- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD aims a break above $1,740 ahead of US Durable Goods Orders

Gold Price Forecast: XAU/USD aims a break above $1,740 ahead of US Durable Goods Orders

- Gold price is aiming to overstep the immediate hurdle of $1,740.00.

- Lower estimates for the US Durable Goods Orders data are supporting the gold prices.

- Fed’s guidance on interest rates at Jackson Hole will be keenly watched.

Gold price (XAU/USD) is attempting a break above $1,740.00 on lower estimates for US Durable Goods Orders data. Earlier, the precious metal rebounded sharply after printing a fresh monthly low of $1,727.85 on Monday. The pullback move seems less lucrative due to the unavailability of momentum in the upside move, therefore the gold prices will remain on the tenterhooks.

The downbeat preliminary estimates for the US Durable Goods Orders have supported the yellow metal. As per the market consensus, the economic data is expected to scale down vigorously to 0.5% from the prior release of 2%. It is worth noting that core price pressures remained steady in the last reading at 5.9%. Therefore, the Durable Goods Orders data should remain the same or go through a minor change. However, a serious decline in the economic data indicates a plunge in the overall demand.

Apart from that, the commentary from Federal Reserve (Fed) chair Jerome Powell at Jackson Hole Economic Symposium will remain in limelight. Fed Powell will dictate the economic situation in the US and guidance on inflationary pressures and interest rates.

Gold technical analysis

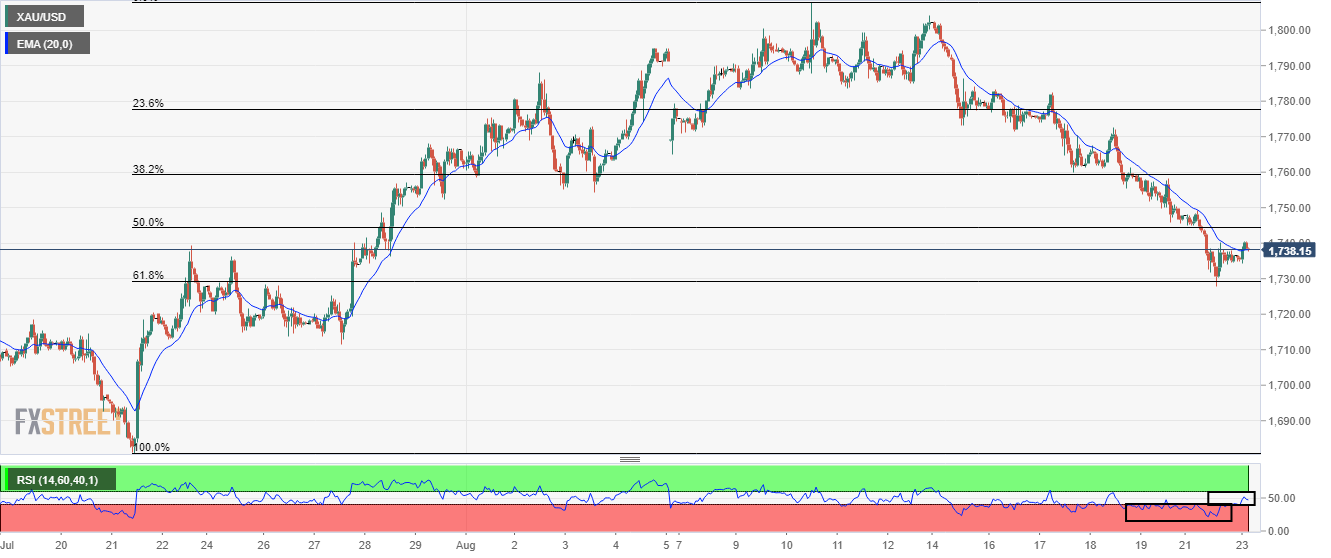

On an hourly scale, gold prices are aiming to extend their recovery after rebounding from 61.8% Fibonacci retracement (placed from July 21 low at $1,680.91 to August 10 high at $1,807.93) at $1,729.44. The precious metal has challenged the 20-period Exponential Moving Average (EMA) at $1,738.00 and a break above the same could turn the short-term trend into a bullish trajectory.

Also, the Relative Strength Index (RSI) (14) has shifted into the 40.00-60.00 range from the bearish range of 20.00-40.00, which indicates that the gold prices are not bearish now.

Gold hourly chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.