- Analytics

- News and Tools

- Market News

- GBP/USD bulls hold the fort above critical levels at the edge of the abyss

GBP/USD bulls hold the fort above critical levels at the edge of the abyss

- GBP/USD holds in bullish territories as the US dollar slides from fresh bull cycle highs.

- GBP/USD bulls step in at a key area of support on the near and longer-term charts.

GBP/USD remains in bullish territory above 1.1500 having recovered from the low of the day down at 1.1443, around a two-and-a-half-year low, making its way into test 1.1520 in recent trade. The US dollar is the driver in the forex space but, domestically, the main feature so far for the week has been Liz Truss becoming Britain's next prime minister after winning a leadership race for the governing Conservative Party.

Truss will take power and name her cabinet on Tuesday, and markets will be on the lookout for any leaks of her fiscal plans. She has already pledged not to raise taxes nor to ration energy and has specifically ruled out any windfall taxes on energy companies.

Reports suggest Truss is preparing an emergency mini-budget in her first month as Prime Minister and it is yet to be seen whether she will follow through on her promises to immediately cut taxes in an effort to jump-start the economy. British government bonds suffered their biggest monthly price losses in decades in August, due to inflation fears but also on Truss's planned tax cuts and proposals to stimulate the economy with fiscal spending.

Meanwhile, on Wednesday, the Bank do England Governor, Andrew Bailey & 3 members of the Monetary Policy Committee will face MPs for a grilling on the outlook for inflation and interest rates. This will be the last we will hear from them ahead of the September BoE meeting, so traders will be all ears to the ground for hints with regards to a bias leaning towards either a 50bps or 75bps hike for the MPC rate decision.

''Governor Bailey, Chief Economist Pill, and MPC members Mann and Tenreyro will testify. They will of course come under heavy criticism for allowing inflation to rise so much above target,'' analysts at Brown Brothers Harriman said. ''Tightening expectations continue to rise, as WIRP suggests nearly 70% odds of a 75 bp hike to 2.5% September 15. Looking ahead the swaps market is pricing in 275 bp of tightening over the next 12 months that would see the policy rate peak near 4.5%, up from 4.0% just two weeks ago.''

US dollar is faded through 110 psychological level

The US dollar, as measured by the DXY index, rallied to 110.271 on Monday, helped by a plunge in the euro due to the Russian gas halt and a drop in the Chinese yuan that struggles in the face of a resurgence of COVID-19 infections across the country. Besides the risk-off pulses, the greenback continued to be driven higher on the coattails of Fed Chair Jerome Powell's recent remarks made at the Jackson Hole symposium in Wyoming, explaining that rates would need to be high "for some time" to combat stubbornly high inflation. However, the dollar has since been faded from the highs which gave some relief to the forex space, including the pound. At the time of writing, DXY is trading at 109.779 and recently plummeted to 109.534.

For the week ahead, the data highlight will be August ISM services PMI Tuesday. The headline is expected at 55.4 vs. 56.7 in July. Traders will be taking note of the employment and prices paid data, which stood at 49.1 and 72.3 in July, respectively. fed speakers will also be key. Chair Powell, Vice-Chair Brainard, and Governor Waller will make public appearances to talk about the economic outlook and markets will be looking for them to build on Powell's Jackson Hole remarks.

''They will stress that inflation is still too high and bringing it down is priority number 1, which requires further rate hikes as well as keeping the policy rate high for "some time" once the terminal is reached,'' analysts at TD Securities said.

