- Analytics

- News and Tools

- Market News

- EUR/GBP Price Analysis: Hovers around 0.8940 after trimming Monday’s gains

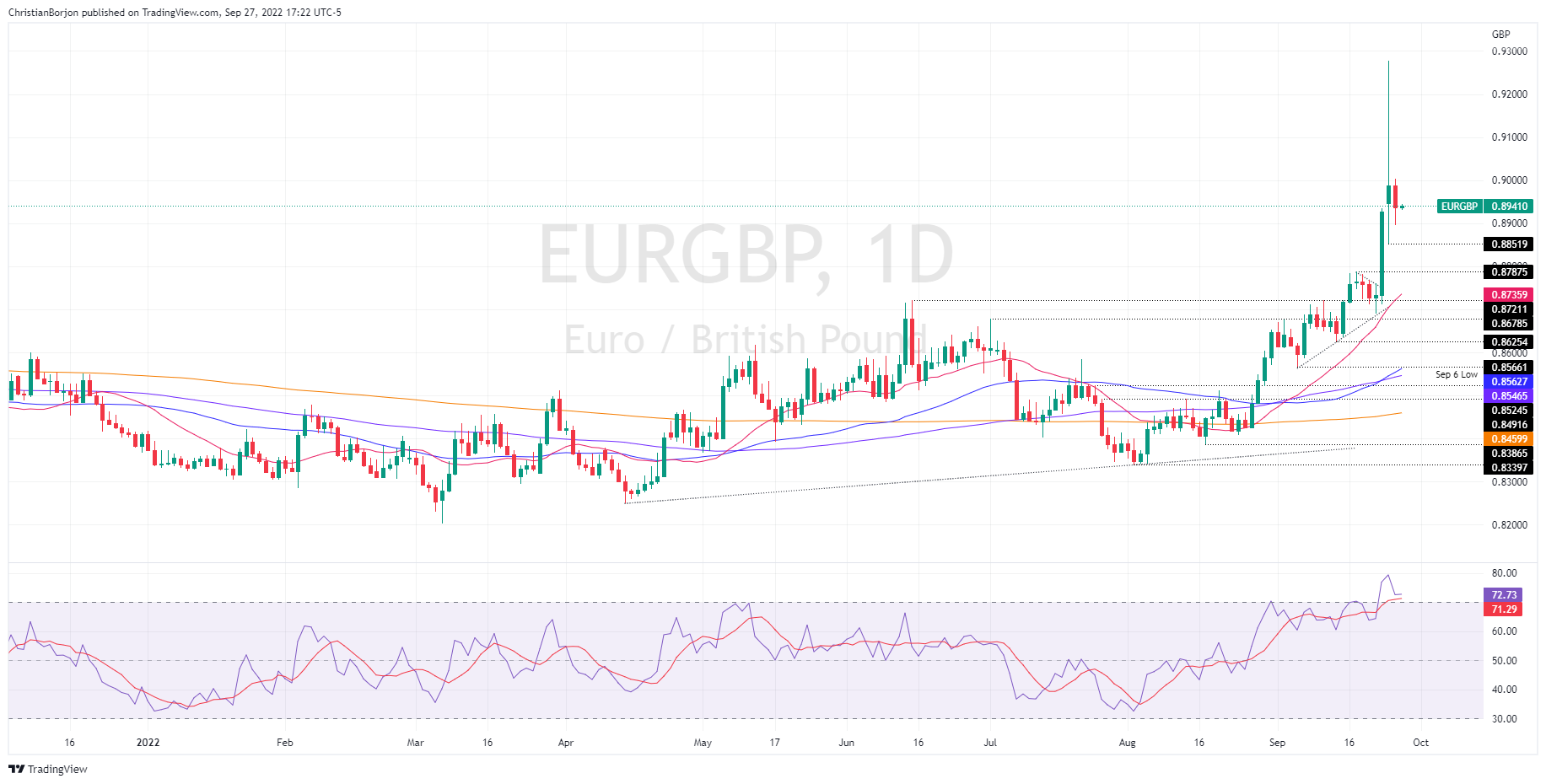

EUR/GBP Price Analysis: Hovers around 0.8940 after trimming Monday’s gains

- As volatility decreased on Tuesday, EUR/GBP fell below 0.9000, which witnessed the cross jumping to a new one-and-a-half year high.

- The EUR/GBP formed a “bearish harami” candle pattern, which suggests sellers are gathering momentum.

- A break below 0.8896 would open the door towards the 0.8700 region; otherwise, a re-test of the 0.9000 figure is on the cards.

The EUR/GBP tumbles below the 0.9000 mark for the first time in the week after hitting a weekly high at 0.9254 on Tuesday, courtesy of growing fears about the UK’s “mini-budget” presented by the new UK Chancellor of the Exchequer Kwasi Kwarteng. However, investors’ worries have eased, and at the time of writing, the EUR/GBP is trading at 0.8938, slightly above its opening price.

EUR/GBP Price Analysis: Technical outlook

The EUR/GBP remains neutral to upward biased, though, after Monday’s monstrous 400-pip rally, which printed a fresh one-year and-half high at 0.9254, the pair was subject to a mean reversion move. Therefore, the EUR/GBP reversed some of its gains on Tuesday. Even though the EUR/GBP formed a “bearish harami” candle pattern, a break below the September 26 low at 0.8851 is needed to extend its losses further.

Therefore, the EUR/GBP’s first support would be the September 27 daily low at 0.8896. Once cleared, the next support would be the 0.8851 cycle low mentioned above, followed by a drop towards the September 19 daily high-turned-support at 0.8787.

Contrarily, if the EUR/GBP breaks above 0.9000, a re-test of the 0.9100 figure is on the cards, ahead of 0.9200, followed by the YTD high at 0.9254.

EUR/GBP Key Technical Levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.