- Analytics

- News and Tools

- Market News

- Bears regain control and drag EUR/USD to the 0.9940 region

Bears regain control and drag EUR/USD to the 0.9940 region

- EUR/USD loses the grip further and revisits the 0.9950/45 area.

- The dollar remains bid and pushes DXY above the 110.00 mark.

- EMU Final inflation Rate came at 9.1% YoY in August.

The upside bias in the greenback drags EUR/USD to new multi-session lows in the vicinity of 0.9940 at the end of the week.

EUR/USD offered on USD-gains

EUR/USD comes under renewed and quite strong downside pressure following two consecutive daily advances, breaking below the parity level with some conviction and reaching new multi-day lows in the 0.9945/40 band.

Indeed, the unabated strength in the greenback lifts the US Dollar Index 9DXY) back above the 110.00 mark in a context dominated by the rally in US yields and the investors’ adjustment to the tighter-for-longer stance from the Fed.

On the opposite side of the road, ECB’s De Guindos suggested that more rate hikes are in store, while his colleague O.Rehn noted that recession risks in the euro area remain on the rise.

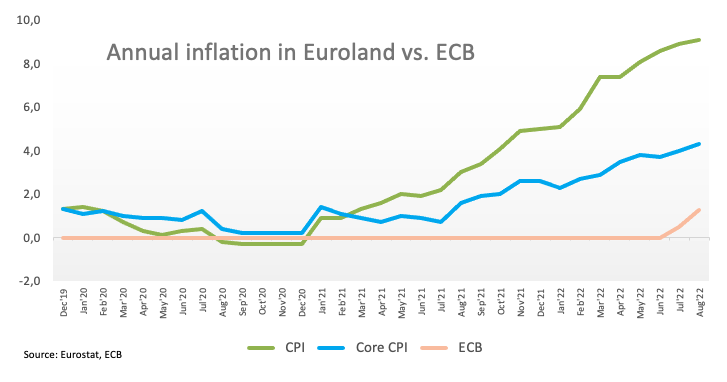

In the domestic calendar, final Inflation Rate in the euro area came at 9.1% in the year to August, in line with the preliminary prints. On a monthly basis, the CPI rose 0.6% and 4.3% YoY when it comes to the Core CPI.

Across the Atlantic, the advanced U-Mich Consumer Sentiment for the month of September will take centre stage later in the NA session.

What to look for around EUR

EUR/USD breaches the parity zone and drops to multi-day lows near 0.9950 following increasing upside momentum in the US dollar.

So far, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

On the negatives for the single currency emerge the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals.

Key events in the euro area this week: Italy, EMU Final Inflation rate (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is losing 0.43% at 0.9953 and the breakdown of 0.9944 (weekly low September 16) would target 0.9863 (2022 low September 6) en route to 0.9859 (December 2002 low). On the other hand, the initial barrier emerges at 1.0197 (monthly high September 12) followed by 1.0202 (August 17 high) and then 1.0314 (100-day SMA).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.