- Analytics

- News and Tools

- Market News

- CFTC Positioning Report: Scope for further weakness around EUR

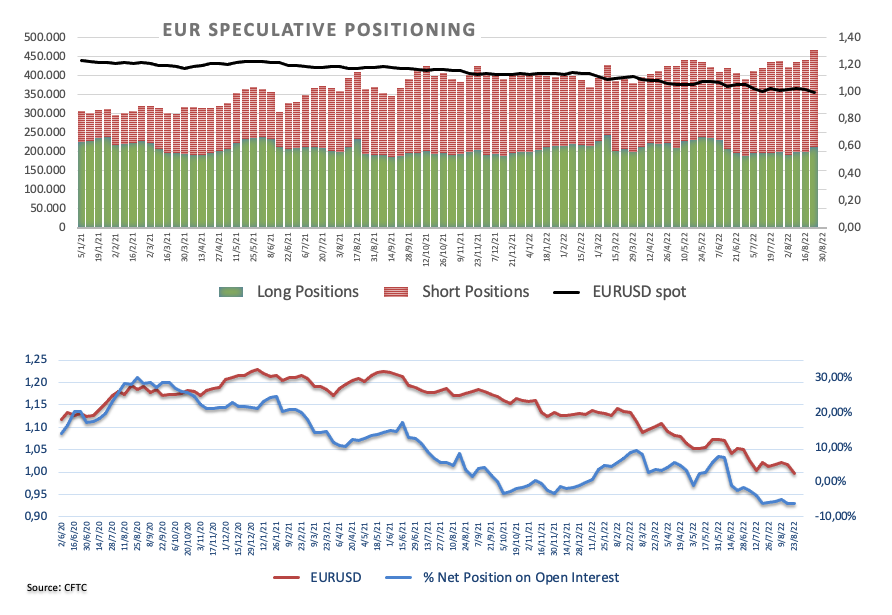

CFTC Positioning Report: Scope for further weakness around EUR

These are the highlights of the CFTC Positioning Report for the week ended on August 23rd:

- Net shorts in the European currency clocked yearly highs and kept navigating the area of more than 2-year highs as a percentage on open interest (>6%) in the period under study. A plethora of hawkish messages from Fed’s rate-setters kept the dollar bid and the risk complex depressed, forcing EUR/USD to break below the parity level once again, although this time with certain conviction. Further downside in the euro should not be ruled out in light of the negative price action in combination with rising open interest.

- Gross shorts in the greenback edged higher and prompted net longs to retreat to an area last visited in early May beyond 35K contracts. Further comments from Fed-speakers underpinned the aggressive rate path by the central bank and lent oxygen to the dollar. However, softer-than-expected advanced PMIs and weak housing data results prompted the buck to give away some ground later. The US Dollar Index (DXY) flirted with YTD peaks near 109.30, although it gave away part of that advance later in the period.

- When it comes to safe havens, speculators added to their negative exposure to the Japanese yen and pushed net shorts to 3-week highs on the back of the resumption of an aggressive message from FOMC members and the impact on US yields. USD/JPY extended the uptrend past the 137.00 barrier from as low as the 131.70 zone in the previous week. Net shorts in the Swiss franc, on the other hand, shrank to levels last seen in late May 2021 pari passu with increasing speculation that the euro area could slip back to recession in the not-so-distant future. USD/CHF edged higher and returned to multi-week tops near the 0.9700 barrier.

- The sentiment around the Aussie dollar deteriorated further on the back of market chatter surrounding the likelihood of a deceleration in the Chinese economy and extra USD strength. AUD/USD extended the leg lower and flirted with lows in the mid-0.6800s, where some contention seems to have emerged.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.