- Analytics

- News and Tools

- Market News

- EUR/USD extends gains north of parity on NFP

EUR/USD extends gains north of parity on NFP

- EUR/USD remains bid above the parity level on Friday.

- US Nonfarm Payrolls rose by 315K jobs in August.

- The unemployment rate ticked higher to 3.7%.

EUR/USD keeps the daily bid bias unchanged and manages to retest the 1.0030 region in the wake of the release of Nonfarm Payrolls for the month of August.

EUR/USD looks well supported near 0.9900

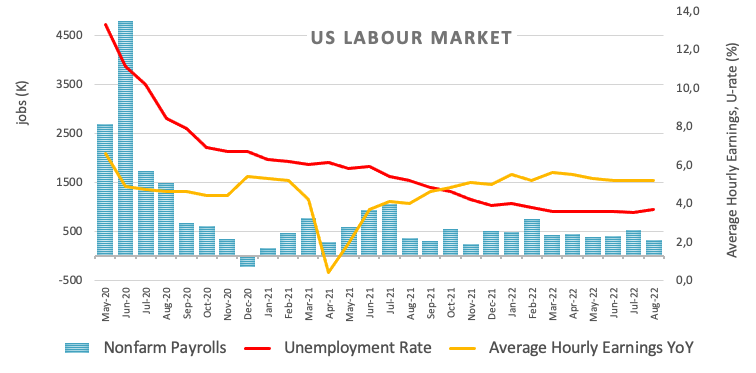

EUR/USD keeps the positive stance on Friday after the release of the Nonfarm Payrolls showed the US economy added 315K jobs during August, surpassing initial estimates for a gain of 300K jobs. The July reading was revised down slightly to 526K (from 528K).

Further data saw the Unemployment Rate edge higher to 3.7% (from 3.5%) and the key Average Hourly Earnings – a proxy for inflation via wages – rise 0.3% MoM and 5.2% from a year earlier. Additionally, the Participation Rate, improved a tad to 62.4% (from 62.1).

Next on the US docket will come July’s Factory Orders.

EUR/USD levels to watch

So far, the pair is gaining 0.67% at 1.0013 and further upside could retest 1.0090 (weekly high August 26) ahead of 1.0202 (high August 17) and finally 1.0203 (55-day SMA). On the flip side, the breach of 0.9899 (2022 low August 23) would target 0.9859 (December 2002 low) en route to 0.9685 (October 2022 low).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.