- Analytics

- News and Tools

- Market News

- NZD/USD Price Analysis: It is all about NFP, but 0.5750 and 0.5590 are important levels

NZD/USD Price Analysis: It is all about NFP, but 0.5750 and 0.5590 are important levels

- NZD/USD bears are lurking at key resistance just below 0.5700.

- Bears eye a move towards this week's low in anticipation of a stronger US dollar and NFP.

NZD/USD came under selling pressure again on Thursday after making a fresh high for the week so far up at 0.5813, only to succumb to higher US yields and a rampant greenback that took revenge on its counterparts into the final seasons for the week.

The moves were extensive in forex that has struggled to find direction on the week so far in the lead into the showdown event in Friday's Nonfarm Payrolls.

US yields and the US dollar both rallied as investors dial back the sentiment surrounding a picot from the Federal Reserve. The following illustrates the market structure in the yields, DXY and NZD/USD ahead of the data for today.

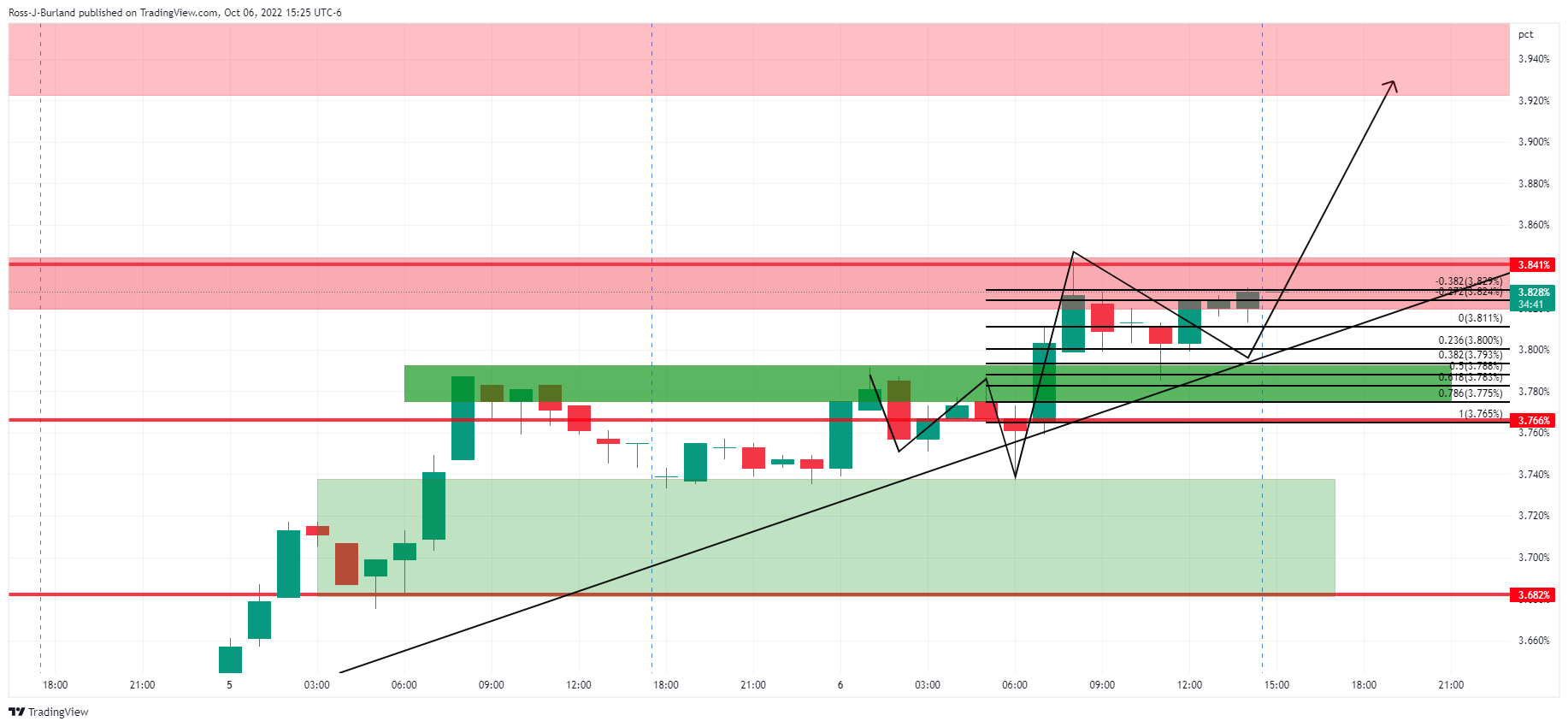

US 10-year yield H1 charts

US yields led the way after showing resilience earlier in the week.

The W-formation, as shown here on the hourly chart that is zoomed-in, is a bullish scenario for the day ahead. The yield will need to hold up on retests of the neckline. This is a bearish scenario for the kiwi as we head over to the Nonfarm Payrolls on Friday.

DXY H1 chart

In anticipation of a positive report, the DXY index, which measures the US dollar vs a basket of currencies, including the kiwi dollar, rose and extended its gains from the previous day. So long as the bulls commit, there are prospects of a retest towards clearing 112.50 again with sights on 113.00.

NZD/USD H1 chart

As illustrated, the bird was sold off heavily and is trying to base around 0.5650. A break below there, however, opens risk of a run-on long position towards this week's lows around 0.5590 with last week's lows located at 0.5565. On the other hand, should the NFP report disappoint, investor sentiment for a Fed pivot will be reignited ahead of next week's inflation data for the US, opening risk of a meanwhile rally back towards or beyond Thursday's highs around 0.58 the figure if bulls can get beyond 0.5750.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.