- Analytics

- News and Tools

- Market News

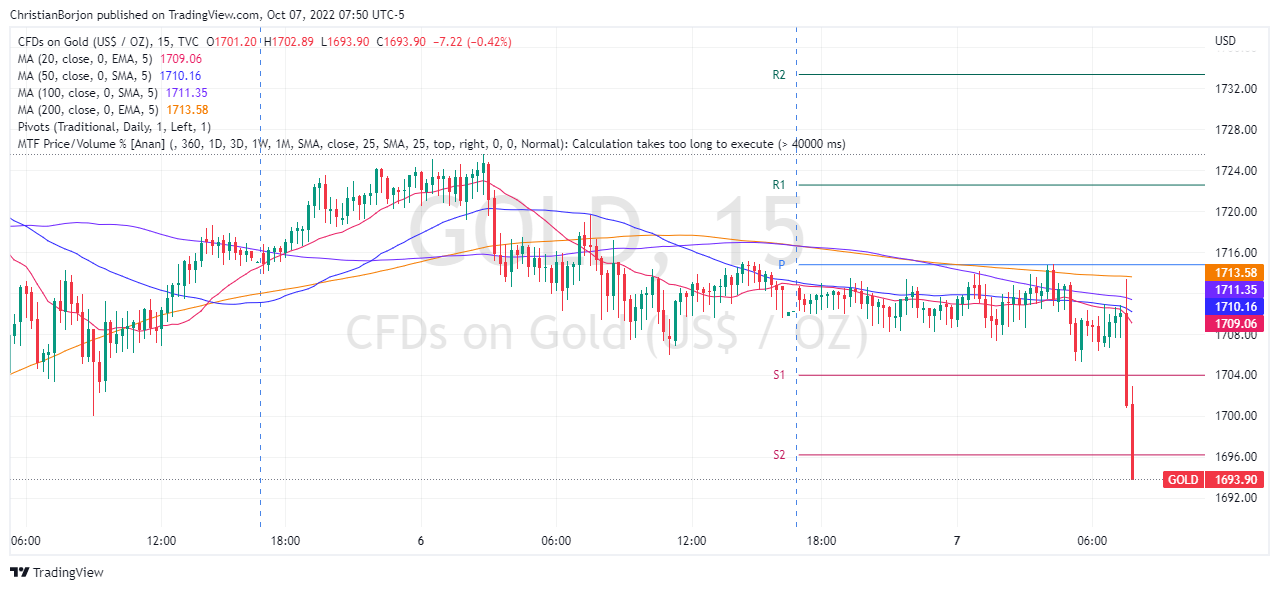

- Gold Price Forecast: XAU/USD plunges below $1700 after upbeat US NFP, next CPI

Gold Price Forecast: XAU/USD plunges below $1700 after upbeat US NFP, next CPI

- The gold price tumbled below the $1700 figure, in the aftermath of the US jobs report.

- US Nonfarm Payrolls exceeded estimates at 263K, further Fed hikes coming.

- US Treasury bond yields pushed to the upside, staying above 3.80%.

Gold price dropped after the US Labor Department reported employment figures, which exceeded estimations, justifying the Fed’s need for further tightening, bolstering the greenback. Therefore, XAU/USD is trading at around $1690, below its opening price.

Before the US Nonfarm Payrolls report was released, the yellow metal meandered around $1710. However, once the headline crossed newswires, gold’s initial reaction slid towards the $1700 region, but the initial move dissipated. Nevertheless, at the time of typing, it extended its losses below $1700 in a volatile reaction.

US Data reported by the US Bureau of Labor Statistics (BLS), showed that the US economy added 263K new jobs, smashing estimations of 250K, while the Unemployment Rate ticked lower to 3.5%, from 3.7% expectations. Even though it is a lower reading than August’s figures, it was above estimates, which would further cement the case for e Federal Reserve rate hike.

In the meantime, money market futures have priced in a 92% chance of a Fed 75 bps rate hake, up from 85.5%, before the US Nonfarm Payrolls report.

US Treasury bond yields pushed to the upside, with the US 10-year Treasury bond yield advancing three bps, at 3.865%, while the US Dollar Index, a gauge of the buck’s value vs. six currencies, is up 0.28%, at 112.565.

What to watch

Now that the US Nonfarm Payrolls report is on the rearview mirror, the next important events in the US calendar would be September CPI figures and the University of Michigan Consumer Sentiment in the next week.

Gold 5-minute Chart

Gold Key Technical Levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.