- Analytics

- News and Tools

- Market News

- GBP/USD Price Analysis: Hovers around 1.1130s, after testing 1.1200

GBP/USD Price Analysis: Hovers around 1.1130s, after testing 1.1200

- During the week, the British pound has recovered 3.84% from the last week’s loss.

- The GBP/USD failure to clear 1.1200 sent the pair sliding toward current exchange rate levels.

- If it clears the 1.1050, it could pave the way towards the 38.2% Fibonacci retracement at around 1.0880s.

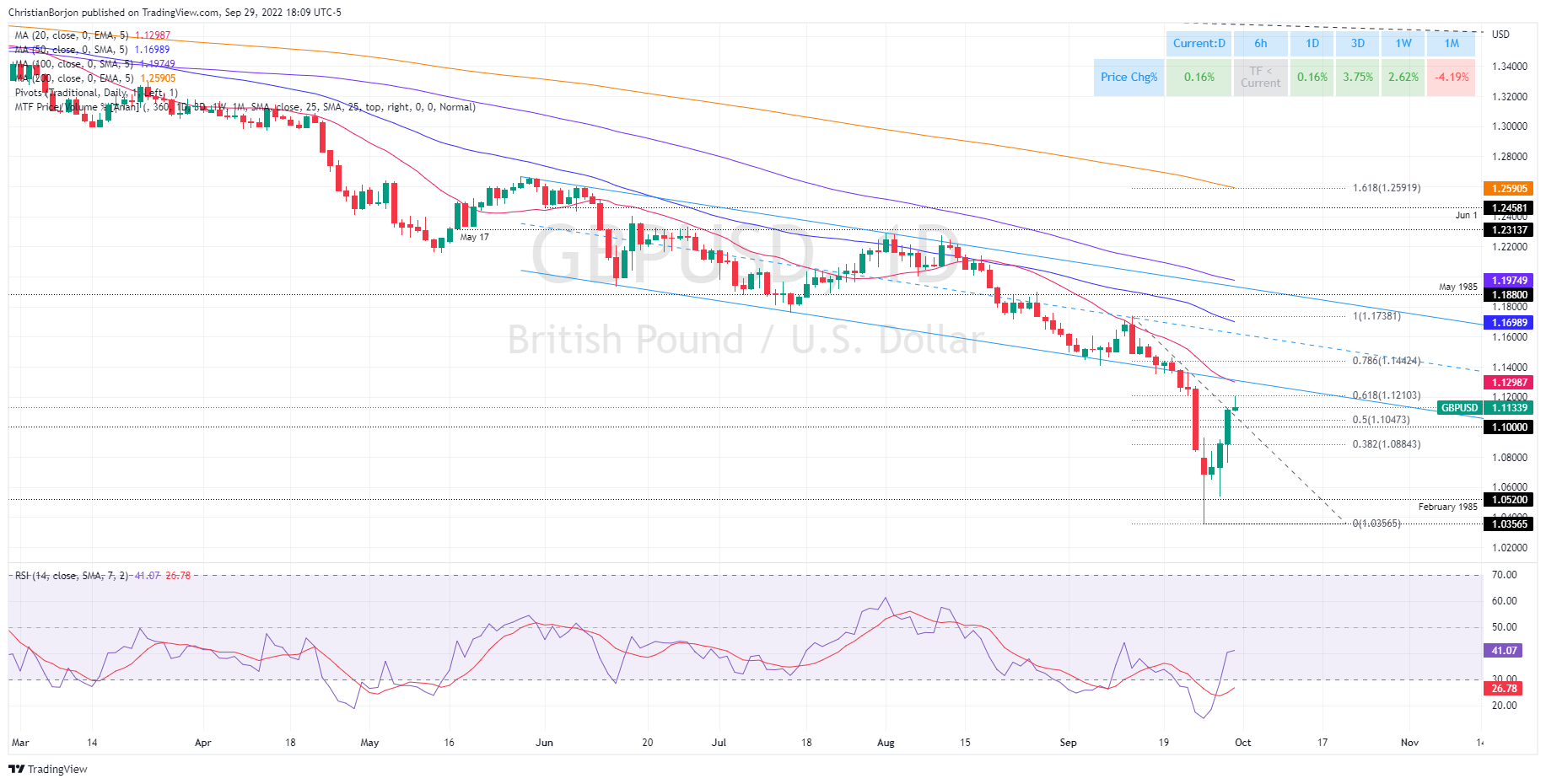

The GBP/USD rallies sharply, trimming some of the last week’s losses, closing to the 1.1200 figure after being at the brink of testing parity when the pound fell to its lowest at 1.0356. At the time of writing, the GBP/USD is trading at 1.1133, 0.25% above its opening price, as the Asian session begins.

GBP/USD Price Analysis: Technical outlook

From a daily chart perspective, the GBP/USD is downward biased, despite the astonishing recovery in the week. Due to last Friday’s 600 pip volatile session, a mean reversion move was expected. The Relative Strength Index (RSI), exited from oversold conditions at 41.59 but shifted almost horizontally, meaning buyers’ momentum is dissipating.

Given the previously mentioned scenario and the GBP/USD failure to clear the 61.8% Fibonacci retracement at 1.1210, a fall towards 1.1050, the 50% Fibonacci level, drawn from the high/low of 1.1738/1.0356, is on the cards.

Therefore, the GBP/USD first support would be the 1.1100 mark. Once cleared, the next support would be the 50% Fibonacci retracement at 1.1050, which, once hurdle, could pave the way for a re-test of the 38.2% Fibonacci retracement at 1.0884.

GBP/USD Key Technical Levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.