- Analytics

- News and Tools

- Market News

- NZD/USD Price Analysis: Bulls take charge towards RBNZ highs, eye a break of 0.5800

NZD/USD Price Analysis: Bulls take charge towards RBNZ highs, eye a break of 0.5800

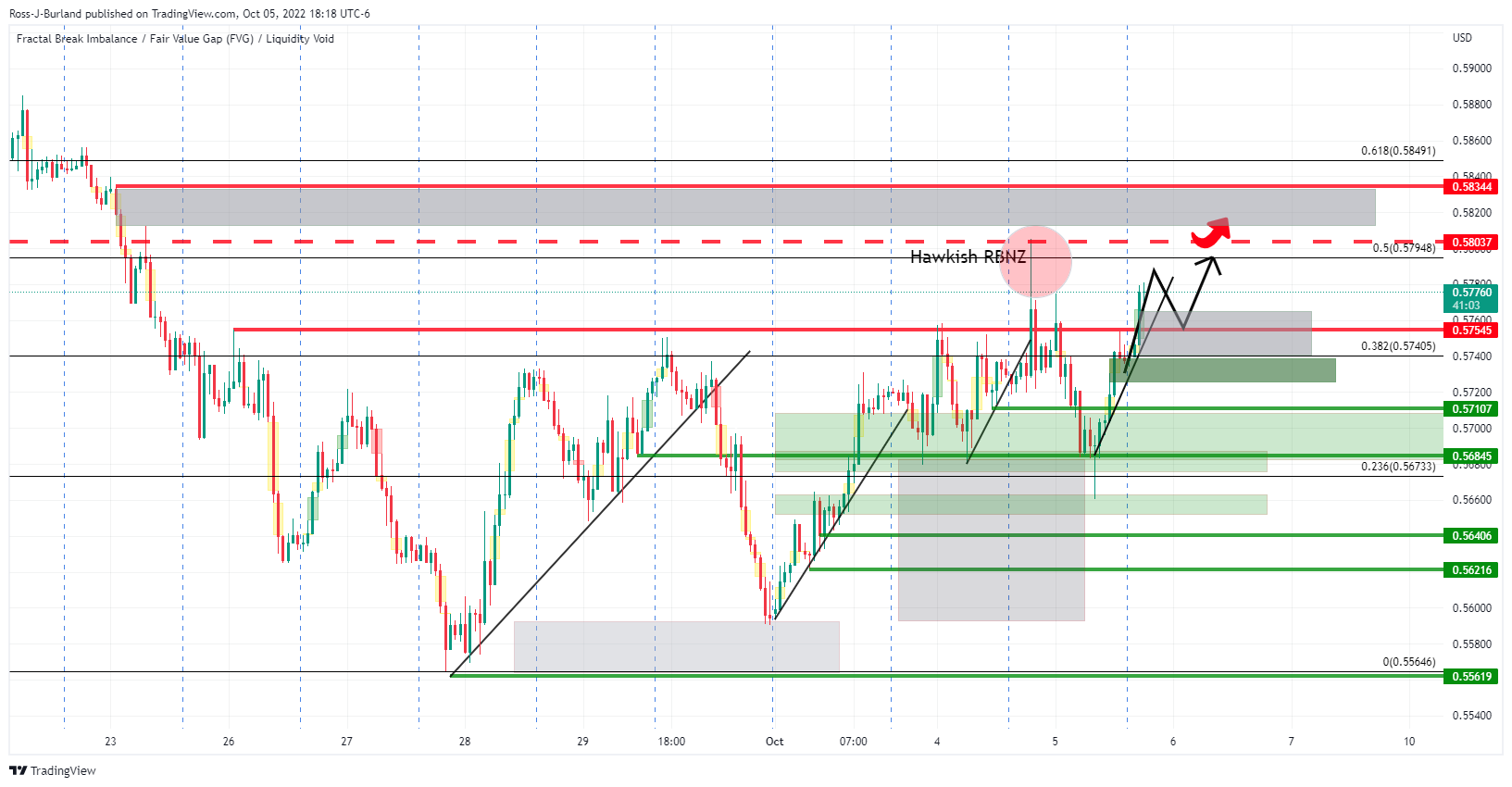

- NZD/USD is breaking towards the RBNZ highs on Thursday.

- A move above 0.5800 will open risk to the price imbalance between 0.5820 and 0.5835 on the way to 0.5850.

NZD/USD crash-landed mid-week, tumbling out of the blue skies made on the back of the Reserve Bank of New Zealand's hawkish hike of 50bps. However. the US dollar has found its feet again and the DXY index was last seen dipping below 111.00 but it had been as high as 111.735 on Wednesday.

