- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bears take out a key hourly trendline, risks of a deeper bearish correction

Gold Price Forecast: XAU/USD bears take out a key hourly trendline, risks of a deeper bearish correction

- Gold bears are moving in and taking out a potentially critical short-term trendline support.

- The week ahead will be focussed once again on the Fed in the run-up to the NPFs.

The gold price is 0.3% higher on the day at the start of a new week, month and quarter while the US dollar feels some heat as it breaks to the downside as per the DXY index that measures the greenback vs. a basket of currencies. At the time of writing, gold is trading at $1,665.50 having traveled between a low of $1,660.95 and $1,669.57 so far.

Markets are closed in China and Australia but there is movement in the FX space which is playing through into the greenback-denominated gold that is less expensive for overseas buyers as a result.

Meanwhile, financial markets have been in turmoil and there is little light seen at the end of the tunnel in this regard which would be expected to continue to underpin the US dollar, weighing on the outlook for gold prices. The S&P 500 and the Nasdaq both fell an additional 1.5% on their final trading day of the quarter on Wall Street where the benchmarks fell by around 8-9% in September. However, gold recorded its best week since mid-August due to US Treasury yields falling onto their back foot. The yield on the US 10-year Treasury fell to a low of 3.682% before recovering to a closing high of 3.837%. However, rising geopolitical risks saw some safe-haven buying emerge into the precious metals complex.

Nevertheless, as we move across into the final quarter of the year, the focus on the Federal Reserve will be firmly back on the market's agenda for the start of the week with resolute policymakers advocating rate rises despite risks of a recession. On Friday, Fed Vice Chair Lael Brainard endorsed the same and added to a chorus of hawkish Fed speakers at the end o the month who are hellbent on curbing inflation. Such a stance has played havoc on the yellow metal as it strips its appeal for Rising interest rates dim bullion's appeal due to the cost of holding the non-yielding asset while the US dollar extends its bullish cycle.

''Historically, gold prices tend to display a systematic and significant underperformance in the latter stage of hiking cycles, as rates enter into restrictive territory,'' analysts at TD Securities explained. ''And, considering the increase in inflation's persistence this cycle, a restrictive regime may last longer than historical precedents with the Fed likely to keep rates elevated for some time, even as recession risks rise, which argues for a prolonged period of pronounced weakness in precious metals. Pressure is rising on a small number of family offices and proprietary trading shops to finally capitulate on their massively bloated and complacent length in gold.''

For the week ahead, the main events to watch for will be US Nonfarm Payrolls that are due at the end of the week, while a flood of manufacturing PMI data out later on Monday will also give insight into the global economic outlook.

''Employment likely continued to advance strongly in September but at a less robust pace compared to recent months,'' analysts at TD Securities said with regards to the NFP report. ''We also look for wage growth to moderate to 0.3% m/m. Separately, regional surveys continue to point to loss of momentum in mfg activity. While we look for a decline in the ISM index, we note that it has failed to match prior weakness suggested by other indicators.''

Gold and DXY technical analysis

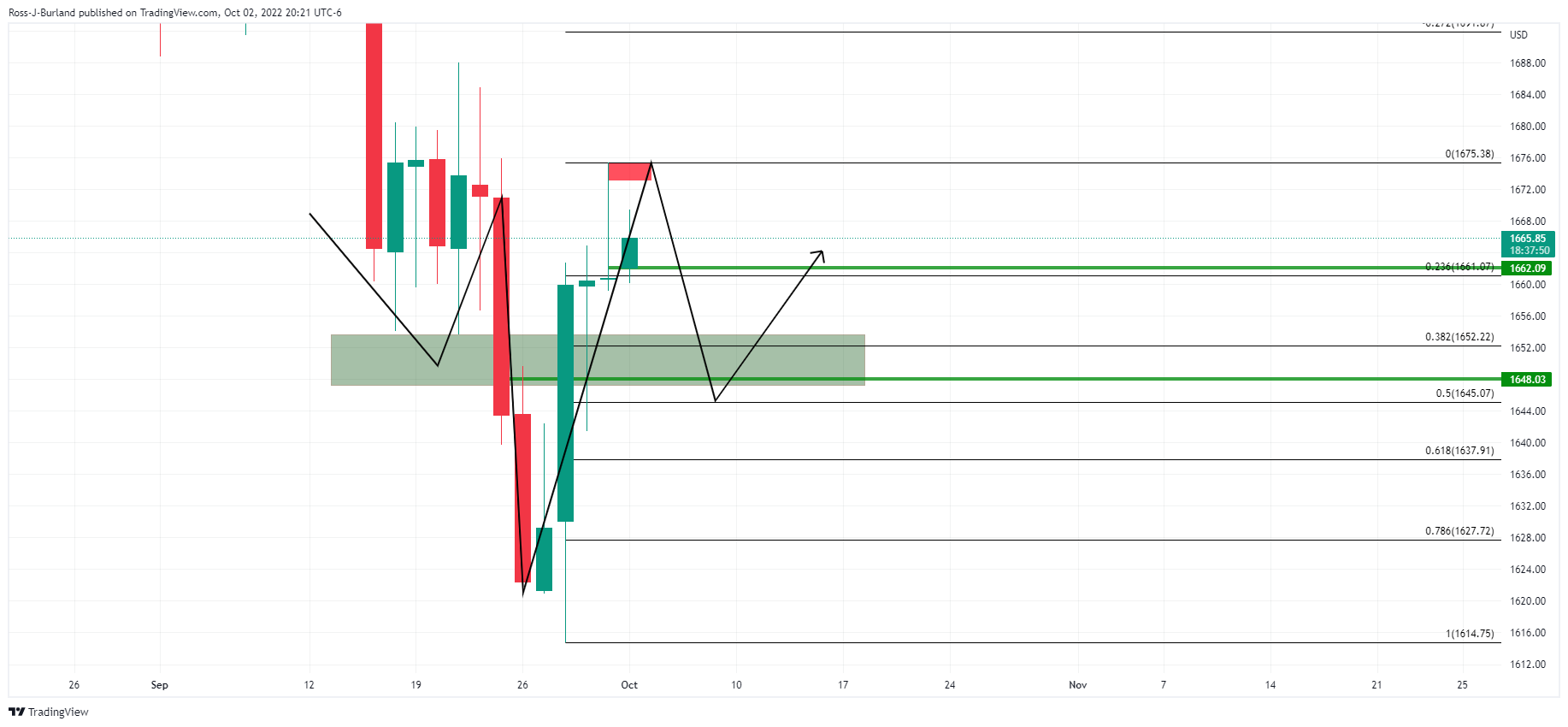

The US dollar is attempting to recover which is weighing on the gold price that is being pressured below a key short tren trendline support as the following illustrates on the hourly and 15-min time frames:

a break of horizontal support opens risk of deeper move to the downside as follows:

On the daily chart, there are prospects of the price forming the right hand shoulder of what would then complete a bullish inverse head and shoulders pattern:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.