- Analytics

- News and Tools

- Market News

- EUR/USD regains the smile and advances beyond 0.9900

EUR/USD regains the smile and advances beyond 0.9900

- EUR/USD retakes the 0.9900 barrier and beyond.

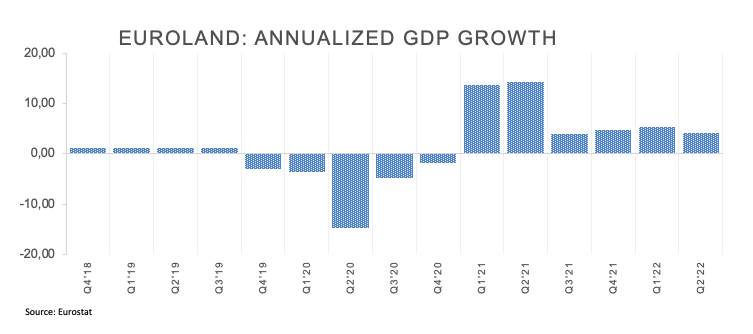

- Revised EMU Q2 GDP came at 4.1% YoY, 0.8% QoQ.

- Fedspeak, trade balance figures, Beige Book all due later.

The single currency manages to regain some poise and encourages EUR/USD to return to the area above the 0.9900 mark on Wednesday.

EUR/USD shifts the focus to the ECB event

EUR/USD trades with modest gains and sets aside two consecutive daily retracements despite the continuation of the bid bias around the greenback.

Indeed, the US Dollar Index (DXY) recorded new cycle highs near 110.70 earlier in the session, although it lost some shine soon afterwards and sponsored the bounce in the pair.

The uptick in spot comes in tandem with some loss of upside momentum in the German 10y bund yields following earlier peaks around 1.65%.

The European currency is expected to trade within a prudent stance in the next hours ahead of the key ECB monetary policy meeting on Thursday. On this, investors remain tilted towards a 75 bps rate hike.

In the domestic calendar, revised GDP figures now see the EMU expanding at an annualized 4.1% in the April-June period and 0.8% inter-quarter.

Data in the US will show usual weekly MBA Mortgage Applications, trade balance results and the release of the Fed’s Beige Book. Additionally, FOMC’s Barkin, Mester and Brainard are all due to speak as well.

What to look for around EUR

EUR/USD regains upside traction following alternating trends in the appetite for the risk complex.

So far, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence. The latter, in the meantime, keeps closely following the prevailing debate around the size of the next interest rate hikes by both the ECB and the Federal Reserve.

On the negatives for the single currency emerge the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals.

Key events in the euro area this week: Revised EMU Q2 GDP Growth Rate (Wednesday) – ECB Interest Rate Decision, Fed Powell (Thursday) – Eurogroup Meeting, Emergency Energy Meeting (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is gaining 0.13% at 0.9915 and faces the next up barrier at 1.0090 (weekly high August 26) ahead of 1.0169 (55-day SMA) and then 1.0202 (August 17 high). On the flip side, a breach of 0.9863 (2022 low September 6) would target 0.9859 (December 2002 low) en route to 0.9685 (October 2002 low).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.