- Analytics

- News and Tools

- Market News

- USD/MXN remains in range, looking at 20.10 as market sentiment deteriorates

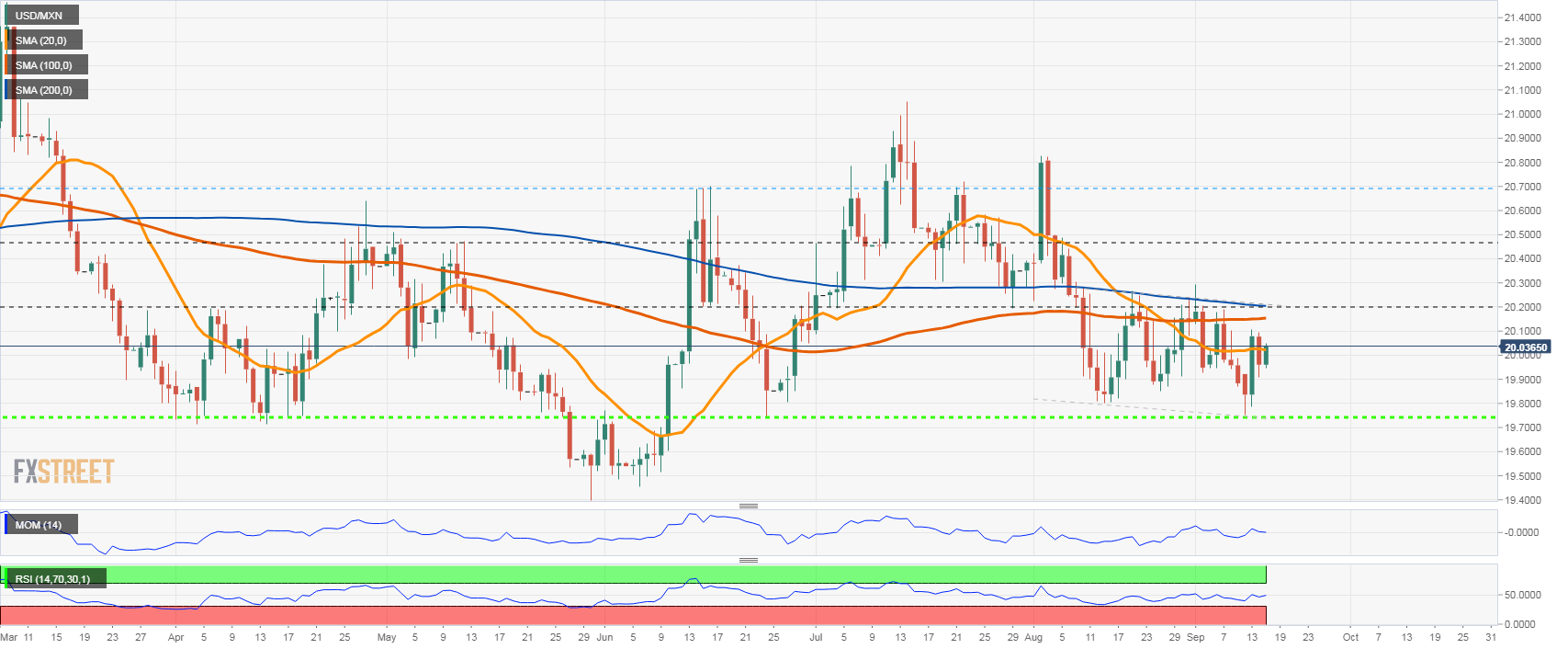

USD/MXN remains in range, looking at 20.10 as market sentiment deteriorates

- USD/MXN moving between 20.20 and 19.80 since mid-August.

- Mexican peso fails to break 19.80, and reverses.

- Stocks turn lower in Wall Street, supporting the dollar.

The USD/MXN is up on Thursday amid a stronger US dollar across the board. The pair is trading at 20.07, at the highest intraday level. Wall Street is turning from neutral to bearish, favoring the greenback.

On the upside, the immediate resistance is seen at 20.10 (Sep 8 and 13 high). A consolidation above could point to further gains and a test of the critical area between 20.17 and 20.20. A daily close above 20.20 would be a positive technical development suggesting more gains ahead, targeting the 20.45 area.

On the flip side, the first support stands at 19.95, but a more significant barrier is located at 19.90. The key area is 19.80 and a break lower would put USD/MXN on its way toward 19.70.

Eyes on the Fed

Following many US economic reports (jobless claims, retail sales, Philly Fed and industrial production) on Thursday and particularly the CPI on Tuesday, attention now sets on the FOMC meeting next week. The central bank is expected to raise interest rates by 75 basis points on Wednesday. Banxico is expected to follow on September 29.

USD/MXN daily chart

Technical levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.