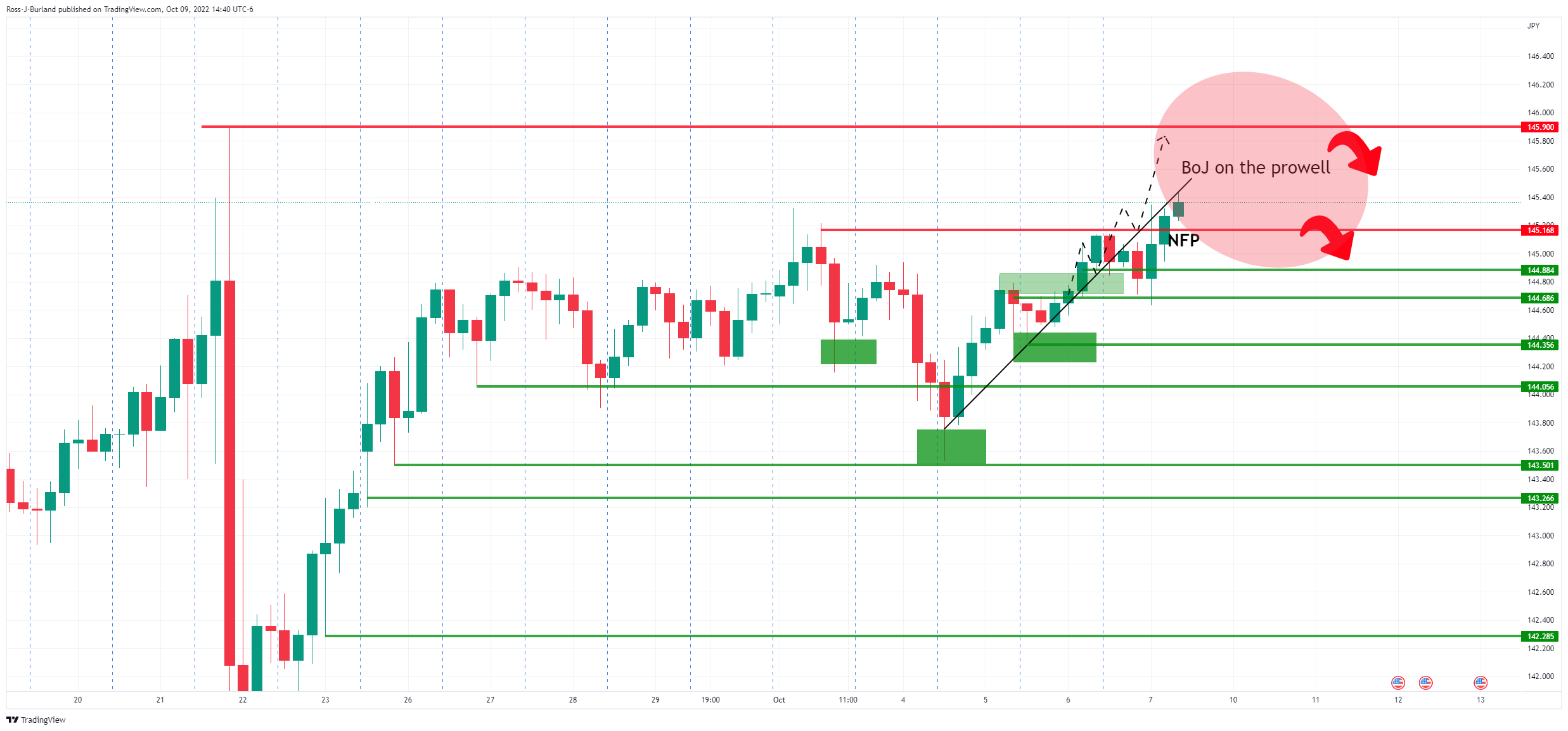

BoJ on the prowell

Meanwhile, a potential thorn in the side of the greenback could be the Bank of Japan. The dollar reversed early losses against the Japanese yen last week and that is the risk for US dollar bulls.

The dollar hit a 24-year peak of 145.90 yen last month, which had prompted an intervention by Japanese authorities to shore up the fragile yen. ''USD upside will be harder to achieve at this point in large part because the MOF/BOJ seem intent on squashing USDJPY vol,'' analysts at TD Securities argued.

''So far, that has been successful. Currently, they sit on about $1tn of reserves, so they have some ammo to engage in this operation. We think a move above 145 risks yen-intervention again and that could introduce some USD drag into the complex, albeit temporarily. 140/145 is fair for USDJPY at this time.''

