- Analytics

- News and Tools

- Market News

- WTI Price Analysis: Eyes to revisit fortnight-old support near $88.00

WTI Price Analysis: Eyes to revisit fortnight-old support near $88.00

- WTI remains pressured after declining heavily in the last two days.

- Nearly oversold RSI might trigger another bounce off a two-week-long support.

- Multiple hurdles stand tall to challenge oil bears before the monthly low.

- Buyers need validation from the key SMAs, MACD also portrays rejection of bullish bias.

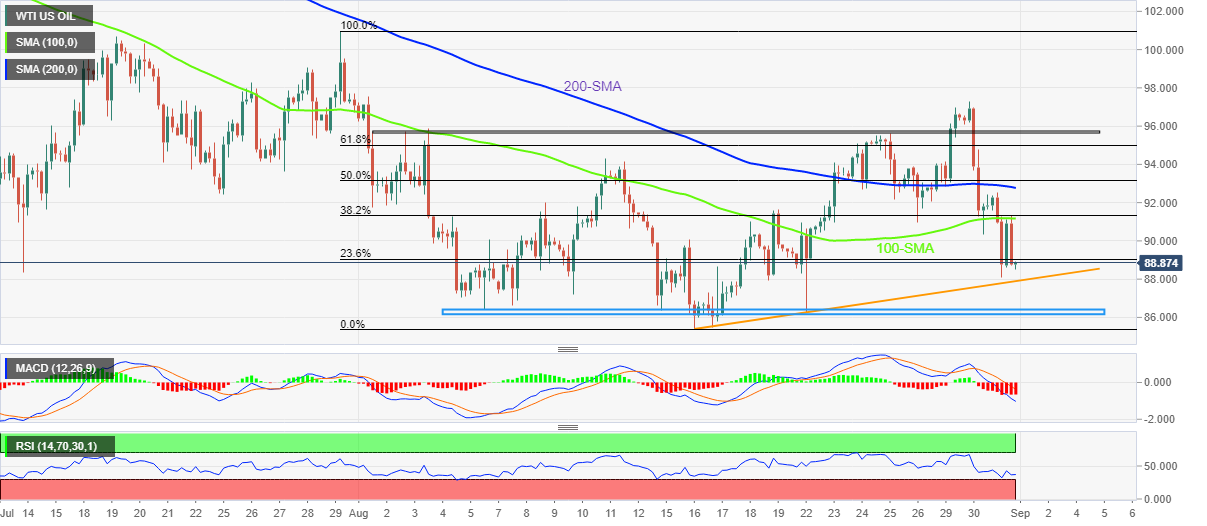

WTI crude oil prices hold lower ground near $88.90 during Thursday’s Asian session, after dropping heavily in the last two days.

The black gold’s latest weakness could be linked to the sustained trading below the key SMAs, as well as bearish MACD signals. However, nearly oversold RSI (14) challenges the commodity’s further downside.

That said, an upward sloping support line from mid-August, around $88.00 by the press time, appears a short-term important level to watch for the WTI bears.

Following that, a horizontal area comprising multiple levels marked since early August, near $86.20-40, could test the downside momentum before highlighting the lowest levels since late January, marked on August 15 at around $85.40.

Alternatively, the 100-SMA and the 200-SMA could restrict short-term recovery moves of the WTI crude oil around $91.20 and $92.80 in that order.

However, the monthly horizontal resistance area and tops marked on Tuesday, respectively around $95.70 and $97.30, could challenge the upside momentum afterward.

Overall, WTI crude oil prices are weak but the downside room appears limited.

WTI: Four-hour chart

Trend: Limited downside expected

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.