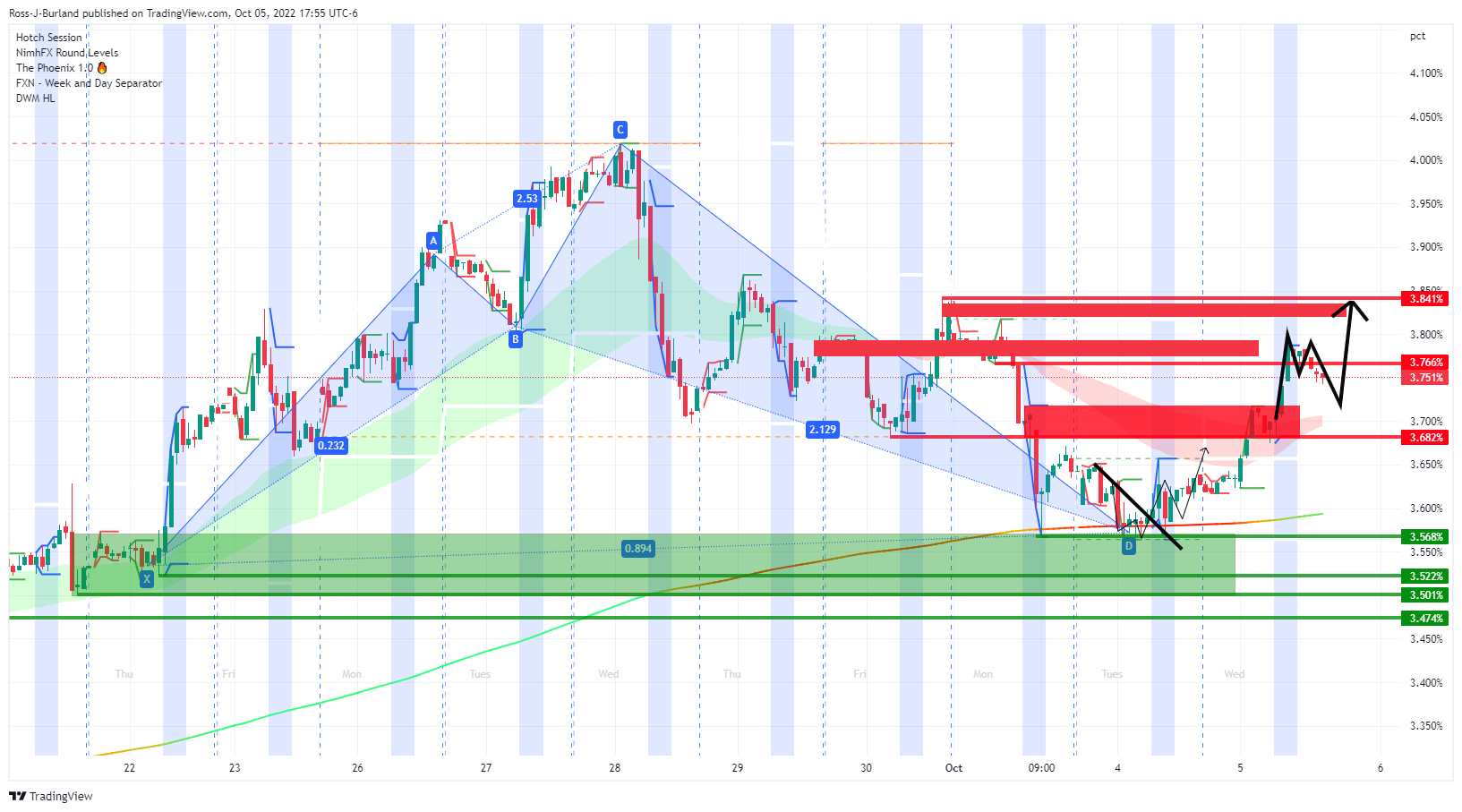

A tear in US yields has helped to prop up the US dollar as the money markets to price out overall optimistic speculation over a Federal Reserve pivot. The yield on the US 10-year note was up a high of 3.78%. It has come under some pressure in the Tokyo session, however:

The yield is resisted but the M-formation is bullish. This in turn could put a floor in the downside for the greenback and weigh on the bird going forward:

DXY H1

The price of the index is extending the downside in Asia which may give rise to a bullish continuation on the kiwi:

NZD/USD H1

The bird is breaking towards the RBNZ highs on Thursday and a move above 0.5800 will open risk to the price imbalance between 0.5820 and 0.5835 on the way to 0.5850.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.