- Analytics

- News and Tools

- Market News

- US Dollar Index remains firm and targets 110.00

US Dollar Index remains firm and targets 110.00

- The index adds to Thursday’s small advance and targets 110.00.

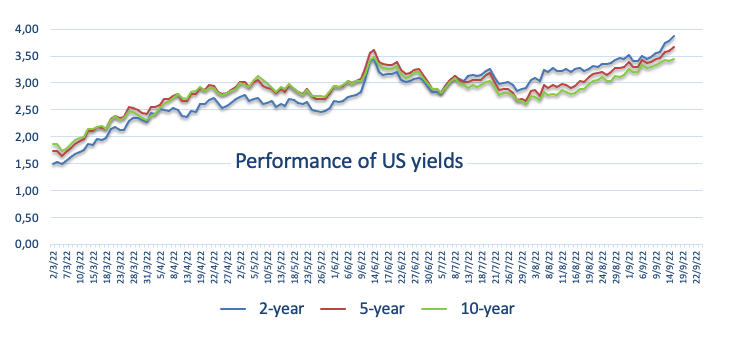

- US yields extend further the march north on Friday.

- Advanced Consumer Sentiment gauge next on tap in the docket.

The US Dollar Index (DXY), which gauges the greenback vs. its main competitors, keeps the bid bias well and sound and approaches the 110.00 neighbourhood at the end of the week.

US Dollar Index remains supported by Fed, data

The index keeps the optimism on the rise in the second half of the week and with the immediate target at the 110.00 neighbourhood.

The rebound in the dollar has been exacerbated following Tuesday’s release of higher-than-expected US inflation figures during August and remains well propped up by the unabated move higher in US yields, especially in the short end and the belly of the curve.

Following the publication of US CPI, a full-point interest rate hike by the Fed at the September 21 meeting emerged on the horizon, although its chances seem to have dwindled a tad since then. Currently, CME Group’s FedWatch Tool sees the possibility of a 100 bps rate raise at 24% amidst investors’ preference for a 75 bps move.

In the docket, the preliminary U-Mich Consumer Sentiment for the current month is due next seconded by Net Long-Term TIC Flows.

What to look for around USD

The index appears bid and keeps the post-CPI rebound well in place for the time being.

Bolstering the dollar’s underlying positive stance appears the firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market. This view was reinforced by Chair Powell’s speech at the Jackson Hole Symposium.

Looking at the more macro scenario, the greenback appears propped up by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: Flash Michigan Consumer Sentiment, TIC Flows (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation over a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

US Dollar Index relevant levels

Now, the index is advancing 0.12% at 109.88 and a break above 110.01 (weekly high September 13) would expose 110.78 (2022 high September 7) and then 111.90 (weekly high September 6 2002). On the other hand, the next support emerges at 107.68 (monthly low September 13) followed by 107.58 (weekly low August 26) and finally 105.76 (100-day SMA).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.