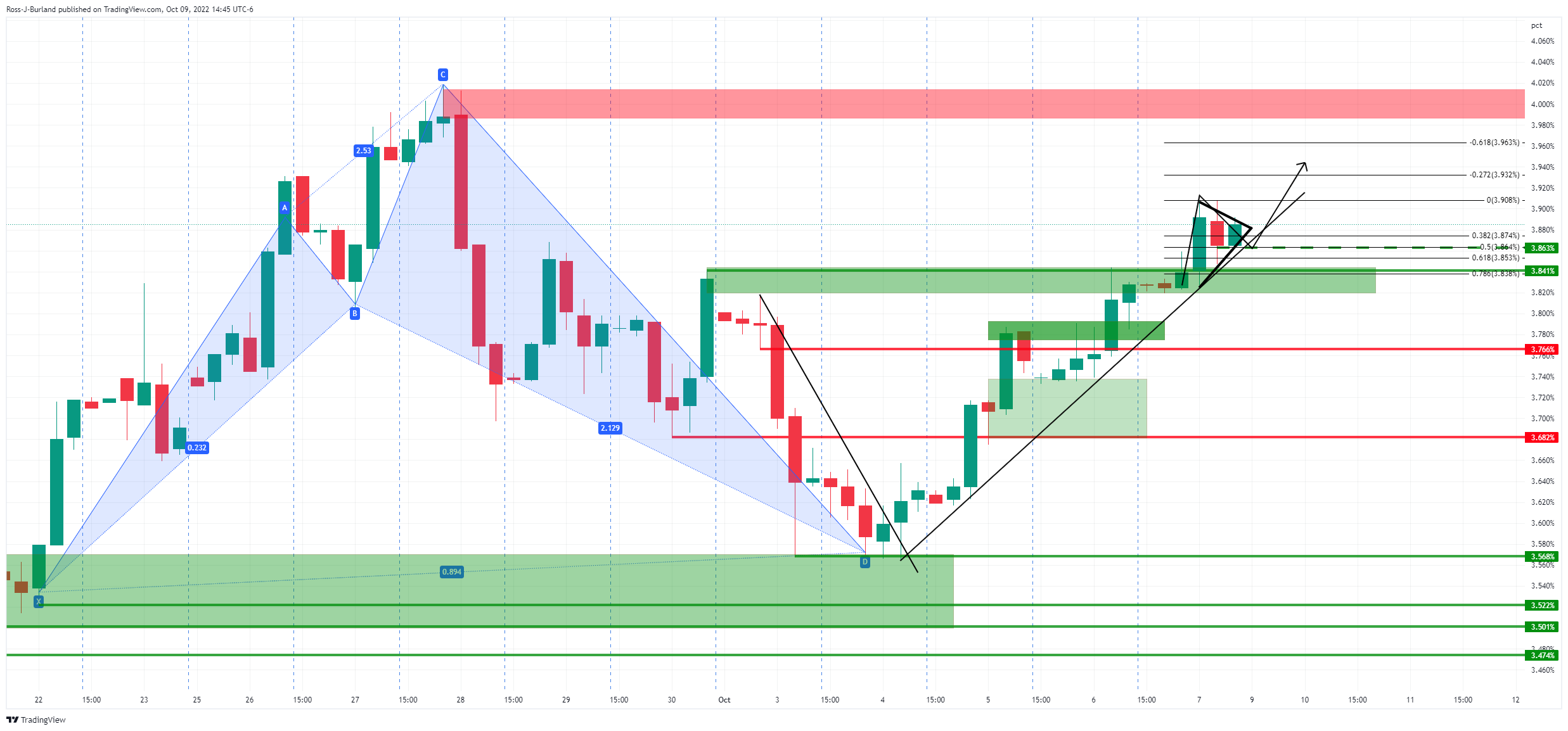

US yields keep on keeping on

The dollar and US Treasury yields surged after the labour report, as investors bet on safe havens:

as seen, the 4-hour chart is showing little signs of deceleration following a move up from a 50% mean reversion of the prior bullish impulse. If the support structure holds, the 4.00% mark will stay on the bull's radar and that will be supportive of the greenback.

Lumber prices the canary n the coal mine?

The break of the head and shoulders neckline and move in on the M-formation's neckline are bullish prospects within the bullish rising wedge in lumber prices. The rate hikes that had hurt the housing market could be a tide that is turning. Lumber prices had dropped 70% year-to-date as mortgage rates jumped through the 5% threshold.

Meanwhile, we have seen a 62% retracement in the September rally and an attempt to move higher again on the front side of a dynamic supporting trendline that is yet to give. There is a price imbalance in the grey area around 114.00 that the bulls can target for the week ahead into the Consumer Price Index (CPI).

Also to keep in mind, the US dollar has been gaining against China's offshore yuan USDCNH and it is set to continue doing so as China's economy struggles under the weight of ongoing COVID outbreaks and lockdowns. We saw more evidence of that in the weekend's Caixin Services Purchasing Managers' Index (PMI) for September 2022 which came in lower at 49.3 from 55.0 in August, taking it back into contraction. We have also seen China official services PMI miss the mark at 50.6 (expected 52.0, prior 52.6) and China Caixin / Markit Manufacturing PMI for September was disappointing at 48.1 (expected 49.5, prior 49.5). this all should fall into the hands o the greenback, especially with the number of geopolitical risks thrown into the mix.

US dollar H4 chart

The US dollar broke above last week's lows of around 112.75 which is a bullish feature for the week ahead that leaves 114.00 on the radar as long as 111.95/55 holds:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.