- Analytics

- News and Tools

- Market News

- EUR/USD Price Analysis: Price balancing on a tightrope over the abyss ahead of NFP

EUR/USD Price Analysis: Price balancing on a tightrope over the abyss ahead of NFP

- EUR/USD bears are balancing at a key level on the charts.

- The price is hanging over the edge of the abyss ahead of NFP.

EUR/USD was sold off on Thursday as investors get set for the outcome of Friday's key US event in Nonfarm Payrolls. US yields and the US dollar both rallied as investors dial back the sentiment surrounding a picot from the Federal Reserve. The following illustrates the market structure in the yields, DXY and EUR/USD ahead of the data for today.

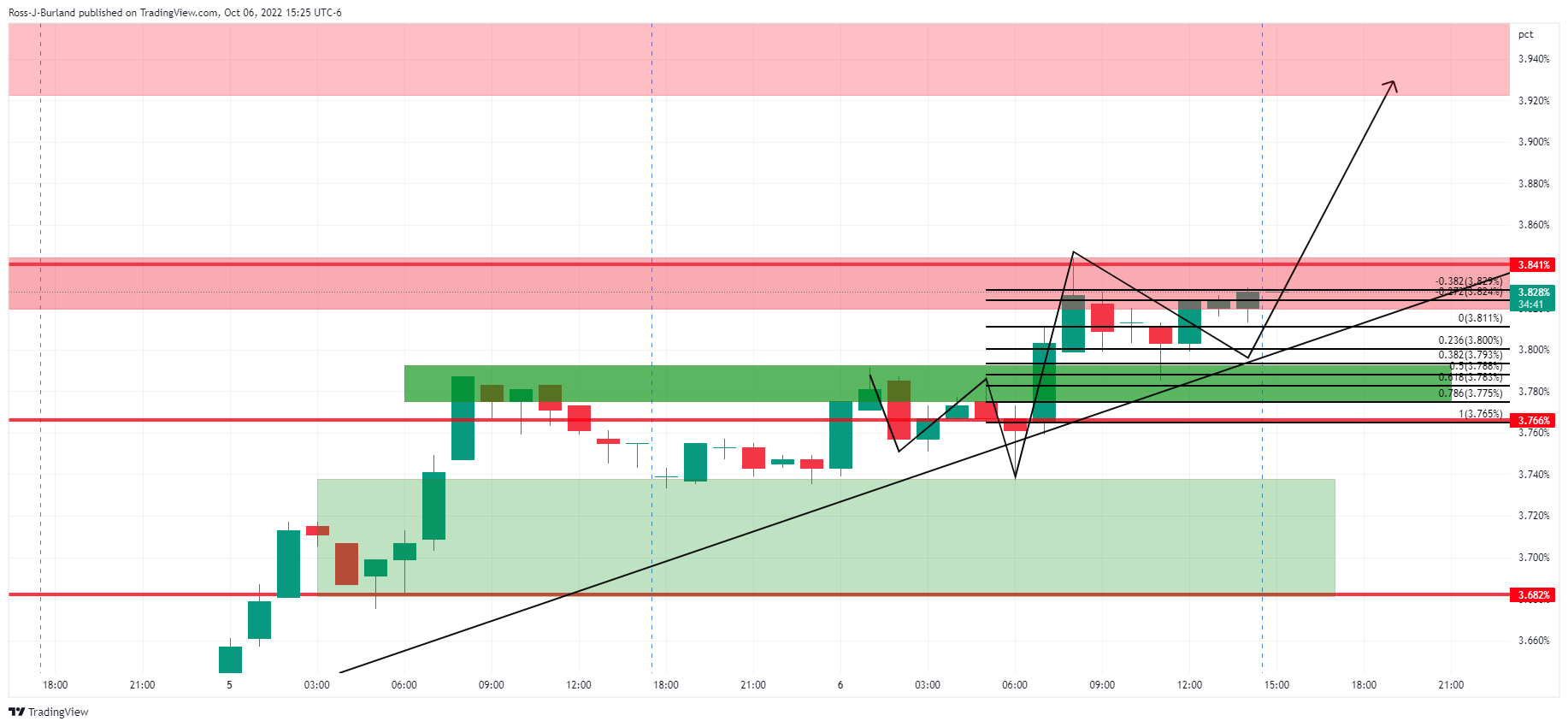

US 10-year yield H1 charts

The W-formation, zoomed-in, is bullish as price meets support at the neckline. This is a bearish scenario for cable.

DXY H1 chart

Despite downbeat Initial Jobless Claims, the DXY index, which measures the US dollar vs a basket of currencies, including the pound, rose and extended its gains from the previous day.

On Thursday, the greenback is back above 112.00, recovering from when it was initially falling against most majors at the start of the week before regaining ground. The question here is whether it can extend the gains towards the high of the week through 112.50.

If Friday's NFP is terrible, then the 111 level will potentially come under pressure, whereas if the data is in line, it will be another disappointment for those looking for a Fed pivot and positive for the greenback, bearish for the euro:

EUR/USD H1 chart

As for the single currency, it is consolidated at Thursday's low and back to where the week started out. We may have already seen the high for the week so the focus is on the downside while below 0.9850 or thereabout. Last week's low is near 0.9535 and a break of 0.9650 guards the area for a downside extension:

The daily chart above is bearish while below the trendline resistance, however, the 30 September doji (highlighted on the chart) is a point of structure around the current level that needs to give for a convincing short-term bearish case currently.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.