- Analytics

- News and Tools

- Market News

- NZD/USD nosedives to fresh weekly lows, eyeing the YTD low at 0.5996

NZD/USD nosedives to fresh weekly lows, eyeing the YTD low at 0.5996

- NZD/USD collapsed after US CPI rose higher than estimated, further cementing a large Fed interest rate increase.

- August inflation in the US flashed signs of being stickier than expected.

- Traders await NZ Current Account alongside US PPI on Wednesday.

The NZD/USD sinks more than 100 pips or 2% during Tuesday’s North American session, spurred by a hot US inflation reading, which favors the US Federal Reserve’s case of a 75 bps rate hike in the September 20-21 meeting. That, alongside higher US Treasury bond yields and a stronger greenback, triggered a risk-off impulse.

The kiwi began trading around 0.6140 and edged toward the daily high at 0.6161. However, as US economic data was released, the NZD/USD slumped to the daily low at 0.6009 before trimming some of its late losses. At the time of writing, the NZD/USD is trading at 0.6007, down 2.12%.

NZD/USD dropped after elevated US CPI

The US Bureau of Labor (BLS) reported that August inflation rose by 0.1% MoM, highest than estimates of a contraction of 0.1% by market participants, while annually based, it hit the 8.3% threshold, also exceeding expectations. The so-called core Consumer Price Index (CPI), which excludes food and energy, ticked up 0.6% MoM, above July’s 0.3%, due to higher rent and medical indexed, as reported by the BLS. The year-over-year core CPI rose by 6.3%, more than 5.9% in July.

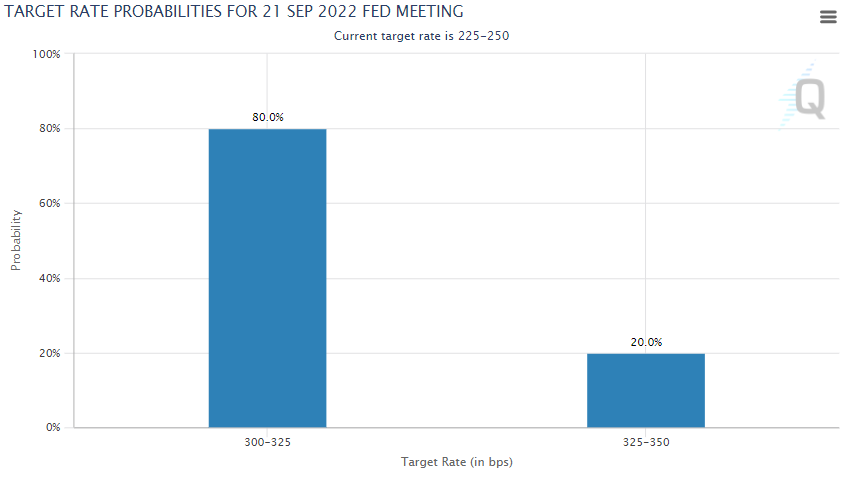

Elsewhere, market participants have fully priced in a 75 bps rate hike next Wednesday at FOMC’s meeting, while odds of a 100 bps increased to 20% via the CME FedWatch Tool.

Source: CME FedWatch Tool

In the meantime, the US Dollar Index, a measure of the buck’s performance against a basket of peers, is rallying more than 1%, up at 109.606, underpinned by higher US Treasury yields, like the 10-year benchmark note rate at 3.447%, gaining close to 9 bps.

On the New Zealand side, the ANZ House Price Index fell 1.3% MoM in August, while adjusted sales printed a solid 4.9%. Later in the day, the New Zealand economic docket will reveal the Current Account data for the second quarter.

The US economic docket will feature the Producer Price Index (PPI) for August on Wednesday, with the headline foreseen at -0.1% MoM, while the core PPI is expected at 0.3%.

NZD/USD Key Technical Levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.