GBP/USD technical analysis

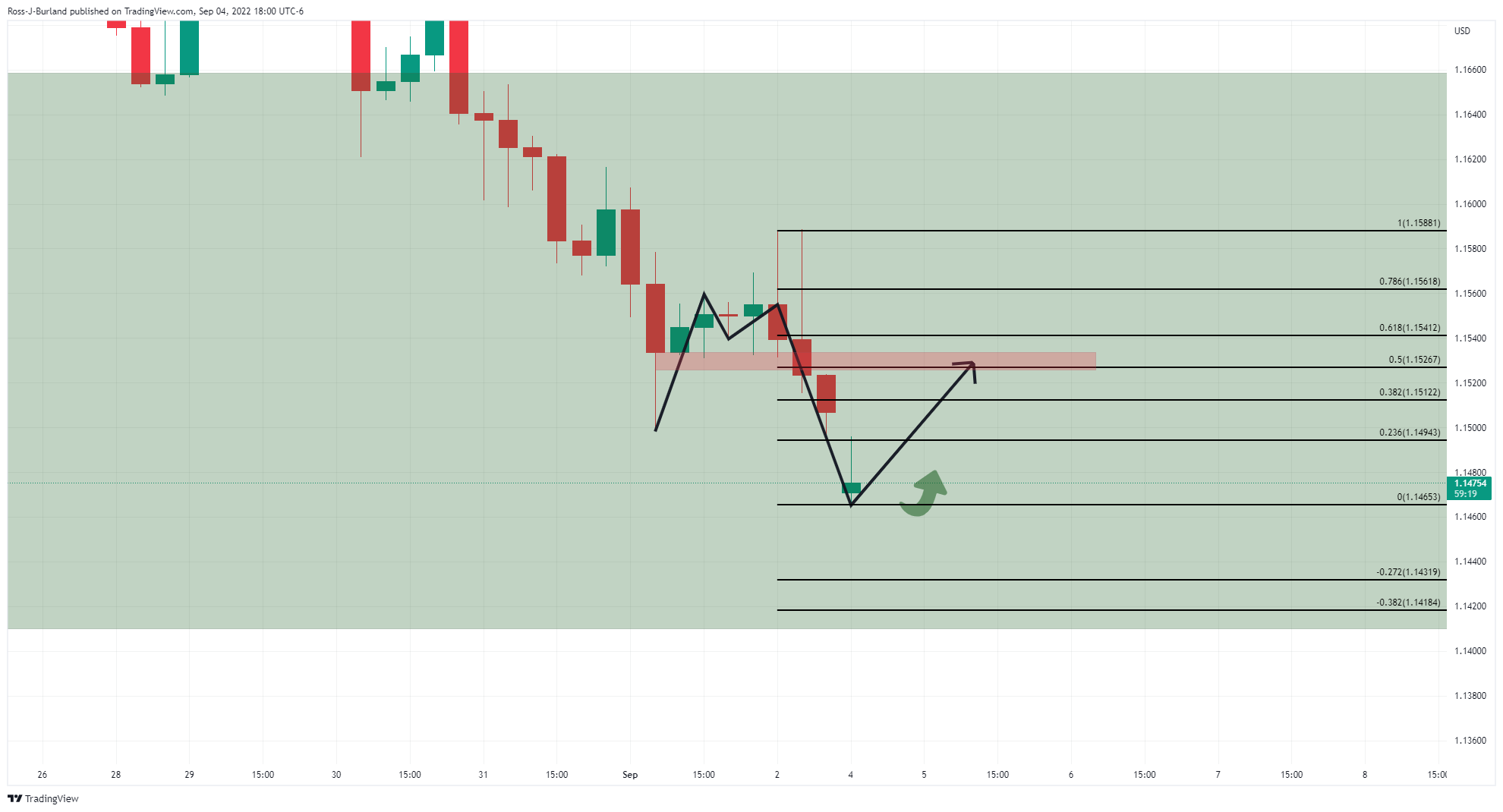

As per the start of the day's analysis, GBP/USD Price Analysis: Bulls move in but there could be more from the US dollar, the bulls have moved in and we did see more from the US dollar.

