- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD renews six-week low with eyes on $1,698, US NFP

Gold Price Forecast: XAU/USD renews six-week low with eyes on $1,698, US NFP

- Gold price stands on slippery grounds, prints five-day downtrend to refresh 1.5-month low.

- Risk-aversion, firmer yields underpin US dollar rebound ahead of the key data.

- Headlines surrounding China, US ISM Manufacturing PMI could also entertain XAU/USD traders.

Gold price (XAU/USD) portrays the market’s risk-aversion wave as it drops to the lowest levels since July 21 amid a rush toward the US dollar. That said, the yellow metal declined for the fifth consecutive day to $1,706 during Thursday’s Asian session.

The risk-aversion wave could be well-witnessed in the strong US Treasury yields despite the softer US data. As a result, the US 10-year Treasury yields refresh a two-month high of around 3.21% while the two-year bond coupons jump to the highest levels since 2007, near 3.51% at the latest. Also portraying the sour sentiment is the S&P 500 Futures’ 0.36% intraday fall to the lowest levels since late July, at 3,930 by the press time.

US data wasn’t either too positive but could manage to keep the greenback buyers hopeful amid the recently loose links between ADP and Nonfarm Payrolls (NFP). Also exerting downside pressure on the sentiment are Taiwan-China tension, fresh covid woes in Beijing and the United Nations (UN) Human Resource Office mentioning that the Chinese government has committed ‘serious human rights violations’ in Xinjiang. Additionally, a blockage in the Suez Canal by Singaporean-flagged oil tanker Affinity V previously challenged the risk appetite but the latest refloating of the ship couldn’t trigger the optimism.

That said, US ADP Employment Change rose by 132K versus 288K expected and 270K prior. However, the average wage increases in the US in August were 7.6% y/y and the same kept the Fed policymakers hawkish.

Following the data, Cleveland Federal Reserve Bank President Loretta Mester said on Tuesday that she was not anticipating the Fed to cut rates next year, as reported by Reuters. Further, the newly appointed Dallas Fed President Lory Logan joined the lines of hawkish fellow US central bankers while saying, “Restoring price stability is No. 1 priority.”

Not only in the US but strong Eurozone inflation data and the hawkish comments from the European Central Bank (ECB), as well as from the Bank of Japan (BOJ) policymakers, also portray the central bankers’ broadly hawkish stance.

Given the central bankers’ aggression, today’s US ISM Manufacturing PMI for August, expected 52.8 versus 52.0 prior, could entertain the traders ahead of Friday’s US Nonfarm Payrolls (NFP). Should the outcome manages to portray firmer US job conditions, as well as activities, the XAU/USD may witness further downside.

Also read: US ISM Manufacturing PMI Preview: Slowing growth or recession?

Technical analysis

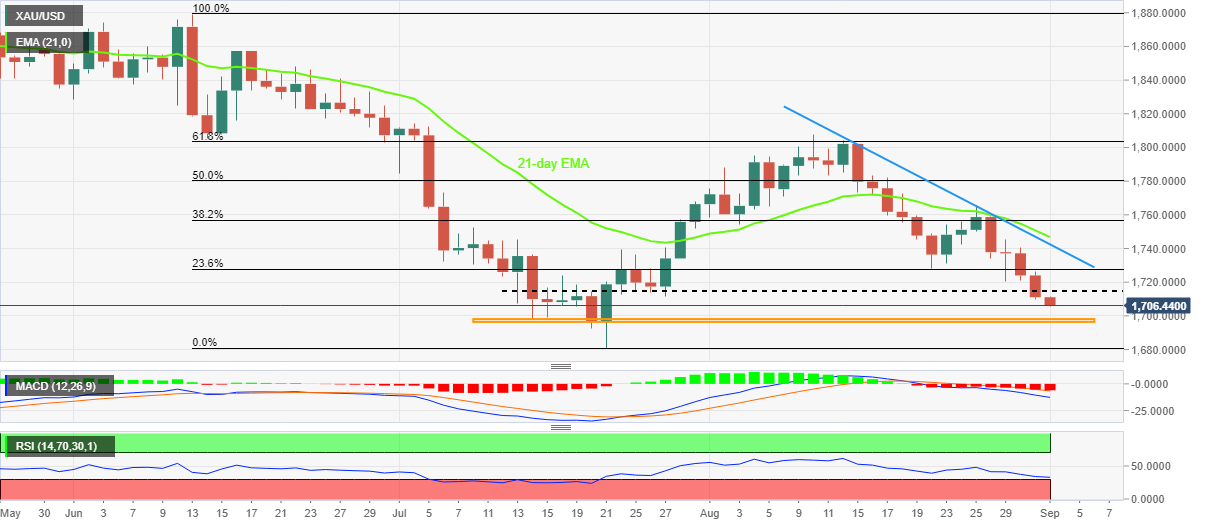

A clear downside break of the 1.5-month-old horizontal support, now resistance around $1,715, directs gold prices towards an area comprising lows marked during mid-July, near $1,698-96. Following that, the yearly bottom surrounding $1,680 will be in focus.

It’s worth observing that the RSI (14) is approaching the oversold territory and hence the XAU/USD may have limited downside room before posing a corrective pullback, which in turn highlights the $1,698-96 region for the bears.

Meanwhile, an upside clearance of $1,715 could direct gold price towards the 23.6% Fibonacci retracement level of June-July downside, near $1,728.

Following that, a 13-day-old resistance line and 21-day EMA, respectively near $1,741 and $1,747, as well as the $1,750 round figure, could challenge the gold price upside.

Gold: Daily chart

Trend: Limited downside expected

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.