- Analytics

- News and Tools

- Market News

- USD/JPY Price Analysis: Bears step in, but there is some work to do yet

USD/JPY Price Analysis: Bears step in, but there is some work to do yet

- USD/JPY bears are moving in but there could be some more working of the highs to come yet.

- The price has rallied parabolically and a pullback could be on the cards.

USD/JPY rallied on Tuesday and took out the symbolic level of 142, scoring a fresh 24-year low as the US dollar sprung into life again and while the gap between Japanese monetary policy and its counterparts widens. USD/July hit the highest levels since August 1998.

The Japanese Finance Minister Shunichi Suzuki jaw-boned the currency but that did nothing to prevent it from falling to a 24-year low on Tuesday. He reiterated that sharp yen moves were "undesirable" and that he was watching rising volatility in the exchange market with a "great sense of urgency".

"It's important for currencies to move stably, reflecting economic fundamentals," Suzuki told reporters at the finance ministry. When pressed to comment on the impact of a weak yen on the economy, Suzuki said "a weak yen has both merit and demerit, but sharp moves are undesirable."

The yen has slumped nearly 20% since the start of the year, on diverging monetary policies between Japan and the United States. However, the Reserve Bank of Australia also hiked rates this week and the focus will turn to the European Central Bank which is also expected to pull the trigger again, potentially hiking as high as 75bps.

Meanwhile, the US dollar has been a major culprit in the extreme moves in forex this week. On Tuesday, data was the catalyst again with the August ISM services index beating expectations, rising to 56.9 (56.7 previously, 55.3 expected). ''The data complement the labour market’s strength and suggest that the economy remains some distance from recession,'' analysts at ANZ Bank said.

USD/JPY technical analysis

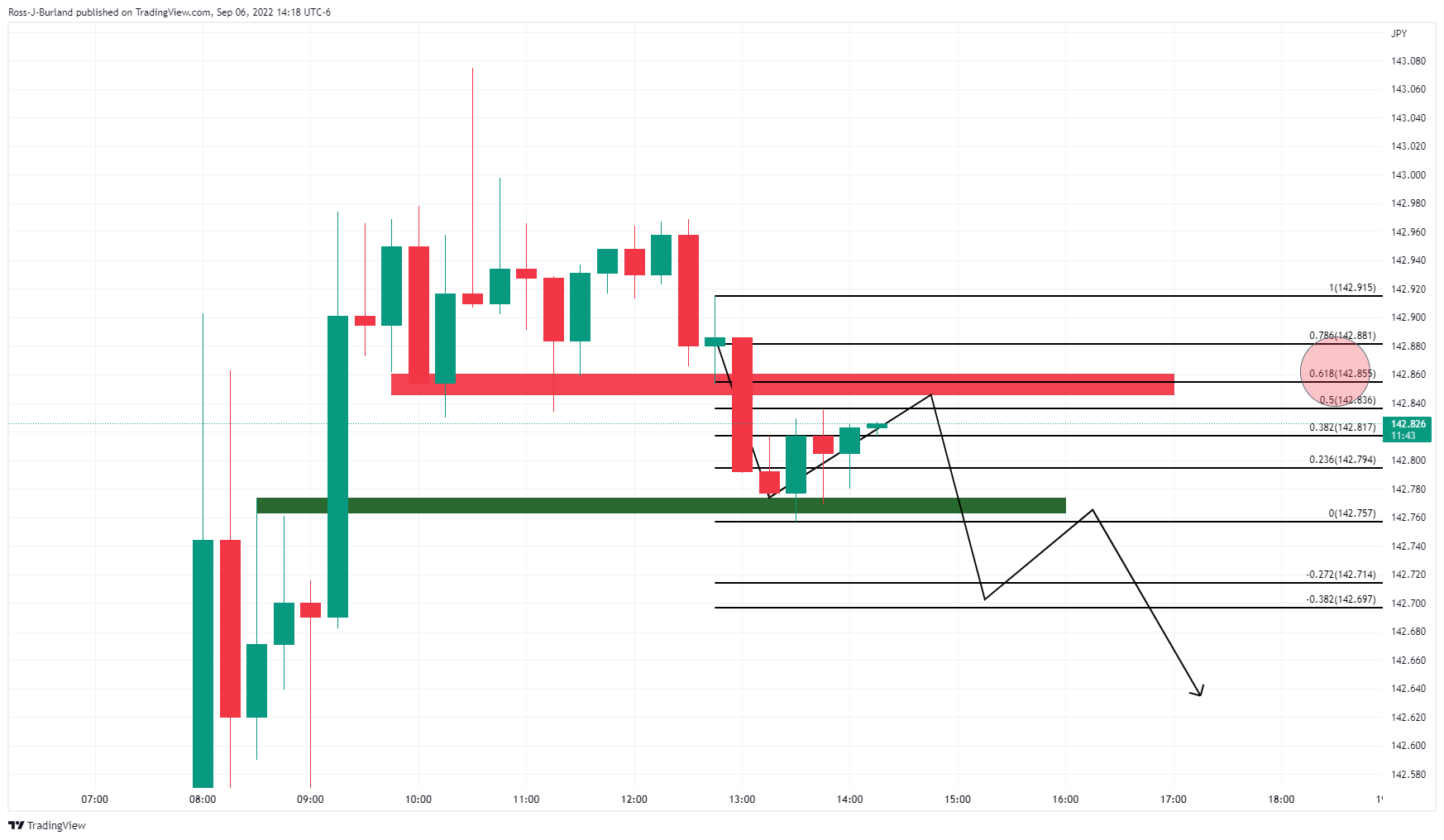

The price could be in for some corrective activity for the day ahead and the 50% mean reversion level signs with the first three hours of Wall Street's high.

From a 15-min time frame basis, the peak formation is more convincing, but a correction to the 61.8% could still be on the cards to restest the support of the topping formaiton. A downside extension of the bearish breakout impulse could be on the cards thereafter.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.