GBP/USD H4 chart, prior analysis

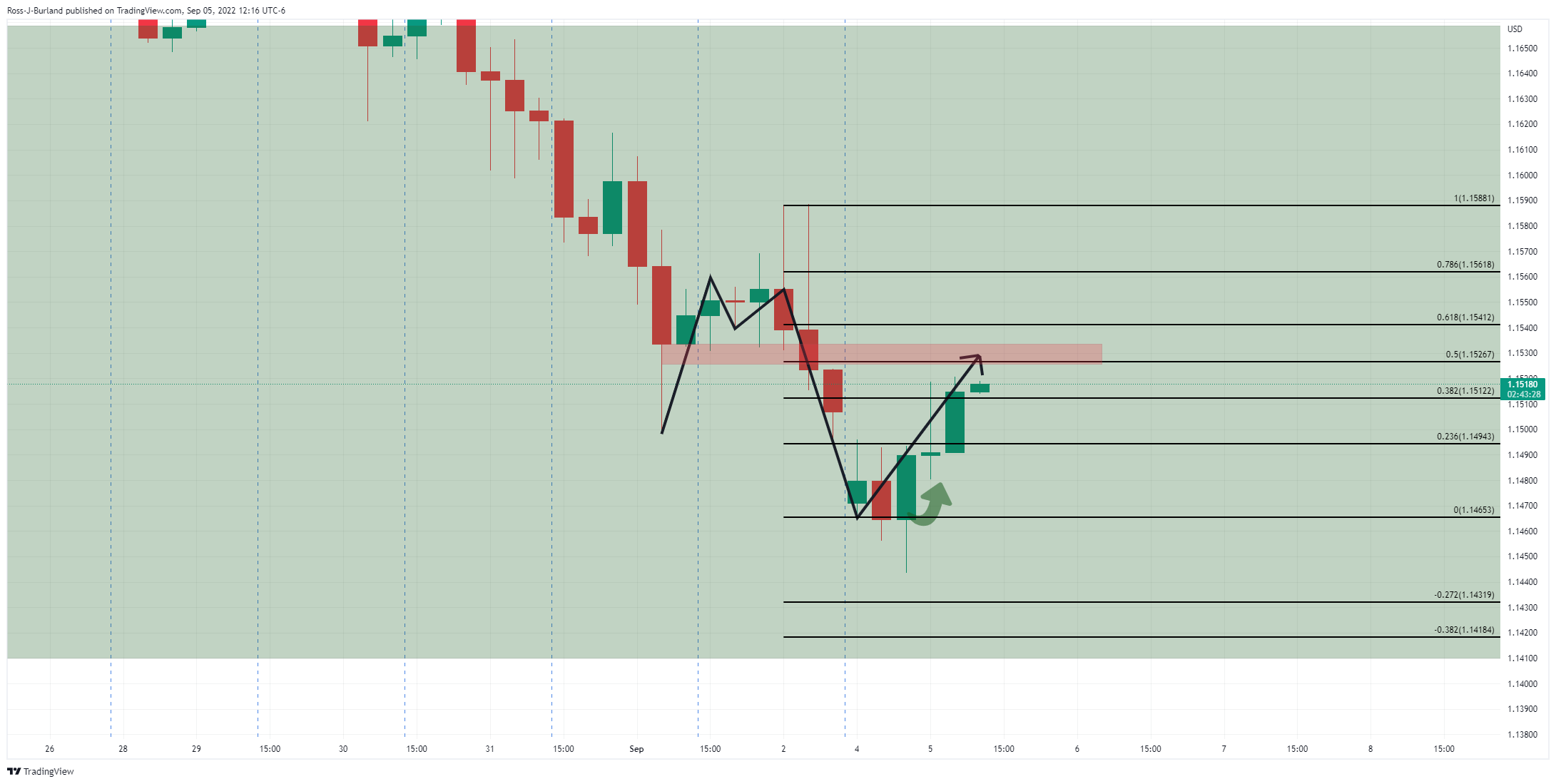

GBP/USD, update

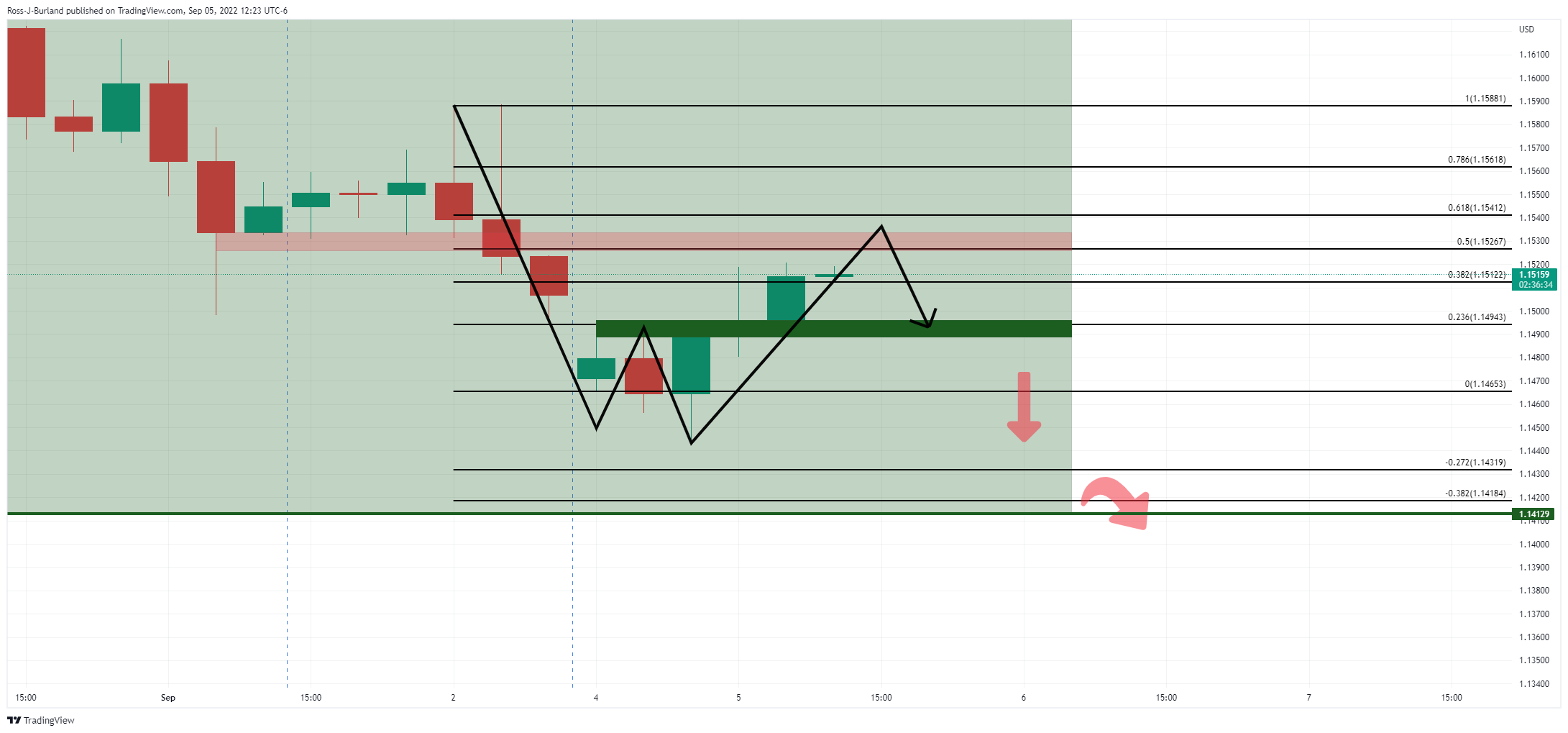

The price made fresh lows but the bulls stuck in there and have subsequently moved in on the 50% mean reversion target as the prior analysis had projected. At this juncture, bulls will need to keep above 1.1490 or face prospects of a move to the lowest levels since 1985, below 1.1413:

