- Analytics

- News and Tools

- Market News

- Breaking: RBNZ hikes as expected 50bps

Breaking: RBNZ hikes as expected 50bps

The Reserve Bank of New Zealand has hiked 50 bps as expected and the market is now digesting the statement, and the committee considered whether to increase by 50 or 75bps at this meeting, concluding that it is appropriate to continue hiking at the current pace.

The OCR is now at a seven-year high of 3.5% while the central bank flagged more to come as it struggles to contain stubbornly high inflation.

"The Committee agreed it remains appropriate to continue to tighten monetary conditions at pace to maintain price stability and contribute to maximum sustainable employment," the RBNZ said in a statement.

Ahead of the event, analysts at ANZ Bank argued that capacity pressures ''are only easing slowly and the labour market remains very tight. In this inflationary environment, we see the RBNZ has little choice but to focus on dampening inflation pressures by delivering another 50bp rate hike.''

- The committee agreed appropriate to continue to tighten policy.

- The committee members agreed monetary conditions needed to continue to tighten until inflation back in target range.

- The core consumer price inflation is too high and labour resources are scarce.

- The level of domestic spending has remained resilient to date.

- Household balance sheets remain resilient despite the fall in house prices.

- New Zealand's productive capacity still being constrained by labour shortages and wage pressures are heightened.

NZD/USD update

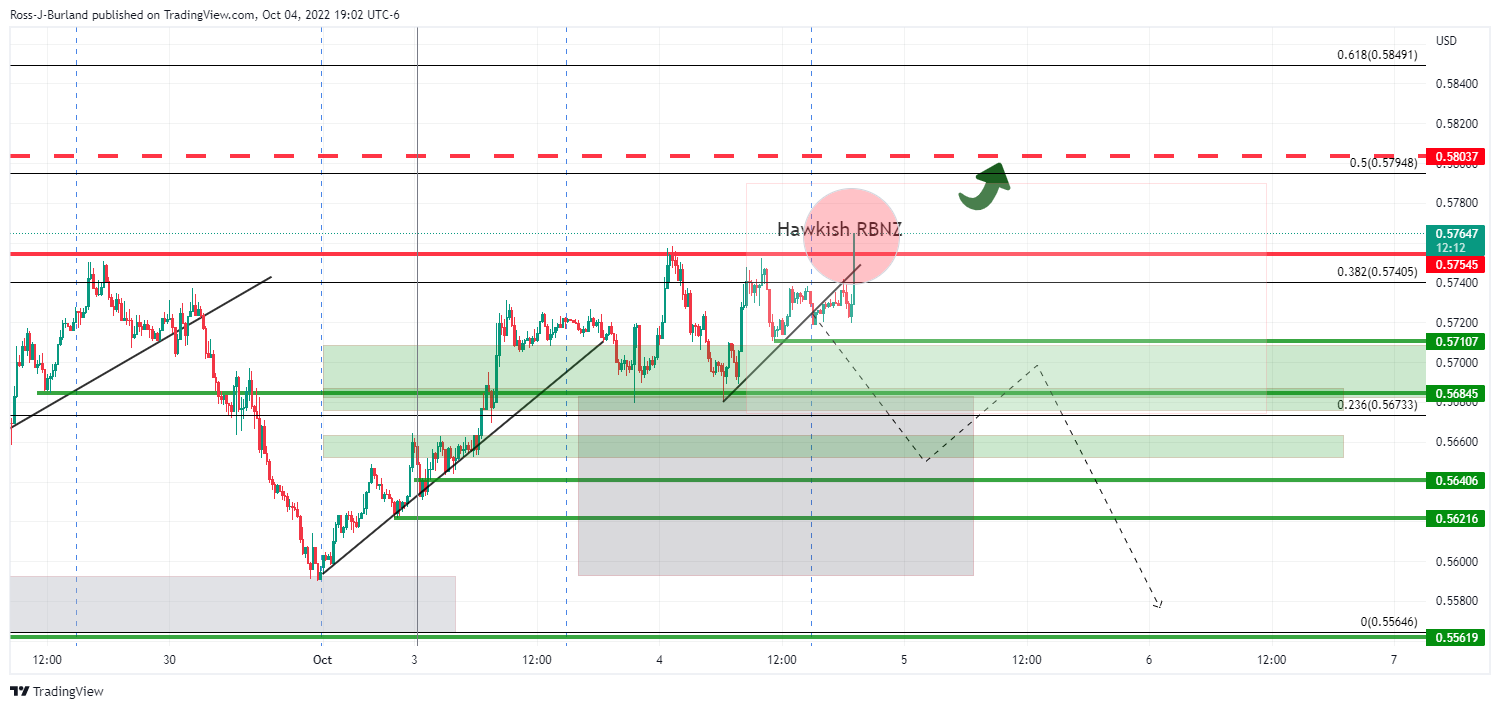

As per the preview, When is the RBNZ and how might it affect NZD/USD?, the price was leaning over the top of a 100 pip box and resisted by the 0.5750s but is now bid on the release of the decision and statement.

It was stated that ''the price could shoot up on a hawkish outcome towards a 50% mean reversion of the daily bearish impulse near 0.5800 and beyond.''

Also worth noting, the knee jerk to the RBA on Tuesday was a 50 pip sell-off before a 100 pip rally that was faded by the bears in London back to the post-RBA lows until the US dollar was sold off in New York.

The kiwi is now testing the upside as follows:

It is now evident that the price can continue much higher, however, as the board decide not to hike by 75bps. While there is cope for the upside, the price may struggle to gain traction at this stage of the runnibgs, especially on a resurgence in the greenback that is trying to base at the lows of the week so far.

About the RBNZ

RBNZ Interest Rate Decision is announced by the Reserve Bank of New Zealand. If the RBNZ is hawkish about the inflationary outlook of the economy and rises the interest rates it is positive, or bullish, for the NZD.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.