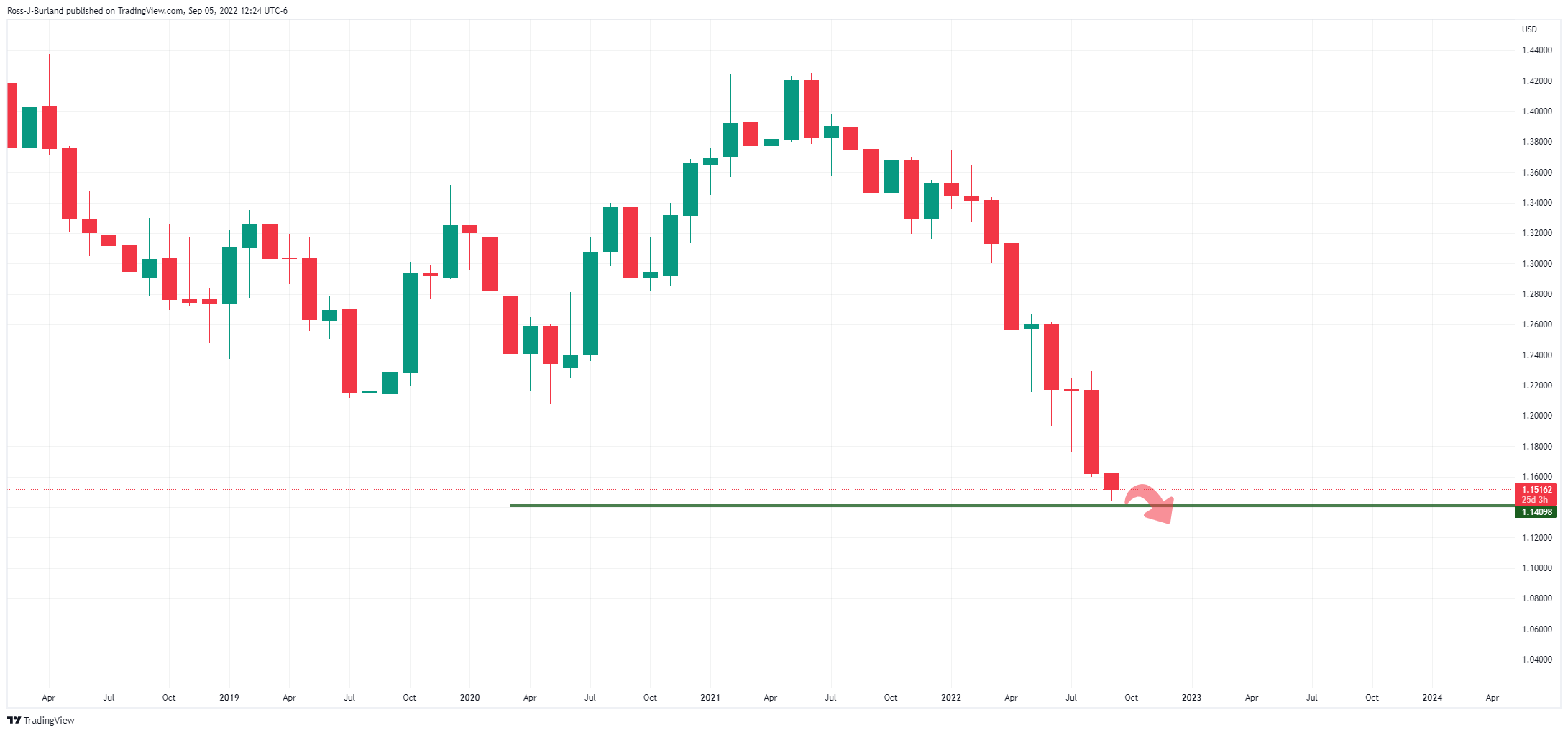

GBP/USD monthly charts

On the other hand, should the bulls stay the course, then the upside eyes prospects of a significant retracement:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.